ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

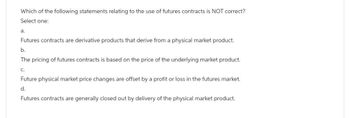

Transcribed Image Text:Which of the following statements relating to the use of futures contracts is NOT correct?

Select one:

a.

Futures contracts are derivative products that derive from a physical market product.

b.

The pricing of futures contracts is based on the price of the underlying market product.

C.

Future physical market price changes are offset by a profit or loss in the futures market.

d.

Futures contracts are generally closed out by delivery of the physical market product.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 3. A trader buys two July futures contracts on frozen orange juice. Each contract is for the delivery of 15,000 pounds. The current futures price is 160 cents per pound, the initial margin is $6,000 per contract, and the maintenance margin is $4,500 per contract. What price change would lead to a margin call? -arrow_forwardWhich of the following is not related to overall market variability. A•Financial risk B•Interest rate risk C•Purchasing power risk D•Market riskarrow_forward2. Explain the benefits to the Potential employee if M&S opens the new food store.arrow_forward

- Give typing answer with explanation and conclusionarrow_forwardWhich of the following is an example of a bourse market? a. Ahorro Muebles, a store that sells premium furniture at discounted rates b. Flippa.com, a Website that allows buyers to negotiate prices with the sellers of handmade goods c. La Tienda Médica, a website that sells surgical equipment in bulk at fixed prices d. National Lumber & Hardware, a hardware store that sells allits products at 10% above the maximum retail pricearrow_forwardIdentify the false statement. a. The productivity increases in manufacturing sector in the USA during the industrial era can be attributed to automation, technology advances, and business process reengineering (BPR). b. In a single-queue, single-server queuing system, if the value of Mu (µ) exceeds the value of lambda (λ), then no queue will form. c. For a single-queue, single-server queuing system, the value of lambda (λ) may exceed that of Mu (µ). d. The SERVQUAL model can be used to assess customer satisfaction based on service quality gaps.arrow_forward

- 7. A firm's can sell higher quality products for more: P = 10 + 20 X, where X is the quality of the product sold. Workers hired by the firm make a product, the quality of which depends on effort and luck X = e +€, where X= Quality, e = effort, and e = Luck E(e) = 0. .so average quality depends on effort Wages are contingent on outcome (X) where w = C(e) = e² with e20 10 + 8 X and the cost of effort Determine the level of effort, the expected wage, and the expected profit for the above wage arrangement. Compare your results to the case where workers are paid a standard wage of $10 and the level of effort and the quality of the product do not alter the wage.arrow_forward5. Using the following table, practice the Expected Monetary Value (EMV), Expected Opportunity Loss (EOL), and Expected Value of Perfect Information (EVPI). Use the .30 for the probability of a Strong Market, .50 for the probability of a Fair Market, and .20 for the probability of a Poor Market. Show your selections (highlight your best alternative). show the work on an excel file. PROFIT ($) STRONG MARKET FAIR MARKET POOR MARKET Large facility 550,000 110,000 -310,000 Medium-sized facility 300,00 129,000 -100,000 Small facility 200,000 100,000 -32,000 No facility 0 0 0arrow_forwardThe demand for product Q is given by Q = 220 - P and the total cost of Q by: STC =1000+80Q -3Q² +=Q³ 3 3 a. Find the price function and then the TR function. See Assignment 3 or 4 for an example. b. Write the MR and MC functions below. Remember: MR = d.TR/dQ and MC = dS.TC/dQ. See Assignment 5 for a review of derivatives. c. What positive value of Q will maximize total profit? Remember: setting MR = MC and solving for Q will give you the Q that maximizes total profit. The value of Q you get should not be zero or negative. d. Use the price function found in (a) to determine the price per unit that will need to be charged at the Q found in (c). This will be the price you should ask per unit for each unit of Q that maximizes total profit. e. How much total profit will result from selling the quantity found in (c) at the price found in (d)? Remember: profit is TR - STC. f. At what level of Q is revenue maximized? Remember, let MR = 0 and solve for Q. MR = 0 signals the objective of…arrow_forward

- A hedger trades futures to protect a price and ensure a margin for a cash commodity while a speculator trades futures to profit strictly from a change in price. A. True B. Falsearrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education