FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

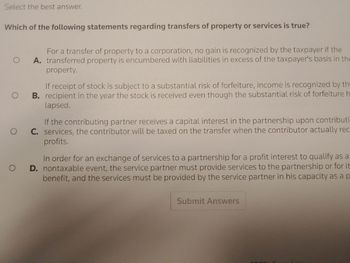

Transcribed Image Text:Select the best answer.

Which of the following statements regarding transfers of property or services is true?

For a transfer of property to a corporation, no gain is recognized by the taxpayer if the

O A. transferred property is encumbered with liabilities in excess of the taxpayer's basis in the

property.

O

O

O

If receipt of stock is subject to a substantial risk of forfeiture, income is recognized by th

B. recipient in the year the stock is received even though the substantial risk of forfeiture h

lapsed.

If the contributing partner receives a capital interest in the partnership upon contributi

C. services, the contributor will be taxed on the transfer when the contributor actually rec

profits.

In order for an exchange of services to a partnership for a profit interest to qualify as a

D. nontaxable event, the service partner must provide services to the partnership or for it

benefit, and the services must be provided by the service partner in his capacity as a p

Submit Answers

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- S1 – All dispositions of real properties classified as capital assets are subject to capital gains tax. S2 – All dispositions of shares of stocks are subject to capital gains tax. Group of answer choices a. Only S1 is true b. Only S2 is true c. Both are true d. Both are falsearrow_forward390. CHAPTER 4—CORPORATIONS: ORGANIZATION AND CAPITAL STRUCTURE Que90 Issues relating to basis arise when a taxpayer is involved in a § 351 transaction. Describe the underlying rules, and the purpose they serve. 391. CHAPTER 4—CORPORATIONS: ORGANIZATION AND CAPITAL STRUCTURE Que91 How is the transfer of liabilities in a property transaction generally treated for tax purposes? How is a transfer of liabilities generally treated in a § 351 transaction? What exceptions could arise to this usual treatment in a § 351 setting? 392. CHAPTER 4—CORPORATIONS: ORGANIZATION AND CAPITAL STRUCTURE Que92 When forming a corporation, a transferor-shareholder may choose to receive some corporate debt along with stock. Identify some of the issues the transferor must consider when deciding whether debt should be a part of the transaction. 393. CHAPTER 4—CORPORATIONS: ORGANIZATION AND CAPITAL STRUCTURE Que93…arrow_forwardA covered member creates a blind trust and transfers assets into the blind trust. The covered member will not supervise or participate in the trust’s investment decisions during the term of the trust. if the covered member retains the right to amend or revoke the trust, Will the trust and the underlying assets be considered the covered member’s direct financial interests? Yes or Noarrow_forward

- (12) Which of the following would not be included in the corpus or principal of an estate? a. accrued interest and declared dividends on investments held by decedent b. personal valuables c. life insurance proceeds where designated beneficiary is the estate d. all of the above are includedarrow_forwardA corporation that transfers restricted stock to an employee as compensation may deduct the stock's fair market value in the year of transfer even if the employee doesn't recognize the value as gross income in the year of transfer. T/F also explain the reason, thanks.arrow_forwardIn an agreement involving the right to acquire property, which of the following are conditions that must be met in order for the IRS to accept the purchase price set in the agreement as a valid measurement of the value of the property being acquired? The purchase price must be determined by an independent appraisal submitted with an informational gift tax return regardless of the value of the property. The agreement must be a bona fide business arrangement. The agreement cannot be an attempt to transfer the property to a family member for less than full and adequate consideration. The terms of the agreement must be comparable to those that would be entered into by persons in an arm's-length transaction A) I and III B) II and IV C) I and IV D) II, III, and IVarrow_forward

- 1. When a business ceases to operate and its inventories are disposed of a gain on the inventories will be treated as a capital gain unless an election is made by the selling taxpayer True or False 2. When a business ceases to operate and its accounts receivable are disposed of with the other business assets any loss on the receivables will be treated as a capital loss unless a joint election is made by the purchaser and seller. True or Falsearrow_forwardwhen a C-Corp distributes appreciated assets to its shareholders should recognize in in the corporate return a taxable profit on the appreciation?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education