Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

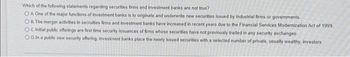

Transcribed Image Text:Which of the following statements regarding securities firms and investment banks are not true?

OA One of the major functions of investment banks is to originate and underwrite new securities issued by industrial firms or governments

OB. The merger activities in secruities firms and investment banks have increased in recent years due to the Financial Services Modernization Act of 1999

OC. Initial public offerings are first time security issuances of firms whose securities have not previously traded in any security exchanges.

OD. In a public new security offering, investment banks place the newly issued securities with a selected number of private, usually wealthy, investors.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A large nation-wide bank’s acquisition of a major investment advisory firm would be an example of a: a. market extension merger. b. conglomerate merger. c. product extension merger. d. horizontal merger.arrow_forwardWhich of the following is an example of a systematic risk? Bond investor invests in a Japanese investment grade bond and receives coupon payments in Japanese yens A firm hires a former politician with ties to the Republican party when a political climate in the state changes U.S. government announces an increase in corporate tax rate Bond investor receives news about a bond issuer issuing another corporate bondarrow_forwardWhich of the following is true of the current state of financial regulation for financial institutions (FIs)? Most banks can transfer risk on a greater scale and in more complex ways than before. Most FIs now conduct virtual global business, reducing the influence of very large FIs. Most global financial money and capital markets are deliberately disconnected. Most securities exchanges have required majority ownership by resident nationals.arrow_forward

- What is the primary function of a stock exchange? a) To provide loans to businesses b) To facilitate buying and selling of securities c) To regulate interest rates d) To manufacture goodsarrow_forwardQuestion about Securitization in Accounts Receivables How does a large company convert it's accounts receivables into securities? How does that process exactly work? And how does this benefit both parties? (when selling the security). Please explain this case and give an e.g for better understanding.arrow_forwardInvestment banking refers to O A. Activities related to underwriting and distributing new issues of equity and debt securities (IPOS and Seasoned Offerings) B. Turning deposits into loans Oc. Opening checking accounts for individuals O D. Selling certificates of deposits (CDs)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education