Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

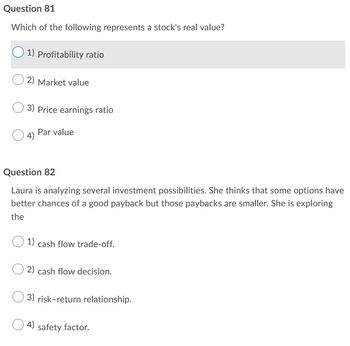

Transcribed Image Text:Question 81

Which of the following represents a stock's real value?

1) Profitability ratio

2) Market value

3) Price earnings ratio

4) Par value

Question 82

Laura is analyzing several investment possibilities. She thinks that some options have

better chances of a good payback but those paybacks are smaller. She is exploring

the

1) cash flow trade-off.

2) cash flow decision.

3) risk-return relationship.

4) safety factor.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Discuss how to determine the risk or beta of a stock, the required rate of return of a stock and the value of a stock. How do you determine if a stock has high or low or average risk when compared to the S&P 500? How do you determine if a stock is overpriced, underpriced or fairly priced? Explain and Discuss.arrow_forwardStep by step explaination (use attached diagram) This question relates to Diagram 6 from the diagrams, which shows the probability distributions of returns for Shares N, P and Q. In which share would a risk-averse investor be most likely to invest? Select one: a. Share N b. Share P c. Share Q d. We need more information about the investor's risk tolerance to determine which share the investor would prefer.arrow_forwardQuestion 77 For the following, fill in the blanks with the appropriate term(s). For questions that give you two or three choices to choose from, circle the most appropriate. (7.1) The return on an investment comes in two forms: the and the two forms: component gain or loss. The return on investment in common stock comes in gains (or losses).. and gains (or losses) for an investment in common stock arise from in the value of the investment. (7.2) The total percentage return for an investment in common stock is the sum of the yield and the [(Pt+1-P)/ Pt] The gains yield. The dividend yield is defined algebraically as gains yield is defined algebraically as (7.3) The debt represented by T-bills is virtually free of any life. We will call the rate of return on such debt the over its short and we will use it as a kind of benchmark. The difference between the rate of return for a risky investment and the return on T-bills is the for the risky asset. som levo (7.4) An investor's portfolio is…arrow_forward

- If you have the chance to invest in the stock market, what company will you invest in and why? Explain your methods or steps in choosing that company.arrow_forwardWhat are some analyzes we can do to predict which stock will go up?arrow_forwardAn informed and prudent investor uses a variety of measures such as financial ratios, book value, earnings per share, return on equity etc. to evaluate the worthiness and prospects of stocks he/she would invest in. It is important for you as an investor to understand how these values are calculated and what do they mean. Use the following tables to assess the worthiness of Verticon stock as an investment. Verticon Stock Data (Current and Historical) 2:12PM EDT Aug 16, 2011 Price 18.85 USD Change +0.64 (+3.51%) Mkt cap 147.1B Div/yield 0.20/4.24 Shares 8,012 Beta 0.70 Book/share 11.335 PE ratio 17 12/2010 12/2009 12/2008 (Millions of Dollars) Total Assets 195,014 195,949 111,148 Total Liabilities 107,201 122,935 53,592 Preferred Shareholders’ Equity 52 61 73 Common Shareholders’ Equity 87,761 72,953 57,483 Shares Outstanding 8,012 8,070 6746 Book/Share ? 9.040 8.521 Q1 (Mar ’11) 2010 Net profit…arrow_forward

- What would be a simple options strategy to exploit your conviction about the stock price's future movements? Group of answer choices Long Straddle Short Straddle Bull Spread Bear Spreadarrow_forward. Define and briefly discuss the investment merits of each of the following. Blue chips Income stocks Mid-cap stocksarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education