FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

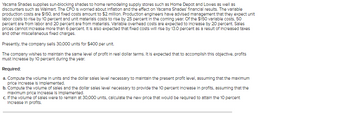

Transcribed Image Text:Yacama Shades supplies sun-blocking shades to home remodeling supply stores such as Home Depot and Lowes as well as

discounters such as Walmart. The CFO is worried about Inflation and the effect on Yacama Shades financial results. The variable

production costs are $150, and fixed costs amount to $2 million. Production engineers have advised management that they expect unit

labor costs to rise by 10 percent and unit materials costs to rise by 25 percent in the coming year. Of the $150 variable costs, 50

percent are from labor and 20 percent are from materials. Variable overhead costs are expected to Increase by 20 percent. Sales

prices cannot Increase more than 6 percent. It is also expected that fixed costs will rise by 13.0 percent as a result of Increased taxes

and other miscellaneous fixed charges.

Presently, the company sells 30,000 units for $400 per unit.

The company wishes to maintain the same level of profit in real dollar terms. It is expected that to accomplish this objective, profits

must Increase by 10 percent during the year.

Required:

a. Compute the volume in units and the dollar sales level necessary to maintain the present profit level, assuming that the maximum

price Increase is implemented.

b. Compute the volume of sales and the dollar sales level necessary to provide the 10 percent Increase in profits, assuming that the

maximum price increase is Implemented.

c. If the volume of sales were to remain at 30,000 units, calculate the new price that would be required to attain the 10 percent

Increase in profits.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps with 14 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Why is variable cost $174?

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Why is variable cost $174?

Solution

by Bartleby Expert

Knowledge Booster

Similar questions

- Suppose that the profit (in dollars) from the sale of Kisses and Kreams is given by P(x, y) = 10x + 6.9y-0.001x²-0.045y² where x is the number of pounds of Kisses and y is the number of pounds of Kreams. Find P/ay, and give the approximate rate of change of profit with respect to the number of pounds of Kreams that are sold if 100 pounds of Kisses and 14 pounds of Kreams are currently being sold. (Give an exact answer. Do not round.) What does this mean? If the number of pounds of Kisses is held constant and the number of pounds of Kreams is increased from 14 to 15, the profit will increase by approximately $ Need Help? Read It Watch itarrow_forwardHow many statements below regarding margin of safety are correct? 1. It is the amount by which sales can be reduced without incurring a loss. 2. It is the difference between budgeted sales and breakeven sales. 3. It can be expressed in terms of unit, pesos or percentage of sales. 4. Its presence indicates that the company expects profit. 5. The product of margin of safety units and unit contribution margin is the projected profit for the period. 6. The higher the margin of safety, the lower is the risk of incurring operating loss. 3 4arrow_forwardAssume that a company uses the absorption costing approach to cost-plus pricing. It is considering the introduction of a new product. To determine a selling price, the company has gathered the following information: Number of units to be produced and sold each year Unit product cost Estimated annual selling and administrative expenses Estimated investment required by the company Desired return on investment (ROI) What is the markup percentage on absorption cost required to achieve the desired ROI? 15,000 30 $ $81,900 $780,000 12%arrow_forward

- A retail store sells a popular cosmetic called Devine and the store manager was given $140,000 by the corporate office to improve store performance any way she thinks best. The "base case" information is a price of $28 per bottle, a contribution margin of 0.30, a customer defection rate of 17 percent, and a repurchase frequency of five times a year. These improvement funds could be used to (a) increase the contribution margin to 0.39 or (b) reduce the customer defection rate to 12 percent or (c) increase the repurchase frequency to six times per year. Assume all other variables remain at the base case level for each of the three improvement options. Use the Excel template VLC to calculate the VLC for each option and summarize your answers using the table below. Round your answers to the nearest cent. Contribution Repurchase Defection Margin Frequency Rate 0.30 5 17% The 0.39 5 17% 0.30 5 12% 6 17% $ (a) (b) Price $28 $28 $28 (c) $28 0.30 What is the best way to use $140,000 in…arrow_forwardCullumber Company is considering two alternatives. Alternative A will have sales of $158,500 and costs of $100,100. Alternative B will have sales of $180,900 and costs of $133,200. Compare alternative A with alternative B showing incremental revenues, costs, and net income. (If an amount reduces the net income then enter with a negative sign preceding the number, e.g. -15,000 or parenthesis, e.g. (15,000).) Revenues Costs Net income $ $ Alternative A $ $ Alternative B $ $ Net Income Increase (Decrease)arrow_forwardHighknob Co is thinking about introducing a new product.Below are the possible levels of unit sales and the probabilities of their occurrence. What is the expected value of the new product? Possible Market Reaction Sales in Units Probabilities Low Response 20 .10 Moderate Response 40 .20 High Response 65 .40 Very High Response 80 .30arrow_forward

- Wilderness Products, Incorporated, has designed a self-inflating sleeping pad for use by backpackers and campers. The following information is available about the new product: a. An investment of $1,350,000 will be necessary to carry inventories and accounts receivable and to purchase some new equipment needed in the manufacturing process. The company's required rate of return is 24% on all investments. b. A standard cost card has been prepared for the sleeping pad, as shown below: Direct materials Direct labor Manufacturing overhead (20% variable) Total standard cost per pad Standard Quantity or Hours 4.0 yards 2.4 hours 2.4 hours Standard Price or Rate $2.70 per yard $8.00 per hour $12.50 per hour Standard Cost $10.80 19.20 30.00 $ 60.00 c. The only variable selling and administrative expense will be a sales commission of $9 per pad. The fixed selling and administrative expenses will be $732,000 per year. d. Because the company manufactures many products, no more than 38,400 direct…arrow_forward1-Due to an increase in labor rates, the company estimates that variable expenses will increase by $3 per ball next year. If this change takes place and the selling price per ball remains constant at $25, what will be the new CM ratio and break-even point in balls? 2. Refer to the data in (2) above. If the expected change in variable expenses takes place, how many balls will have to be sold next year to earn the same net operating income, $90,000, as last year? 3. Refer again to the data in (2) above. The president feels that the company must raise the selling price of its basketballs. If Northwood Company wants to maintain the same CM ratio as last year, what selling price per ball must it charge next year to cover the increased labor costs?arrow_forwardPlease help with 7 through 10. Thank you!:)arrow_forward

- Your Company is considering the addition of a new product to its current product lines. The expected cost and revenue data for the new product are as follows: Annual sales in units 3,000 Selling price per unit $309 Variable costs per unit: Production $130 Selling $50 Traceable annual fixed costs: Production $51,000 Selling $75,000 Allocated annual fixed cost $54,000 If the new product is added to the existing product line, then sales of existing products will decline. As a consequence, the contribution margin of the existing product lines is expected to drop $78,000 per year. What is the increase in net income if the new product is added next year? This is a reverse drop the segment. New CM is positive and new FC and lost CM are negative.arrow_forwardUsing the following data, estimate the new Return on Investment if there is a 11% decrease in the average operating assets - with the new average operating assets as the base. Sales $2,565,862 Contribution margin 48% Controllable fixed costs 293,294 Average operating assets $4,671,197 Round to two decimal places. Be sure to enter the answer as a percentage but do not include the % sign.arrow_forward3) If demand for 2022 is instead 2,500 units should the company pay to increase their capacity? Why? Please explain your calculations and reference to the chart in Figure 1. Assume units are sold at the normal price. Please mention the concept of incremental profits. Hint: If you expand capacity, you will have to pay additional fixed costs of $25,000. Remember that fixed costs are fixed within the relevant range. If you expand capacity then you are outside this range. If you expand capacity then you can make revenue on 500 additional units at the normal price and would pay variable costs on 500 additional units. Please consider the incremental profit or loss of expanding capacity. The incremental profit is the increase in revenues minus the increase in costs of adding 500 more units. If the incremental profit of expanding capacity is positive then you should do so.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education