FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

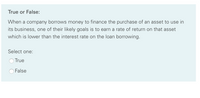

Transcribed Image Text:True or False:

When a company borrows money to finance the purchase of an asset to use in

its business, one of their likely goals is to earn a rate of return on that asset

which is lower than the interest rate on the loan borrowing.

Select one:

True

False

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A company can either purchase or lease an asset. When comparing the two alternatives, which of the following is not an advantage of buying and financing the asset? (a) the possibility of receiving an investment tax credit (b) Obtaining a tax deduction for the depreciation expense (c) The potential of the asset to appreciate in value (d) Improved financial leveragearrow_forwardIf we hold all other factors the same, an increase in interest rates will: a. Decrease the present value of a stream of constant payments we expect to receive. b. Increase the present value of a stream of constant payments we expect to receive. c. Decrease the interest revenue that a company will earn on its funds that it holds in its interest-bearing checking account. d. No impact on how much a company should be willing to pay for factory equipment that is expected to significantly reduce the factory electricity costs.arrow_forwardPlease Make this notes clearer and perfectly written. Here is my notes: At times companies engage in repurchase agreements; are from the perspective of the borrowers. they borrow money to finance themselves short term and the value of the money they borrow whatever that value is they agreed to pay the lenders when they return the money with a higher value even if they borrow low and pay high and that difference is their cost of funding repurchase agreements repurchase agreements are always collateralized with high quality paper government securities it can also be a commodity like precious metals gold or silver repos besides the collateralization. The federal funds that's an important take away that one member of the treasury reserve system lends to another short term loans that one member of the treasury reserve system lends to another The banks have surplus reserves with our central bank some are in deficit the who the ones who are in surplus lend to the ones who are in deficit…arrow_forward

- Which of the following is an example of faithful representation? A Showing lease payments as a rental expense B Being prudent by recording the entire amount of a convertible loan as a liability C Creating a provision for staff relocation costs as part of a planned restructuring D Recording a sale and repurchase transaction with a bank as a loan rather than a salearrow_forwardWhich of the following statements about "avoidable interest" is false? it is computed only on self-constructed assets. it is computed using a weighted-average interest rate on debt and equity financing. it increases assets on the balance sheet. O it is an approximation of the interest expense the firm would have incurred if it financed all construction through debt.arrow_forwardTrue (t) or False (f) _____ A reason some companies purchase investments is because they generate a significant portion of their earnings from investment income.arrow_forward

- Suppose a firm wants to maintain a specific TIE ratio. It knows the amount of its debt, the interest rate on that debt, the applicable tax rate, and its operating costs. With this information, the firm can calculate the amount of sales required to achieve its target TIE ratio. a. True b. Falsearrow_forwardIn looking at Free Cash Flow, which of the following is true? The value of any asset business is based solely on the free cash flow and it is important to buyers and sellers. FCF's are the discounts received from vendors for purchases made The net income of a company should be equal to its free cash flow. FCF's represent the funds available to business owners that can be withdrawn after all business related costs and investments have been paid.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education