FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

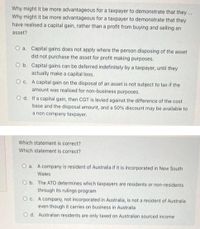

Transcribed Image Text:Why might it be more advantageous for a taxpayer to demonstrate that they ...

Why might it be more advantageous for a taxpayer to demonstrate that they

have realised a capital gain, rather than a profit from buying and selling an

asset?

O a. Capital gains does not apply where the person disposing of the asset

did not purchase the asset for profit making purposes.

O b. Capital gains can be deferred indefinitely by a taxpayer, until they

actually make a capital loss.

O c. A capital gain on the disposal of an asset is not subject to tax if the

amount was realised for non-business purposes.

O d. If a capital gain, then CGT is levied against the difference of the cost

base and the disposal amount, and a 50% discount may be available to

a non company taxpayer.

Which statement is correct?

Which statement is correct?

O a. A company is resident of Australia if it is incorporated in New South

Wales

O b. The ATO determines which taxpayers are residents or non-residents

through its rulings program

O c. A company, not incorporated in Australia, is not a resident of Australia

even though it carries on business in Australia

O d. Australian residents are only taxed on Australian sourced income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Which of the following statements is false? Group of answer choices A realized gain that is never recognized results in the temporary recovery of more than the taxpayer’s cost or other basis for tax purposes. A realized loss on which recognition is postponed results in the temporary recovery of less than the taxpayer’s cost or other basis for tax purposes A realized loss that is never recognized results in the permanent recovery of less than the taxpayer’s cost or other basis for tax purposes. A realized gain on which recognition is postponed results in the temporary recovery of more than the taxpayer’s cost or other basis for tax purposes.arrow_forwardWhich of the following statements is incorrect? Assume that the rental activity is classified as ‘production-of-income.’ If the taxpayer sells the rental property later at a loss, the loss will be treated as a capital loss (i.e., $3,000/$1,500 deduction limit in the current year). An amount that would have been paid in an arm’s-length transaction is considered a reasonable amount as deduction. Payment (except for medical or educational expense) of another person’s obligation does not result in a tax deduction for the payer. Regarding the start-up costs, if the new business is in the same line of business as the existing one and if the new business is not launched, then none of the start-up costs are deductible. Payments for a speeding ticket are nondeductible. HELParrow_forwardThe deductibility of interest on borrowed money is limited to the extent that it was invested to generate an income that is not tax exempt. Question 10 options: True Falsearrow_forward

- One-half of capital gain is treated as taxable capital gain and one-half of capital loss is deductible as allowable capital loss. Question 11 options: True Falsearrow_forwardAn individual's current year capital loss from investment property not offset against capital gains and ordinary income is carried forward indefinitely. True or falsearrow_forwardExplain when a firm may recognize a deferred tax asset under SFAS No. 109. Howshould deferred tax assets that are not expected to be realized be accounted for?arrow_forward

- THe depreciation recapture provisions are designed to prevent taxpayers from converting capial gains into ordinary income.arrow_forwardSection 1221(a) of the Internal Revenue Code defines what: a. is a capital asset. b. is not a capital asset. c. is a ordinary gain. d. is capital gainarrow_forwardAn allowable capital loss realized in a year can first be deducted in the current year against taxable capital gain. If any amount of the loss is still not deducted what other options does the taxpayer have? Write-off from current year employment income Forget about the remaining loss Carry back or carry forward to taxable capital gains Carry back or carry forward to all sources of incomearrow_forward

- 1. When a business ceases to operate and its inventories are disposed of a gain on the inventories will be treated as a capital gain unless an election is made by the selling taxpayer True or False 2. When a business ceases to operate and its accounts receivable are disposed of with the other business assets any loss on the receivables will be treated as a capital loss unless a joint election is made by the purchaser and seller. True or Falsearrow_forwardThe income tax rates are the same for capital gains and depreciation recapture of an asset that is depreciated. O True O Falsearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education