FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

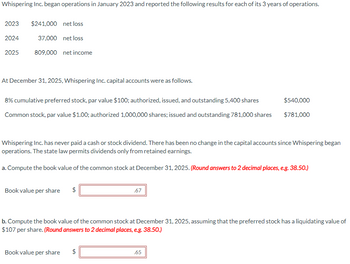

Transcribed Image Text:Whispering Inc. began operations in January 2023 and reported the following results for each of its 3 years of operations.

2023 $241,000

2024

net loss

37,000 net loss

809,000 net income

2025

At December 31, 2025, Whispering Inc. capital accounts were as follows.

8% cumulative preferred stock, par value $100; authorized, issued, and outstanding 5,400 shares

Common stock, par value $1.00; authorized 1,000,000 shares; issued and outstanding 781,000 shares

Whispering Inc. has never paid a cash or stock dividend. There has been no change in the capital accounts since Whispering began

operations. The state law permits dividends only from retained earnings.

a. Compute the book value of the common stock at December 31, 2025. (Round answers to 2 decimal places, e.g. 38.50.)

Book value per share $

+A

.67

b. Compute the book value of the common stock at December 31, 2025, assuming that the preferred stock has a liquidating value of

$107 per share. (Round answers to 2 decimal places, e.g. 38.50.)

Book value per share $

$540,000

$781,000

.65

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- sarrow_forwardSelected information regarding the accounts of Infinity Minerals Corp. follows: Common shares, unlimited authorized, 51,000 shares issued and outstanding, December 31, 2022 Common dividends declared and paid during 2023 Cumulative effect of change in accounting estimate (net of $7,200 tax) Profit for the year ended December 31, 2023 Preferred dividends declared and paid during 2023 Preferred shares, $4.90 non-cumulative, 15,100 shares orized, issued, and outstanding, December 31, 2022 Retained earnings, December 31, 2022 (as originally reported) Balance, January 1 Balance, December 31 Next Prepare a statement of changes in equity for the year ended December 31, 2023, assuming 7,100 common shares were issued during 2023 at an average price of $21.94 per share and that no preferred shares were issued in 2023. (Negative answers should be indicated by a minus sign.) INFINITY MINERALS CORP. Statement of Changes in Equity For Year Ended December 31, 2023 Preferred Shares $ $1,075,000 121,000…arrow_forwardThe equity section of the December 31", 2025, balance sheet for BOOYA Inc. showed the following: BOOYA Inc. Equity Section of the Balance Sheet December 31, 2025 Contributed Capital: Preferred shares, $0.25 non-cumulative, 80,000 shares authorized, 60,000 shares issued and outstanding Common shares, 250,000 shares authorized, 120,000 shares issued and outstanding Total contributed capital Retained earnings Total equity $150,000 120.000 $270,000 92.500 $362,500 During the year 2026, BOOYA Inc had the following transactions affecting equity accounts: Sold 20,000 common shares for a total of $21,500 cash Sold 5,000 preferred shares for $3.00 each, cash. Issued and exchanged 7,000 common shares for equipment with a list price of $10,000 (fair value unknown). Common shares were trading at $1.42 on June 15th. Jan. 3 Mar. 1 June 15. Closed the Income Summary account, which showed a credit balance of $175,000. Dec. 31 The board of directors had not declared a dividend for the past two years…arrow_forward

- On December 31, 2022, the equity accounts of Book Creations, Inc., contained the following balances: Common stock ($10 par, 100,000 shares authorized) 30,000 shares issued and outstanding $300,000 Retained earnings $476,600 For the year 2022, the corporation had net income before income taxes of $176,300, income taxes of $35,260, and net income after taxes of $141,040. The corporation’s tax rate is 20 percent.An expansion of the existing plant at a cost of $564,300 is planned. The corporation’s president, who owns 60 percent of the corporation’s common stock, estimates that the expansion would result in an increased net income of approximately $176,300 before interest and taxes. The financial vice president forecasts that the increase would be only $88,150. Management is considering two possibilities for financing: Issuance of 20,000 additional shares of common stock for $29 per share. Issuance of $564,300 face amount, 10-year, 6 percent bonds payable, secured by a…arrow_forwardOn December 31, 2022, the equity accounts of Book Creations, Inc., contained the following balances: Common stock ($10 par, 100,000 shares authorized) 30,000 shares issued and outstanding $300,000 Retained earnings $476,600 For the year 2022, the corporation had net income before income taxes of $176,300, income taxes of $35,260, and net income after taxes of $141,040. The corporation’s tax rate is 20 percent.An expansion of the existing plant at a cost of $564,300 is planned. The corporation’s president, who owns 60 percent of the corporation’s common stock, estimates that the expansion would result in an increased net income of approximately $176,300 before interest and taxes. The financial vice president forecasts that the increase would be only $88,150. Management is considering two possibilities for financing: Issuance of 20,000 additional shares of common stock for $29 per share. Issuance of $564,300 face amount, 10-year, 6 percent bonds payable, secured by a…arrow_forwardVishalarrow_forward

- Pharoah Inc. began operations in January 2018 and reported the following results for each of its 3 years of operations. $36,000 net loss 2020 2018 $283.000 net loss 2019 At December 31, 2020, Pharoah Inc. capital accounts were as follows. 9% cumulative preferred stock, par value $100; authorized, issued. and outstanding 5,300 shares Common stock, par value $1.00; authorized 1,000,000 shares; issued and outstanding 758,000 shares $746,000 net income Book value per share $ $530,000 $758,000 Pharoah Inc. has never paid a cash or stock dividend. There has been no change in the capital accounts since Pharoah began operations. The state law permits dividends only from retained earnings. (a) Compute the book value of the common stock at December 31, 2020. (Round answers to 2 decimal places, e.g. $38.50.) Book value per share $ (b) Compute the book value of the common stock at December 31, 2020, assuming that the preferred stock has a liquidating value of $107 per share. (Round answers to 2…arrow_forwardSkysong Company's ledger shows the following balances on December 31, 2025. 6% Preferred stock-$10 par value, outstanding 20,100 shares Common stock-$100 par value, outstanding 30,300 shares Retained earnings Assuming that the directors decide to declare total dividends in the amount of $362,000, determine how much each class of stock should receive under each of the conditions stated below. One year's dividends are in arrears on the preferred stock. a. The preferred stock is cumulative and fully participating. (Round the rate of participation to 6 decimal places, eg0.014278. Round answers to O decimal places, e.g. 38,487.) Preferred Preferred 158,870 Preferred b. The preferred stock is noncumulative and nonparticipatine. (Round answers to 0 decimal places, eg. 38,487.) 12060 Common 76712 Common 203130 $201.000 3,030,000 664,000 c. The preferred stock is noncumulative and is participating in distributions in excess of a 8% dividend rate on the common stock. (Round the rate of…arrow_forwardRiverbed Ltd. provides the following information for calendar 2023: 1. Net income $468,470 2. Capital Structure a) $9 preferred shares, no par value, cumulative, 6,000 shares outstanding $600,000 No dividends were declared during 2023. b) Common shares, 81,000 shares outstanding on January 1. On April 1, 43,000 shares were issued for cash. On October 1, 19,000 shares were purchased and retired $1,187,500 c) On January 2, 2022, Riverbed purchased Apso Corporation. One of the terms of the purchase was that if Riverbed’s net income for 2022 or subsequent years is $448,470 or more, 53,000 additional common shares would be issued to Apso shareholders.Calculate basic and diluted earnings per share for 2023. (Round answers to 2 decimal places, e.g. 15.25.) Basic earnings per share $enter a dollar amount rounded to 2 decimal places Diluted earnings per share $enter a dollar amount rounded to 2 decimal placesarrow_forward

- Centipede Ltd. reported $1,558,200 net income for the year ended December 31, 2023 and paid preferred dividends of $45,800 on December 31, 2023. The following changes in common shares outstanding occurred during the year: 1-Jan 1-Apr 1-Jul 1-Sep 1-Nov 213,000 common shares were outstanding Issued 50,000 common shares Declared and issued a 10% common share dividend Repurchased and retired 12,000 common shares Issued a 3:1 stock split Required: Show all of your calculations in this spreadsheet EPS Question 2.xlsx so that you may be awarded part marks. Save your URL below part b. a) What is the weighted average number of common shares (WACS) outstanding during 2023? (5 marks) Round WACS to nearest unit (no mal places). WACS = b) What is the company's earnings per share for the year ended December 31, 2023? (2 marks) Round EPS to 2 decimal places. PS = $ A/arrow_forwardListed below are the transactions that affected the shareholders' equity of Branch-Rickie Corporation during the period 2024-2026. At December 31, 2023, the corporation's accounts included: Common stock, 105 million shares at $1 par Paid-in capital-excess of par Retained earnings ($ in thousands) $ 105,000 624,000 840,000 a. November 1, 2024, the board of directors declared a cash dividend of $0.60 per share on its common shares, payable to shareholders of record November 15, to be paid December 1. b. On March 1, 2025, the board of directors declared a property dividend consisting of corporate bonds of Warner Corporation that Branch-Rickie was holding as an investment. The bonds had a fair value of $1.9 million, but were purchased two years previously for $1.7 million. Because they were intended to be held to maturity, the bonds had not been previously written up. The property dividend was payable to shareholders of record March 13, to be distributed April 5. c. On July 12, 2025, the…arrow_forwardCrane Limited reported the following items in shareholders' equity on December 31, 2024: Share capital: Preferred shares, $4 cumulative dividend, 165,000 shares issued and outstanding $16,500,000 Share capital: Common shares, 767,000 issued and outstanding 38,350,000 Retained earnings 26,290,000 (a) No dividends were declared in 2022 or 2023; however, in 2024, cash dividends of $5,431,500 were declared. Calculate how much would be paid to each class of shares. Preferred Common Total Arrears 2022 $ $ $ Arrears 2023arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education