FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Please answer all of them

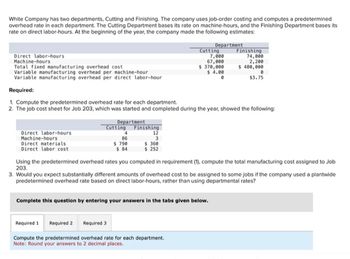

Transcribed Image Text:White Company has two departments, Cutting and Finishing. The company uses job-order costing and computes a predetermined

overhead rate in each department. The Cutting Department bases its rate on machine-hours, and the Finishing Department bases its

rate on direct labor-hours. At the beginning of the year, the company made the following estimates:

Direct labor-hours

Machine-hours

Direct materials

Direct labor cost

Cutting

4

86

$ 790

$ 84

Direct labor-hours

Machine-hours

Total fixed manufacturing overhead cost

Variable manufacturing overhead per machine-hour

Variable manufacturing overhead per direct labor-hour

Required:

1. Compute the predetermined overhead rate for each department.

2. The job cost sheet for Job 203, which was started and completed during the year, showed the following:

Department

Finishing

12

3

$ 360

$ 252

Department

Cutting

7,000

67,000

$ 370,000

$ 4.00

0

Required 1 Required 2

Required 3

Compute the predetermined overhead rate for each department.

Note: Round your answers to 2 decimal places.

Finishing

74,000

2,200

$ 480,000

Complete this question by entering your answers in the tabs given below.

Using the predetermined overhead rates you computed in requirement (1), compute the total manufacturing cost assigned to Job

203.

0

$3.75

3. Would you expect substantially different amounts of overhead cost to be assigned to some jobs if the company used a plantwide

predetermined overhead rate based on direct labor-hours, rather than using departmental rates?

![Exercise 2B-1 (Algo) Overhead Rate Based on Capacity [LO2-7]

Wixis Cabinets makes custom wooden cabinets for high-end stereo systems from specialty woods. The company uses a job-order

costing system. The capacity of the plant is determined by the capacity of its constraint, which is time on the automated bandsaw that

makes finely beveled cuts in wood according to the preprogrammed specifications of each cabinet. The bandsaw can operate up to

184 hours per month. The estimated total manufacturing overhead cost at capacity is $15,088 per month. The company bases its

predetermined overhead rate on capacity, so its predetermined overhead rate is $82 per hour of bandsaw use.

The results of a recent month's operations appear below:

Sales

Beginning inventories

Ending inventories

Direct materials

Direct labor

Manufacturing overhead incurred

Selling and administrative expense

Actual hours of bandsaw use

Required:

1-b. What was the cost of unused capacity during the month?

1-a. Prepare an income statement for the month. Your income statement should include the cost of unused capacity as a period

expense.

$ 43,800

$ $0

$0

Required 1A Required 1B

$5,310

$8,840

$14,260

$ 8,220

154

Complete this question by entering your answers in the table below.

Wixis Cabinets

Income Statement

Prepare an income statement for the month. Your income statement should include the cost of unused capacity as a period

expense.](https://content.bartleby.com/qna-images/question/c9737efd-391f-457a-98f6-aa044a0527f1/1f1a0c7c-127a-4eb4-ae0d-61041ca60212/1ikqb9_thumbnail.jpeg)

Transcribed Image Text:Exercise 2B-1 (Algo) Overhead Rate Based on Capacity [LO2-7]

Wixis Cabinets makes custom wooden cabinets for high-end stereo systems from specialty woods. The company uses a job-order

costing system. The capacity of the plant is determined by the capacity of its constraint, which is time on the automated bandsaw that

makes finely beveled cuts in wood according to the preprogrammed specifications of each cabinet. The bandsaw can operate up to

184 hours per month. The estimated total manufacturing overhead cost at capacity is $15,088 per month. The company bases its

predetermined overhead rate on capacity, so its predetermined overhead rate is $82 per hour of bandsaw use.

The results of a recent month's operations appear below:

Sales

Beginning inventories

Ending inventories

Direct materials

Direct labor

Manufacturing overhead incurred

Selling and administrative expense

Actual hours of bandsaw use

Required:

1-b. What was the cost of unused capacity during the month?

1-a. Prepare an income statement for the month. Your income statement should include the cost of unused capacity as a period

expense.

$ 43,800

$ $0

$0

Required 1A Required 1B

$5,310

$8,840

$14,260

$ 8,220

154

Complete this question by entering your answers in the table below.

Wixis Cabinets

Income Statement

Prepare an income statement for the month. Your income statement should include the cost of unused capacity as a period

expense.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education