ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

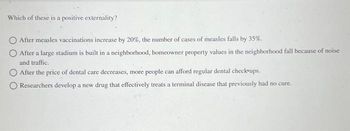

Transcribed Image Text:Which of these is a positive externality?

After measles vaccinations increase by 20%, the number of cases of measles falls by 35%.

After a large stadium is built in a neighborhood, homeowner property values in the neighborhood fall because of noise

and traffic.

After the price of dental care decreases, more people can afford regular dental check-ups.

Researchers develop a new drug that effectively treats a terminal disease that previously had no cure.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Assume that health insurance is private in a country, and the market for insurance is competitive. The figure below shows the marginal benefit and willingness and ability to pay curve. Premium (thousands of dollars per year) $6,000 per family. $4,000 per family. $8,000 per family. $2,000 per family. 12 10 8 6 2 0 D = MB 10 20 30 40 50 Quantity (millions of families insured) Suppose that the marginal social benefit of insurance exceeds the willingness and ability to pay by a constant $2,000 per family per year. Suppose the marginal cost of health insurance is a constant $8,000 a year. If the government decides to subsidize health insurance, what subsidy will achieve the efficient coverage?arrow_forwardSuppose a new social service is introduced by a government at a fixed cost of $3,000 (note: there is no marginal cost to provide this service). This service has not been provided before and there is no available substitute for this service. Economists have estimated the marginal benefit of the new service is given by: MB = 100 – Q where Q is the quantity (in hours) of the service that is used. Please note the MB gives both the marginal private benefit (MPB) and marginal social benefit (MSB) (i.e., MB = MPB = MSB). Now, suppose the $3,000 investment can only provide 50 hours of service. Please draw the supply and demand graph for this service. Make sure to use all relevant information from the above questions. Please label your graph carefully.arrow_forwardGive an example of supply and demand during the pandemicarrow_forward

- A consumer’s demand for a medical service is as follows: Q = 100 - PP where PP is the out-of-pocket price she actually faces. She is considering four different insurance options: uninsurance, full insurance, a 50% coinsurance plan, and a copayment plan with a $25 copay. Assume this service has a list price of PL = $70. Calculate Q under each insurance plan. Calculate the amount of social loss under each insurance plan. Derive a general expression for social loss as a function of x and PL, where x is the copay amount under a copayment plan. For simplicity’s sake, assume x < PL. Derive a general expression for social loss as a function of y and PL, where y is the coinsurance rate.arrow_forwardSuppose a new social service is introduced by a government at a fixed cost of $3,000 (note: there is no marginal cost to provide this service). This service has not been provided before and there is no available substitute for this service. Economists have estimated the marginal benefit of the new service is given by: MB = 100 – Q where Q is the quantity (in hours) of the service that is used. Please note the MB gives both the marginal private benefit (MPB) and marginal social benefit (MSB) (i.e., MB = MPB = MSB). To ensure those that need the service the most are the ones that receive it, the government sets up an administrative mechanism to ration the 50 hours of service (e.g. people have to meet certain criteria that have to be checked). The cost to the government of setting up this mechanism is $500. Is it a good investment for the government to provide the service with this rationing mechanism in place? What is the net social benefit that is created? Explain your reasoning and…arrow_forwardExternalities Mark owns a butchery. His marginal cost of selling meat is MC = 0.35Q, where Q is the pounds of meat he sells. Mark is in a competitive market and can sell all the meat he wishes for $7 per pound. However, the smell from the butchery bothers the customers of George, the owner of the coffee shop next door. Assume that every pound of meat costs George $1.4 worth of lost business. If Mark focuses on maximizing his profit, how much would he sell? At the profit-maximizing quantity from part a, does selling the last pound of meat benefit the society. Calculate the social marginal cost and compare it to the marginal benefit. Note that here “society” refers to Mark and George. What is the socially optimal quantity of meat sold?arrow_forward

- The pandemic has upended the way New Yorkers dine out: There are sidewalk tables, open streets, streeteries, and barely anyone eating indoors. Now, as the weather gets colder, there are also plastic bubbles out on sidewalks, too. A video of the dome-shaped tents on a West Village street went viral this week, prompting questions of how safe they are, not to mention just what they are. Bubbles of various sorts have shown up around the country since restaurants began to ease into this new, strange era of dining out. […] But the igloolike tents can also get costly and require strict sanitation measures, and some health experts question how safe they actually are. … the big question: Are these things safe? Along with sanitation protocols, most restaurants use flameless candles inside the bubbles in hopes of avoiding any melt-y fires (PVC is toxic when it burns). But the biggest concern is of course the reason for the bubble in the first place, COVID. Dr. Abraar Karan is an internal…arrow_forwardHow to draw the market equilibrium quantity of the vaccine diagram?arrow_forwardSuppose a new social service is introduced by a government at a fixed cost of $3,000 (note: there is no marginal cost to provide this service). This service has not been provided before and there is no available substitute for this service. Economists have estimated the marginal benefit of the new service is given by: MB = 100 – Q where Q is the quantity (in hours) of the service that is used. Please note the MB gives both the marginal private benefit (MPB) and marginal social benefit (MSB) (i.e., MB = MPB = MSB). Suppose that instead of using an administrative mechanism, the government imposes a price to ration the use of the service to recover part of its costs. What price should be introduced to ration the use of the service to 50 hours? What is the net social benefit when the service charge is used? How does charging a price compare to providing it for free and/or rationing? Be Hint(s): similarly, think about measuring the area of consumer surplus and compare it to the…arrow_forward

- Medical bills may be paid by any of the following methods except shifting consumption from one period to another. reducing your welfare loss. charity. family or friends. third party insurance companies.arrow_forwardThis is an exercise. Answer the statement below. Why most people wanted to move to another house during pandemic, but felt stuck and keep staying in their home? Does it because they did not have enough money to pay for their house or they felt stress over the pandemic?arrow_forwardSuppose a new social service is introduced by a government at a fixed cost of $3,000 (note: there is no marginal cost to provide this service). This service has not been provided before and there is no available substitute for this service. Economists have estimated the marginal benefit of the new service is given by: MB = 100 – Q where Q is the quantity (in hours) of the service that is used. Please note the MB gives both the marginal private benefit (MPB) and marginal social benefit (MSB) (i.e., MB = MPB = MSB). Compare the two mechanisms (administrative and price) for rationing the service. How do they compare in terms of efficiency (the size of the pie) and in terms of distributional impacts (the way the pie is divided up between the service users and taxpayers)?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education