Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

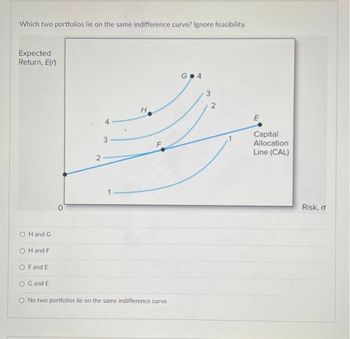

Transcribed Image Text:Which two portfolios lie on the same indifference curve? Ignore feasibility.

Expected

Return, E(r)

OH and G

OH and F

O F and E

0

2

4

3

H

O G and E

O No two portfolios lie on the same indifference curve

G 4

3

N

E

Capital

Allocation

Line (CAL)

Risk, o

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Baghibenarrow_forwardBhagiarrow_forwardWhen, if ever, will the geometric average return exceed the arithmetic average return for a given set of returns? Never When the set of returns includes only risk-free rates. When all of the rates of return in the set of returns are equal to each other.arrow_forward

- Which of these are true about the Security Market Line and Capital Market Line models? 1. the intercepts are the same 2. the independent variable for the Capital Market Line is beta 3, the Capital Market Line applies to portfolios only O 1 and 2 only O 2 only O 1 and 3 only O 2 and 3 only O 3 onlyarrow_forwardA diagram of the CML and SML for the market M, risk-free asset ry, an inefficient portfolio P, and a complete portfolio C is shown below. The diagram is not to scale. E(r) E(13) CML & CALP E(12) P C E(r) M 01 02 03 P βρ SML M Вм The values of the labeled variables are E[1] = 3.0%, E[12] = 10.3%, E[3] = 16.7%, σ₁ = 17.9%, σ = 30.0%, 03 = 44.3%. What is the standard deviation of nonsystematic risk for the complete portfolio σc under the CAPM? O a. 0.1374 O b. 0.1180 O c. 0.0988 d. 0.1105 O e. 0.0791 O f. 0.0913 Og. 0.0858 O h. 0.1443arrow_forwardPlease do not give solution in image format Thankyouarrow_forward

- If the internal rate of return (IRR) of a well-behaved investment alternative is equal to MARR, which of the following statements about the other measures of worth for this alternative must be true? i. PW = 0 ii. AW = 0. Solve, a. I onlyb. II only c. Neither I nor II d. Both I and II.arrow_forwardCalculate the optimal risky portfolio for the following cases when short-sales are allowed. Compute its expected return and the standard deviation of its returns. 1. Two risky assets: Rp = 3, R' = [6, 9], and 4 5 5 20 2. Three risky assets: Rp = 4, R' = [5,9, 8], and [10 0 0 E=0 40 0 0 20 3. Three risky assets: Rp = 5, R' = [12, 9, 8], and 40 10 -5] E= 10 20 0 5 0 30 4. Five risky assets: Rp = 2, R' = [5, 3, 18, 9, 2], and %3D 2 16 0. -12 5 -12 20 16 10 7 14 27 14 9. -13 8. 7 27 13arrow_forwardYou plan to analyze the value of a potential investment by calculating the sum of the present values of its expected cash flows. If the discount rate decreases the it would lower the calculated value of the investment. Group of answer choices True Falsearrow_forward

- Which one of the following is a property of a pure arbitrage portfolio?a. Negative investment.b. Zero return.c. Positive systematic risk.d. Zero total risk.arrow_forwardExplain the meaning and differences between the correlation coefficients “p” in the traditional portfolio and the beta “B” coefficients in the capital asset pricing model (CMPL) approacharrow_forwardIn order to create an efficient set of portfolios thru optimization using concepts from Markowitz portfolio theory, you would need to forecast only 2 variables including expected return and standard deviation or variance for the asset classes or securities in focus. True or falsearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education