Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

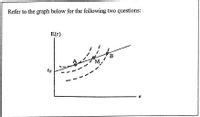

Suppose the solid line represents the capital market line that results from a

Group of answer choices

The individual optimally holds only the market portfolio, M.

The individual optimally holds portfolio B which can be partially characterized by a long position in the riskless asset.

The individual optimally holds portfolio B which can be partially characterized by a short position in the riskless security

The individual optimally holds portfolio A which can be partially characterized by a long position in the riskless security.

None of the above.

Transcribed Image Text:**Graph Description for Educational Purposes:**

The graph is used to analyze risk-return dynamics in financial studies. It consists of the following components:

1. **Axes:**

- The vertical axis is labeled as \( E(r) \), representing the expected return.

- The horizontal axis is labeled as \( \sigma \), representing risk or standard deviation.

2. **Key Points and Line:**

- A straight line originates from the point labeled \( r_F \) on the vertical axis. This point represents the risk-free return rate.

- The line extends upward and to the right, illustrating the Capital Market Line (CML) which represents risk-return trade-off of efficient portfolios.

3. **Curved Lines:**

- Three dashed curved lines are displayed, indicating the indifference curves of an investor. These lines represent combinations of risk and return that provide the same level of utility to the investor.

4. **Labeled Points:**

- Point \( A \) lies on one of the lower curved dashed lines, indicating a combination of risk and return that is less optimal on the investor's utility curve.

- Point \( B \) is positioned on a higher indifference curve, suggesting a more preferred risk-return profile.

- Point \( M \) is on the straight line (CML) and represents the market portfolio, which is tangent to the highest indifference curve attainable given the risk-free rate and market conditions.

This graph serves as a tool to understand the equilibrium in the market for risk and return, highlighting the optimal market portfolio and the investor’s preferences for risk.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A beta of 1.0 represents an asset that O is less responsive than the market portfolio has the same response as the market portfolio O is unaffected by market movement O is more responsive than the market portfolioarrow_forwardAssume a utility function of ? = ?[?] − 1 ?? 2. Which statement(s) is/are correct about investors with this utility function? [I] An investor with a higher degree of risk aversion chooses the optimal portfolio with a higher risk premium [II] An investor with a higher degree of risk aversion chooses the optimal portfolio with lower risk [III] An investor with a higher degree of risk aversion chooses the optimal portfolio with a higher sharpe ratio [IV] The extent to which the investor dislikes risk is captured by ? 2 A. [II] only B. [I], [II] only C. [III] , [IV] only D. [II], [IV] only E. [I], [II], [III] onlyarrow_forwardAt a minimum, which of the following would you need to know to estimate the amount of additional reward you will receive for purchasing a risky asset instead of a risk-free asset? 1. I. Asset's standard deviation 2. II. Asset's beta 3. III. Risk-free rate of return 4. IV. Market risk premium I, III, and IV only I, II, III, and IV I and III only II and IV only III and IV only ооо Oarrow_forward

- You are testing the no-arbitrage principle of the APT, and you find a well-diversified portfolio with a β of 0.9 with respect to the market portfolio, M. You also have a risk-free asset, rf. Create a mimicking portfolio and show that it’s beta is also 0.9.arrow_forwardConsider the following portfolio choice problem. The investor has initial wealth w and utility u(x)=. There is a safe asset (such as a US government bond) that has net real return of zero. There is also a risky asset with a random net return that has only two possible returns, R₁ with probability 1-q and Ro with probability q. We assume R₁ 0. Let A be the amount invested in the risky asset, so that w - A is invested in the safe asset. 1) Does the investor put more or less of his portfolio into the risky asset as his wealth increases?arrow_forwardWhich of the following portfolios achieves the highest Sharpe ratio? (check all that applies) Any portfolio created with a combination of mvp and risk free rate Any portfolio created with a combination of tangency portfolio and risk free rate Any portfolio created with a combination of mvp and tangency portfolioarrow_forward

- What impact does each of the followingparameters have on the value of a call option?(4) Risk-free ratearrow_forwardSuppose you have an investment portfolio with fraction x invested in a market portfolio and (1-x) in a risk- free asset. Increasing fraction x invested in the market portfolio and consequently decreasing (1-x) invested in the risk-free asset shall (select any correct answer, if there are multiple correct answers) Select one or more: O decrease the Sharpe ratio of the resulting portfolio O decrease the expected return of the resulting portfolio increase the Sharpe ratio of the resulting portfolio increase the expected return of the resulting portfolio Dincrease the risk of the resulting portfolioarrow_forwardTheta measures an option's: Multiple Choice O O intrinsic value. volatility. rate of time decay. sensitivity to changes in the value of the underlying asset. sensitivity to changes in the risk-free rate.arrow_forward

- Which of these are true about the Security Market Line and Capital Market Line models? 1. the intercepts are the same 2. the independent variable for the Capital Market Line is beta 3, the Capital Market Line applies to portfolios only O 1 and 2 only O 2 only O 1 and 3 only O 2 and 3 only O 3 onlyarrow_forwardWhich of the following best describes an investor's risk-return trade-off function? Group of answer choices Indifference curves Capital Asset Pricing Model Characteristic line Efficient portfolio Arbitrage Pricing Modelarrow_forwardThe CAPM states that the expected (required) return on an asset is : E(Ri)=Rf+βi[E(RM)−Rf] where the term in square brackets is the risk-premium earned by the market portfolio. Therefore, the beta of the market portfolio (βM) must be equal to __________ . A) zero B) 0.5 C) 1.0 D) an unknown estimatearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education