Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

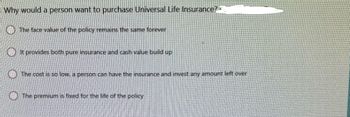

Transcribed Image Text:- Why would a person want to purchase Universal Life Insurance?

The face value of the policy remains the same forever

It provides both pure insurance and cash value build up

The cost is so low, a person can have the insurance and invest any amount left over

The premium is fixed for the life of the policy

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Question # 3: Suppose that your retirement benefits during your first year of retirement are $50000. Assume that this amount is just enough to meet your cost of living during the first year. However, your cost of living is expected to increase at an annual rate of 5% due to inflation. Suppose you do not expect to receive any cost-of-living adjustment in your retirement pension. Then some of your future cost of living has to come from savings other than retirement pension. If your savings account earns 7% interest a year, how much should you set aside in order to meet this future increase in the cost of living over 25 years?arrow_forwardA 40 year old man in the United States has a 0.199% risk of dying during the next year. An insurance company charges a premium of $429 pays a $166,010 death benefit. What is the expected gain or loss to the man when for a life-insurance policy that purchasing the insurance policy? Hint: Calculate the expected loss of the premium if the man survives (always a negative value), then subtract the premium from the death benefit and calculate the expected gain to the beneficiarles if the man dies (always a positive value), and then add these two numbers to find the net result. A negative net result should be entered as a negative value In the box below. Note: Please avold rounding numbers in the middle of your calculations. However, round your final answer to two decimal places, before entering it in the box below. A negative final answer indicates an expected loss for purchasing the policy.arrow_forwardTaylor Jones has a Insurance policy that returns every cent she pays in premiums if she outlives the term of the policy. She knows this policy costs 30 to 50 percent more than a traditional policy but thinks it is worth it. What type of term life insurance does Taylor have?arrow_forward

- 9. If Diana wants a life insurance policy that will provide both a fixed death benefit and guaranteed cash value, what type of policy should she consider buying? a. annual renewable term life insurance b. universal life insurance c. whole life insurance d. variable universal life insurancearrow_forwardWhich type of insurance has no cash value? Term life insurance Universal life insurance Variable life insurance O All of the above have cash valuesarrow_forward1. How much total money would you have spent out of pocket with each plan? 2. With each plan, how much total money would you have to spend before the insurance coverage pays 100% of your medical costs?arrow_forward

- A Quick Response will be appreciatedarrow_forwardImagine that a friend tells you that you should not rush to pay off your mortgage early because you will lose out on the interest tax deductions you are getting. Discuss the role of amortization of mortgages in your analysis of the issue.arrow_forwardDisadvantages of Whole Life insurance include... Group of answer choices -More expensive than Term -All of the above -Lack of control over your investments -None of the above -Your cash value is lost if you cancelarrow_forward

- With high market prices for homes, for many elderly Canadians, the most important source of retirement income will be the equity they have in their homes. A is a secured loan that allows older Canadians to generate income using the equity in their homes without having to sell this asset and in many cases, the mortgage does not have to be paid back until the death of the borrower. A Mortgage-Backed Security B Mortgage Stress Test C Mortgage Term D Reverse Mortgage E Conventional Mortgagearrow_forwardValue of a retirement annuity. Personal Finance Problem An insurance agent is trying to sell you an annuity, that will provide you with $ 14,000 at the end of each year for the next 15 years. If you don't purchase this annuity, you can invest your money and earn a return of 8%. What is the present value of the annuity?arrow_forwardPls correct solution with steps.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education