FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

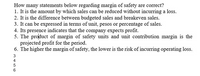

Transcribed Image Text:How many statements below regarding margin of safety are correct?

1. It is the amount by which sales can be reduced without incurring a loss.

2. It is the difference between budgeted sales and breakeven sales.

3. It can be expressed in terms of unit, pesos or percentage of sales.

4. Its presence indicates that the company expects profit.

5. The product of margin of safety units and unit contribution margin is the

projected profit for the period.

6. The higher the margin of safety, the lower is the risk of incurring operating loss.

3

4

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Target profit is added to what other financial statement line item, or element, to determine the numerator in the overall target contribution margin (CM) calculation in break-even analysis? Variable costs Fixed costs Net income after taxes Operating profitarrow_forwardNow suppose that annual unit sales, variable cost, and unit price are equal to their respective expected values—that is, there is no uncertainty. Determine the company's annual profit for this scenario. Round answer to a whole number, if needed.$arrow_forwardPlease explain this statement thoroughly. "To estimate what the profit will be at various levels of activity, multiply the number of units to be sold above or below the break-even point by the unit contribution margin."arrow_forward

- Change in operating income = change in sales dollars x contribution margin What is the equation for the "change in sales dollars"?arrow_forwardThe contribution margin equals sales minus all O period O variable O fixed O product expenses.arrow_forwardIf an organization wants to make a profit, it must generate more sales revenue than the total costs it incurs. This relation can be expressed using which of the following profit equations? O a. Operating income = [(Sales price per unit - Variable cost per unit) x #units sold] - Fixed cost O b. Operating income = [Sales price per unit - Fixed cost per unit) x # units produced] -Variable cost Oc Operating income Sales revenue - Total variable costs - Discretionary costs O d. Operating income - Sales revenue - Committed costs - Fixed costsarrow_forward

- At break even point: a) sales - contribution margin = net income or net loss b) sales - fixed expenses = variable expenses c) sales + variable expenses = contribution margin d) contribution margin + fixed expenses = net incomearrow_forwardWhen the sales price per unit decreases, the contribution margin per unit A. decreases B. increases OC. increases proportionately OD. remains the same 13arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education