FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

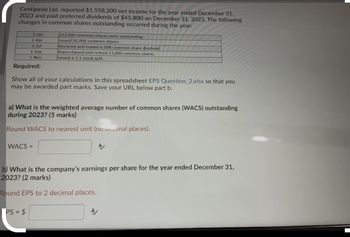

Transcribed Image Text:Centipede Ltd. reported $1,558,200 net income for the year ended December 31,

2023 and paid preferred dividends of $45,800 on December 31, 2023. The following

changes in common shares outstanding occurred during the year:

1-Jan

1-Apr

1-Jul

1-Sep

1-Nov

213,000 common shares were outstanding

Issued 50,000 common shares

Declared and issued a 10% common share dividend

Repurchased and retired 12,000 common shares

Issued a 3:1 stock split

Required:

Show all of your calculations in this spreadsheet EPS Question 2.xlsx so that you

may be awarded part marks. Save your URL below part b.

a) What is the weighted average number of common shares (WACS) outstanding

during 2023? (5 marks)

Round WACS to nearest unit (no mal places).

WACS =

b) What is the company's earnings per share for the year ended December 31,

2023? (2 marks)

Round EPS to 2 decimal places.

PS = $

A/

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Markus Company’s common stock sold for $5.25 per share at the end of this year. The company paid a common stock dividend of $0.63 per share this year. It also provided the following data excerpts from this year’s financial statements: EndingBalance BeginningBalance Cash $ 49,000 $ 44,200 Accounts receivable $ 92,000 $ 68,700 Inventory $ 76,300 $ 92,000 Current assets $ 217,300 $ 204,900 Total assets $ 801,000 $ 875,400 Current liabilities $ 85,500 $ 90,000 Total liabilities $ 206,000 $ 185,400 Common stock, $1 par value $ 165,000 $ 165,000 Total stockholders’ equity $ 595,000 $ 690,000 Total liabilities and stockholders’ equity $ 801,000 $ 875,400 This Year Sales (all on account) $ 1,095,000 Cost of goods sold $ 635,100 Gross margin $ 459,900 Net operating income $ 313,875 Interest expense $ 15,500 Net income $ 208,862 7. What is the amount of working capital and the current ratio at the end of this year?arrow_forwardNonearrow_forwardOn January 1, 2017, Ehrlich Corporation had the following stockholders’ equity accounts.Common Stock ($10 par value, 100,000 shares issued and outstanding) $1,000,000Paid-in Capital in Excess of Par—Common Stock 200,000Retained Earnings 540,000During the year, the following transactions occurred.Jan. 15 Declared a $1 cash dividend per share to stockholders of record on January 31, payable February 15.Feb. 15 Paid the dividend declared in January.Apr. 15 Declared a 15% stock dividend to stockholders of record on April 30, distributable May 15. On April 15, the market price of the stock was $15 per share.May 15 Issued the shares for the stock dividend.Dec. 1 Declared a $0.50 per share cash dividend to stockholders of record on December 15, payable January 10, 2018. 31 Determined that net income for the year was $250,000.Instructions(a) Journalize the…arrow_forward

- Every entry should have narration pleasearrow_forwardThe following information was taken from the financial statement of Fox Resources for December 31 of the current fiscal year: Common stock, $20 par value (no change during the year) $5,000,000 Preferred 10% stock, $40 par (no change during the year) 2,000,000 The net income was $600,000, and the declared dividends on the common stock were $125,000 for the current year. The market price of the common stock is $20 per share. Calculate for the common stock: i cant figure out earnings per share, price-earnings ratio, dividends per share or dividend yieldarrow_forwardThe following selected accounts appear in the ledger of Parks Construction Inc. at the beginning of the current fiscal year: Preferred 1% Stock, $50 par (100,000 shares authorized, 83,900 shares issued)$4,195,000 Paid-In Capital in Excess of Par—Preferred Stock184,580 Common Stock, $3 par (5,000,000 shares authorized, 2,120,000 shares issued)6,360,000 Paid-In Capital in Excess of Par—Common Stock1,590,000 Retained Earnings31,692,000 During the year, the corporation completed a number of transactions affecting the stockholders’ equity. They are summarized as follows: Journalize the entries to record the transactions. Should equal 18 lines. Jan. 5 Issued 467,700 shares of common stock at $9, receiving cash. Feb. 10 Issued 10,700 shares of preferred 1% stock at $62. Mar. 19 Purchased 53,000 shares of treasury stock for $6 per share. May 16 Sold 20,000 shares of treasury stock for $8 per share. Aug. 25 Sold 5,200 shares of treasury stock for $5 per share. Dec. 6 Declared cash…arrow_forward

- At December 31, the records of Kozmetsky Corporation provided the following selected and incomplete Common stock (par $2; no changes during the current year). Shares authorized, 5,000,000. Shares issued, ?; issue price $8 per share. Shares held as treasury stock, 10,300 shares, cost $6 per share. Net income for the current year, $509,740. Common Stock account, $153,000. Dividends declared and paid during the current year, $2 per share. Retained Earnings balance, beginning of year, $830,000. Required: Complete the following: (Round "Earnings per share" to 2 decimal places.) 1-a. Shares issued 1-b. Shares outstanding 2. The balance in Additional Paid-in Capital would be 3. Earnings per share is 4. Total dividends paid on common stock during the current year is 5. Treasury stock should be reported in the stockholders' equity section of the balance sheet in the amount of 6. Assume that the board of directors voted a 2-for-1 stock split. After the stock split, the par value per share will…arrow_forwardThe records of Seahawks Company reflected the following balances in the stockholders' equity accounts at the end of the current year: Common stock, $11 par value, 49,000 shares outstanding Preferred stock, 8 percent, $9 par value, 9,000 shares outstanding Retained earnings, $231,000 On September 1 of the current year, the board of directors was considering the distribution of a(n) $71,000 cash dividend. No dividends were paid during the previous two years. You have been asked to determine dividend amounts under two independent assumptions: a. The preferred stock is noncumulative. b. The preferred stock is cumulative. Required: 1. Determine the total and per share amounts that would be paid to the common stockholders and the preferred stockholders under the two independent assumptions. Note: Round your "per share" amounts to 2 decimal places. Noncumulative: Total Per share Cumulative: Total Per share $ Preferred stock Common stock 35,280 $ 64,520arrow_forwardBlossom Ltd. reported the following balances at January 1, 2023: Common shares Retained earnings Accumulated other comprehensive income $355,000 67,200 68,200 During the year Blossom earned net income of $297,000 and generated other comprehensive income of $61,300. Prepare a statement of changes in shareholders' equity for the year ended December 31, 2023.arrow_forward

- The records of Seahawks Company reflected the following balances in the stockholders' equity accounts at the end of the current year: Common stock, $10 par value, 42,000 shares outstanding Preferred stock, 12 percent, $8 par value, 8,000 shares outstanding Retained earnings, $223,000 On September 1 of the current year, the board of directors was considering the distribution of a(n) $65,000 cash dividend. No dividends were paid during the previous two years. You have been asked to determine dividend amounts under two independent assumptions: The preferred stock is noncumulative. The preferred stock is cumulative. Required: 1. Determine the total and per share amounts that would be paid to the common stockholders and the preferred stockholders under the two independent assumptions. Note: Round your "per share" amounts to 2 decimal places. Preferred stock Common stock Noncumulative: Total Per share Cumulative: Total Per sharearrow_forwardTexas Inc. has 4,724 shares of 8%, $100 par value cumulative preferred stock and 83,877 shares of $1 par value common stock outstanding at December 31. What is the annual dividend on the preferred stock? a. $80.00 per share b. $4,724 in total )c. $37,792 in total Od. $6,710 in totalarrow_forwardA company with 118,808 authorized shares of $5 par common stock issued 31,951 shares at $16 per share. Subsequently, the company declared a 2% stock dividend on a date when the market price was $33 a share. What is the amount transferred from the retained earnings account to paid-in capital accounts as a result of the stock dividend? Oa. $17,893 Ob. $21,088 Oc. $3,195 Od. $78,413arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education