FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

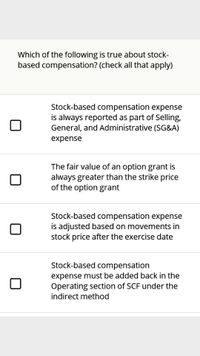

Transcribed Image Text:Which of the following is true about stock-

based compensation? (check all that apply)

Stock-based compensation expense

is always reported as part of Selling,

General, and Administrative (SG&A)

expense

The fair value of an option grant is

always greater than the strike price

of the option grant

Stock-based compensation expense

is adjusted based on movements in

stock price after the exercise date

Stock-based compensation

expense must be added back in the

Operating section of SCF under the

indirect method

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- If common stock is issued for an amount greater than par value, the excess goes to what account? a. Legal Capital b. Retained Earnings C. Cash d. Paid-in-Capital in Exess of Par Value A Moving to the next question prevents changes to this answer. & % #3 8.arrow_forwardThe Equity Method of accounting for investments: a) Requires the investment asset to increase proportionally with the affiliates net income b) Requires the investment asset to decrease proportionally with the affiliates net loss c) Requires the investment asset to decrease proportionally with dividends received d) All of the abovearrow_forwardeAssignmentSession Locator=&inprogress=false True O False Lo Under the equity method, a stock purchase is recorded at its original cost and is not adjusted to fair market value each accounting period. Yarrow_forward

- Which of the following items would not appear in the section of the statement of financial position (balance sheet) headed 'Capital and reserves'? a) Share premium b) Revaluation reserve c) Preference shares d) Debenturesarrow_forwardCommon Stock investments using the fair value method are: A. reported at fair value on the balance sheet. B. reported at cost on the balance sheet. C. reported with property, plant and equipment on the balance sheet. D. not reported on the balance sheet.arrow_forwardAn offering of shares to institutional investors at a discount to the current market price is known as a: Select one: a. Initial Public Offering (IPO). b. Private Placement c. Rights Issue d. Dividend Reinvestment Plan (DRP).arrow_forward

- Which of the following stock investments should be accounted for using the cost method? Group of answer choices.... Investments of less than 20%. Investments between 20% and 50%. Investments of less than 20% and investments between 20% and 50%. All stock investments should be accounted for using the cost method.arrow_forwardTrue or False: When stock is issued for more than its par value, the excess is considered to be an expense and should be reported on the income statement. Select one: O True Falsearrow_forward4. Define the following terms. Signaling hypothesis; clientele effect Residual distribution model; extra dividend Declaration date; holder-of-record date; ex-dividend date; payment date Dividend reinvestment plan (DRIP) Stock split; stock dividend; stock repurchasearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education