Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

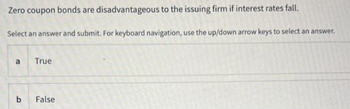

Transcribed Image Text:Zero coupon bonds are disadvantageous to the issuing firm if interest rates fall.

Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer.

a

b

True

False

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 3. When the bond stated interest rate (coupon rate) exceeds the market rate, the bonds are issued at discount (meaning the issuance price is less than the face value). Is this statement TRUE or FALSE? Your answer is Explain your answer: 4. Corporate credit ratings CCC suggest the lowest default risk. Is this statement TRUE or FALSE? Your answer is Explain your answer:arrow_forwardWhen borrowers tend to pay back the loans to bankers earlier, the bank is facing a. Repricing risk O b. Yield curve risk O c. Basis points risk d. Embedded options riskarrow_forwardA zero coupon bond has more interest rate risk than a comparable coupon bond. true or falsearrow_forward

- 1. Use the following statements to answer questions 1-2. Statement 1: Modified duration is a better measure for a bond’s sensitivity for shaping risk than key rate duration. Statement 2: Effective duration is a better measure for a bond with an embedded option than modified duration. Statement 3: Spread duration is a measure of the risk-free rate change. Statement 4: Modified duration is a measure of curve duration. A. Statement 3 B. Statement 4 C. Both statement 3 and 4 D. Neither statementarrow_forwardPlease help me.thank youarrow_forwardThe money market is the short-term market for stocks and bonds. Select one: True OR Falsearrow_forward

- Solve this practice problem. Both pictures are the same problemarrow_forwardPrice risk is the risk that Select one: a. the bond principal will not be paid in full or on time. b. market prices increase due to market interest rate changes making bonds more expensive to purchase. c. the bonds in a dedicated portfolio will decrease in value in response to an increase in interest rates. d. the yield-to-maturity will be less than the inflation risk causing the real rate of return to be negative. e. coupon payments will be reinvested at a rate that is less than the bond's yield-to-maturityarrow_forwardBond ratings predict the probability of default. Select one: True OR Falsearrow_forward

- Bonds that have investment-grade ratings from sources such as S&P tend to have higher interest (coupon) rates due to higher default risk. True Falsearrow_forwardHistorical evidence indicates that stocks Seleccione una: a. underperform bonds. b. outperform bonds. C. Are less risky than bonds. d. have the same return as bonds.arrow_forwardZero-coupon bonds has higher yield than otherwise identical coupon paying bonds. Select one: True Falsearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education