Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

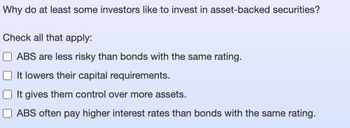

Transcribed Image Text:Why do at least some investors like to invest in asset-backed securities?

Check all that apply:

ABS are less risky than bonds with the same rating.

It lowers their capital requirements.

It gives them control over more assets.

ABS often pay higher interest rates than bonds with the same rating.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Bonds that have investment-grade ratings from sources such as S&P tend to have higher interest (coupon) rates due to higher default risk. True Falsearrow_forwardHistorical evidence indicates that stocks Seleccione una: a. underperform bonds. b. outperform bonds. C. Are less risky than bonds. d. have the same return as bonds.arrow_forwardThese are corporate bonds that have a higher rate of return with a higher level of risk? Group of answer choices Revenue bonds Junk bonds GOBs Tax increment bondsarrow_forward

- Why think that convertibles are riskier than straight bonds?arrow_forwardCorporate bonds are riskier than US Treasury, so they pay default risk premium over what Treasury pays to stay competitive in the market. True Falsearrow_forwardA bond does not pay out regular interest. This means that *a. This is a bad investment.b. It is unsecured.c. It is a junk bond.d. It is a zero-coupon bond.arrow_forward

- In a few sentences, answer the following question as completely as you can. In discussing asset pricing, your textbook suggests that an investor will be indifferent between two bonds with equal yield to maturity, as long as they are of equivalent risk. Can you think of any real-world factors that might make an investor prefer one of these bonds over the other?arrow_forwardETFs are the most popular investment instruments for individual and institutional investors. You are interviewing with a FinTech firm that creates bond ETFs. Make a pitch for how you will design Bond ETFs that offer something unique and that are able to stand out in the crowd given the proliferation of bonds ETFs in the market. Keep in mind that bond values depend on, (a) bond ratings, and (b) the macroeconomic environment. Also keep in mind the relation between the promised payments and interest-rate risk; indenture/structured provisions and agency theory; the concept of over and underpriced bonds; the concept of hidden risk; the importance of being able to predict the macro environment; and the importance of AI and ML in a robo-advising context.arrow_forwardExplain why company managers might choose to issue zero-coupon bonds instead of interest-bearing bonds or coupon bonds instead of zero- coupon bonds? Give pros and cons of each. Be sure to consider the situation from the bond issuer's viewpoint and not the bondholder.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education