Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

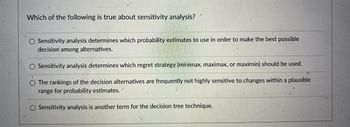

Transcribed Image Text:Which of the following is true about sensitivity analysis?

O Sensitivity analysis determines which probability estimates to use in order to make the best possible

decision among alternatives.

O Sensitivity analysis determines which regret strategy (minimax, maximax, or maximin) should be used.

O The rankings of the decision alternatives are frequently not highly sensitive to changes within a plausible

range for probability estimates.

O Sensitivity analysis is another term for the decision tree technique.

n

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- What is the difference between an IRR preference and an IRR lookback?arrow_forwardWhich of the following statements about Least Squares Regression is not true ? Least -squares regression is a mathematical technique to fit a cost -estimating equation to observed data . In least -squares regression , a statistical measure (R -squared ) can be used to determine how well the equation fits the data . Least -squares regression is considered superior to the high -low method because it uses more data points than just the high and low points None of the listed choices are the correct answer because all of the listed choices are true . Least -squares regression maximizes the vertical squared difference between the estimated and actual costs at each data point .arrow_forwardWith regard to dynamic risk strategies, MGRM was subject to: Group of answer choices B. Backwardation D. Both A & B C. Non-basis risk A. Contangoarrow_forward

- Real options can be analyzed using a scenarioapproach with decision trees or using the BlackScholes Option Pricing Model. What are the prosand cons of the two approaches? Is one procedure“better” than the other?arrow_forwardIn choosing where to invest, return and risk for an investment must be compared. It is not sufficient to choose an investment based only on return without taking risk into consideration. There are two methods or measures that compare return and risk. State these two methods, the formula for each and the criteria used in evaluating alternative investment of each method.arrow_forwardWhat is the primary use of a p-value in statistics? a) To measure the central tendency b) To assess the strength of evidence against the null hypothesis c) To calculate the mean d) To measure the spread of dataarrow_forward

- Isn't trend analysis more subjective than it is objective?... Which means it's more subject to interpretation ? Thoughts?arrow_forward(a) Compare and contrast nominal, dichotomous, ordinal, and normal variables. (b) In social science research, why isn’t it important to distinguish between interval and ratio variables?arrow_forwardWhat are the two major types of tests that have been performed totest the validity of the CAPM? (beta stability; slope of the SML)Explain their results.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education