Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Please answer in 10 minute just need final answer not explanation

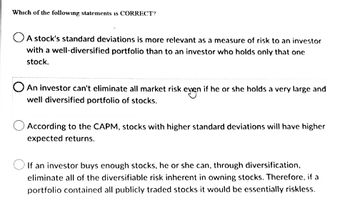

Transcribed Image Text:Which of the following statements is CORRECT?

A stock's standard deviations is more relevant as a measure of risk to an investor

with a well-diversified portfolio than to an investor who holds only that one

stock.

O An investor can't eliminate all market risk even if he or she holds a very large and

even

well diversified portfolio of stocks.

According to the CAPM, stocks with higher standard deviations will have higher

expected returns.

If an investor buys enough stocks, he or she can, through diversification,

eliminate all of the diversifiable risk inherent in owning stocks. Therefore, if a

portfolio contained all publicly traded stocks it would be essentially riskless.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Question Z Short Answer (2 sentences or less) What are 3 benefits of reducing a client’s AGI? I. II. III. Full explain this question and text typing work only We should answer our question within 2 hours takes more time then we will reduce Rating Dont ignore this linearrow_forwardPlease do not give solution in image format thankuarrow_forward7:27 f t < Session[1].docx - Word ✓ Qo 138 - 21 Paragraph O References Mailings Review View Help BLUEBEAM One day you're going to miss my boring texts ## TO Accessibility: Investigate Search Costs to date Estimated costs to complete Progress billings during the year Cash collected during the year hoher webb ng Normal ||| No Spacing Styles Acrobat 2021 $ 980,000 3,020,000 1,000,000 648,000 Go to website O Heading 1 √ Calculate the amount will be reported for accounts receivable on the statement of financial position at December 31, 2022. 3. Accounts Receivable on the Statement of Financial Position at December 31, 2022 for Newton Corp.: Accounts Receivable is calculated as the cumulative billings to date minus the cumulative cash collected: Accounts Receivable at December 31, 2022 = Cumulative Billings- Cumulative Cash Collected Accounts Receivable at December 31, 2022 = ($1,000,000+ $1,000,000) - ($648,000+ $1,280,000) = $2,000,000 - $1,928,000 = $72,000 Therefore, the amount reported…arrow_forward

- Bookmarks People Tab Window Help 192.168.1.229 60 83% Wed 12:20 PM Chapter 10 Homework (Applice X CengageNOWv2 | Online teach x lim/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false ☆ 青N Login Common A... A Common Black Co... *No Fear Shakespe... b Hamlet, Prince of... E 12th Grade PVA H.. O Paraphrasing Tool.. eBook Labor Variances. Verde Company produces wheels for bicycles. During the year, 656,000 wheels were produced. The actual labor used was 364,000 hours at $9.20 per hour. Verde has the following labor standards: 1) $10.40 per hour; 2) 0.48 hour per wheel. Required: 1. Compute the labor rate variance. 2. Compute the labor efficiency variance. Previous Next Check My Workarrow_forwardPlease solve max please in 15-22 minutes and no reject thank u. Im needed please no rejectarrow_forwardFile Edit View History Bookmarks Profiles estion 4 - Proctoring Enable X getproctorio.com/secured #lockdown ctoring Enabled: Chapter 6 Homework Assignm... i 4 kipped ic raw 511 F CUNY Login 2 Req 1 Req 2 to 4 #3 Complete this question by entering your answers in the tabs below. с Tab How many performance obligations are in this contract? Number of performance obligations $ Window Help st X 4 Barrick Gold Corporation is a mining company that produces gold and copper with 16 operating sites in 13 countries. It is headquartered in Toronto, Ontario, Canada. On March 1, 2024, Barrick Gold receives $150,000 from Citizen Bank and promises to deliver 95 units of certified 1-ounce gold bars on a future date. The contract states that ownership passes to the bank when Barrick Gold delivers the products to Brink's, a third-party carrier. In addition, Barrick Gold has agreed to provide a replacement shipment at no additional cost if the product is lost in transit. The stand-alone price of a gold…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education