ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

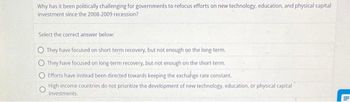

Transcribed Image Text:Why has it been politically challenging for governments to refocus efforts on new technology, education, and physical capital

investment since the 2008-2009 recession?

Select the correct answer below.

They have focused on short-term recovery, but not enough on the long-term.

O They have focused on long-term recovery, but not enough on the short-term.

Efforts have instead been directed towards keeping the exchange rate constant.

High-income countries do not prioritize the development of new technology, education, or physical capital

investments.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Consider a world with only two countries (i.e., two large open economies), the home country and the foreign country. Both countries have a zero current account balance initially. When answering the following questions, clearly label the lines and show the changes in the graph provided below. Give an intuitive explanation for the effects in each case. b-What are the effects on the world equilibrium interest rate, national saving, investment, and the current account balance in each country if home expected future marginal productivity of capital increases? c- What are the effects on the world equilibrium interest rate, national saving, investment, and the current account balance in each country if foreign country experiences a temporary adverse supply shock?arrow_forward3arrow_forwardHow is the impact of contractionary monetary policy different in an open economy than in a closed economy? How is the impact of expansionary fiscal policy different in an open economy than in a closed economy?arrow_forward

- Explain the impact of a sudden appreciation in a country's currency exchange rate on its export-oriented industries and overall economic growth.arrow_forwardConsider a small open economy that takes the world real interest rate as given. Suppose that initially the world real interest rate is less than the country’s autarky real interest rate. Now suppose there is a change in tax policy that leads to an increase in domestic investment demand. Which of the following is TRUE? a. The economy may flip from importing capital to exporting capital b. There is an increase in the quantity of domestic saving c. There is an increase in the real interest rate paid by domestic investors d. None of the other optionsarrow_forwardExplain why a developing country with a fixed exchange rate Explain why a developing country with a fixed exchange rate and foreign exchange controls in place (perfectly immobile capital) may find itself dependent on growth in exports, foreign investment, or foreign aid to attain economic growth. Explain why a developing country with a fixed exchange ratearrow_forward

- If a country runs a deficit in its current account, it has to be financed by running a capital account surplus which is limited to borrowing from abroad. Select one: O True O Falsearrow_forwarda. Describe what is happening to the country’s capital account of the balance of payments prior to government changing its tack on supporting the value of the currency? Which items in the capital account are likely to change and how will they change? b. What is likely to happen to the country’s real exchange rate initially and after the government changes its policy stance with respect to supporting the currency? Please justify your answer. c. What happens to the current account balance right after the oil price shock and after the government stops supporting the currency? What items of the current account are likely to change and why? d. How is the market for non-tradables in the domestic economy affected in these two stages?arrow_forwardHelp on all parts please.arrow_forward

- provides some hypothetical data on macroeconomicaccountsforthreecountriesrepresented by A, B, and C and measured in billions of currency units. In Table, private household saving is SH, tax revenue is T, government spending is G, and investment spending is I. a. Calculate the trade balance and the net inflow of foreign saving for each country. b. State whether each one has a trade surplus or deficit (or balanced trade). c. State whether each is a net lender or borrower internationally and explain.arrow_forwardGive correct answer with short explanationarrow_forward1. What explains how the dollars per euro exchange rate will change in the future if the exchange rate is wxpected to rise. 2. What is addressed by the USMCA? 3. Country A has a GDP of 60,000,000 and country B has a per capita of 2,000. If the populations of countries a and b are 40,000 and 20,000 respectively, which country is most developed based on per capita GDP? 4. how can a difference in Gini coefficients for the United States and china be interpreted 5. which of the following trends have followed globalization?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education