ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

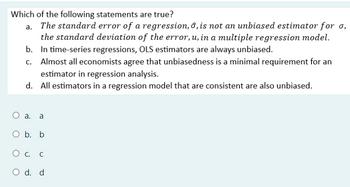

Transcribed Image Text:Which of the following statements are true?

a. The standard error of a regression, 6, is not an unbiased estimator for σ,

the standard deviation of the error, u, in a multiple regression model.

b. In time-series regressions, OLS estimators are always unbiased.

c. Almost all economists agree that unbiasedness is a minimal requirement for an

estimator in regression analysis.

d. All estimators in a regression model that are consistent are also unbiased.

○ a. a

O b. b

О с.

O d. d

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Sally Sells Sea Shells by the Sea Shore and collects all sales dataNow she is curious to find out what the elasticity of demand is for her shells Assume they are all the same type and quantity She scatter plots the data and finds there is a linear relationship that looks ripe for a regression estimation of the price response function for her shells The slope of her regression line is 61. Currently, her average daily price is 11.74 and she sells 95 quantity at that priceCalculate the point elasticity of demand for her sea shellsarrow_forwardwhat are the key features , Strength and limitation of following model? and when which model should be used? Ordinary Least Squares Logit regression model Probit regression modelarrow_forwardIn a multiple OLS regression. Does correlation between explanitory variables violate assumtion number 4 multicolliniearity? Or is it just for perfect colinearity?arrow_forward

- Suppose you run the following regression: outcome=alpha0 + alpha1*female + alpha2*married + epsilon. You know that female equals 1 for females and 0 otherwise. You know that married equals 1 if the person is married and 0 otherwise. What is the estimated outcome for non-married females?arrow_forwardPlease help me with both the question. Answer there are incorrectarrow_forwardQUESTION 2 Continue to use the example from Question 1. Suppose each product is randomly assigned to a process by a computer program, but some products get reassigned on the factory floor (for practical reasons). Let Z¡ denote the original assignment and X¡ the actual process used to produce i. In a regression of Y¡ on X¡ and Wj, OLS is: d. Potentially biased because W; should not be included b. Potentially biased, but an IV regression using Z¡ as an instrument can be used to obtain a consistent estimator C. Unbiased because the products were randomly assigned in the beginning d. Unbiased as long as Zj is also included as a control variablearrow_forward

- Suppose you have run four regression models: A, B, C, and D. You are going to make a decision on which one to use just based on the adjusted r² value. Here are the adjusted r² values for each model: A: 0.71 B: 0.57 C: 0.65 D: 0.76 Which regression model would you choose based on the adjusted r²? OD since it has the highest adjusted r² value B since it has the lowest adjusted r² OC since it has an adjusted r² between the adjusted r² of regressions B and D. Either B or C since they have the lowest adjusted r²arrow_forwardPlease answer all 3 sub-sections of this questionarrow_forwardImagine you are an economist working for the Government of Econville. You are tasked with developing a model to predict the GDP of the country based on various factors such as interest rates, inflation, unemployment rate, and population growth. You collect quarterly data for the past 20 years and start building your model. After running your initial regression, you notice some peculiar patterns in the residuals: (1) residuals do not have identical variances across different levels of the independent variables; (2) two or more independent variables in a regression model are highly correlated with each other; (3) the correlation of a variable with its own past values. You suspect that your model might be suffering from 3 potential issues in the regression analysis that can affect reliability and validity. List 2 factors in your model that might be causing the Multicollinearity and give a reasonarrow_forward

- The data for this question is given in the file 1.Q1.xlsx(see image) and it refers to data for some cities X1 = total overall reported crime rate per 1 million residents X3 = annual police funding in $/resident X7 = % of people 25 years+ with at least 4 years of college (a) Estimate a regression with X1 as the dependent variable and X3 and X7 as the independent variables. (b) Will additional education help to reduce total overall crime (lead to a statistically significant reduction in crime)? Please explain. (c) Will an increase in funding for the police departments help reduce total overall crime (lead to a statistically significant reduction in total overall crime)? Please explain. (d) If you were asked to recommend a policy to reduce crime, then, based only on the above regression results, would you choose to invest in education (local schools) or in additional funding for the police? Please explain.arrow_forward18 Calculate the least square regression líne equation with the given X and Y values. Consider the values: X Y 60 3.1 61 3.6 62 3.8 63 4 65 4.1 To Find, Least Square Regression Line EquationY = a+ b Xarrow_forwardDefine coefficients of the Linear Regression Model?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education