ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

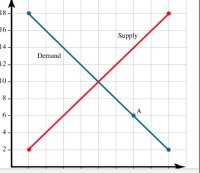

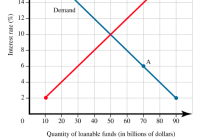

Please use the graph to answer the given questions. Assume the people act rationally.

Which of the statements best describes a situation represented by point A? Look at the image to solve for this

Jeff agrees to lend money to his brother, who plans to use the funds to open a shoe store.

Wayne projects that if he takes out a loan to open another gym franchise, he will earn a lower return than the interest rate he would have to pay, so he decides against it.

Janine predicts that, if she borrows to expand operations, she will earn a rate of profit higher than the interest rate of the loan. So, she decides to take out the loan.

Carly decides against purchasing a corporate bond because she has another investment opportunity that returns 17%.

Given the market conditions, what will be the prevailing interest rate?

18%

2%

17%

10%

6%

Given the market conditions, how much will be available in loanable funds?

$90 billion

$50 billion

$30 billion

$70 billion

$10 billion

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Tom is a retail manager who's training one of his seasoned salespeople on the features and benefits of a new product the company will be carrying. What training method is Tom using? A. Behavior modeling B. Role rotation C. In-basket technique D. On-the-job training Give justification for your answerarrow_forwardHow does the scarcity of resources affect the firm’s decision making? Justify your answer through discussing specific situations.arrow_forwardMaggie is currently using the website Matchmaker.com to help her search for a new partner. Maggie is enjoying going on the dates she has arranged through this website. She believes the marginal benefits are more than the marginal costs from using the website. Which of the following statements is true? Maggie should always continue using Matchmaker.com as the benefits outweigh the cost. Maggie's opportunity cost from using Matchmaker.com will eventually start to rise and her benefits will eventually start to fall. Maggie should immediately cease using Matchmaker.com when she has a successful date. With her benefits per hour currently exceeding her costs per hour, Maggie is at the optimal level of information. Maggie's use of Matchmaker.com will become subject to diminishing returns to scale as her costs fall. 0000arrow_forward

- Whose work on decision making received a 2002 Nobel Prize?arrow_forwardEconomics promotes which of the following as the way to make the best decision? Continue an enjoyable activity until you are tired of doing it. Continue an enjoyable activity up to the point where its marginal benefit equals its marginal cost. Continue an enjoyable activity as long as you do not have to pay for it. Continue an enjoyable activity until you cannot afford to pursue it.arrow_forwardQUESTION 23 In the 1950s, Walt Disney began to plan the development of a theme park that would eventually become Disneyland. Disney hired an economist to help determine whether the park would be a financial success. This economist surveyed managers of existing amusement parks for advice. Many of these managers A. recommended that the theme park be located in California because population in the state would increase greatly in the future. Disney followed this advice. B. recommended that Disney first build an audience for his park by offering the ABC television network a weekly program that would feature Disney movies, cartoons and original programming. Walt Disney followed this advice. Both the television program and Disneyland were financial successes. C. recommended that Disney not build the park and leave the amusement park business to those who knew what they were doing. D. believed that a theme park would be very successful because the Disney name created a market among children…arrow_forward

- You want to travel to Las Vegas to celebrate spring break and your "A" in your microeconomics class! You are trying to figure out if you should drive or fly. A round trip airline ticket from Riverside to Las Vegas costs $350 and flying there and back takes about 5 hours. Driving roundtrip to Las Vegas costs about $50 in gas and takes about 10 hours. Other things constant, what is the minimum amount of money that you would have to expect to make by gambling in Las Vegas to induce you as a rational individual to fly rather than drive? O $10 an hour $60 an hour O $70 an hour O $300 an hourarrow_forwardIn an attempt to adopt a system to enhance organizational performance, Mr. Addison is torn between adopting a centralized decision-making system or a decentralized decision-making system. Which of these two systems will you recommend to him and why?arrow_forwardEconomics Describe an interaction in the business world that can be described as each of the following. Note that your example can be interactions between competitors, between firms on a supply chain, or among employees or investors within a firm. (a) Prisoner's Dilemma-style game (cooperation beneficial, but defecting is dominant) (b) Coordination game (like Stag Hunt) (c) Competing coordination game (like Date Night or Format Wars) (d) Mixed equilibrium game (e) Sequential game with first-mover advantage (f) Sequential game with second-mover advantagearrow_forward

- How would you analyze your data for a quantitative research proposal?arrow_forwardWrite a research paper on the 2008 Economic Crisis that affected McDonald's Corporation, a global fast-food chain. In this research paper, perform the following tasks: Do research on the worldwide economic crisis of 2008 and, in particular, focus on the company you selected. Discuss how your chosen company faired in the economic crisis of 2008. Discuss the microeconomic implications of the crisis on your company. Discuss whether your company was immune or not immune to the crisis. Discuss the performance after the crisis and the implications for the future.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education