ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

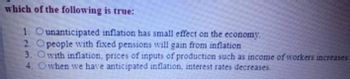

Transcribed Image Text:### Question: Which of the following is true?

1. ○ Unanticipated inflation has small effect on the economy.

2. ○ People with fixed pensions will gain from inflation.

3. ○ With inflation, prices of inputs of production such as income of workers increase.

4. ○ When we have anticipated inflation, interest rates decrease.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The rate of inflation in Zimbabwe rose in 2018 from 10.6% to 577.21% in 2020. What was the positive effect of this unexpected inflation on the residents of the country? O It helped debtors It helped creditors ) Helped those people on fixed incomes None because everybody is hurt by inflationarrow_forward4) If actual inflation is more than expected inflation, which of the following groups will most certainly benefit? а. Lenders b. Borrowers с. Minorities d. Women е. Men Suppose that the consumer price index of a country was 160 at year-end 2004 and 168 at the 5) end of 2005. What was the country's inflation rate during 2005? 5 percent b. а. 8 percent 60 percent d. с. 68 percent 6) If the consumer price index (CPI) at the end of year one was 100 and was 108 at the end of year two, the inflation rate during year two was zero; the CPI of 100 indicates that prices were stable. b. а. 8 percent. 5 percent. d. c. 108 percent.arrow_forward12arrow_forward

- on The quality change bias is most likely to put The quality change bias is most likely to put_ into the CPI and so.... into the CPI and so O a. a downward bias; understate O b. a random bias; randomly overstate or understate O c. an upward bias; understate O d. a downward bias; overstate e. an upward bias; overstate Clear my choice the inflation rate.arrow_forwardSuppose the nominal interest rate equals 9%, the expected inflation rate is 5%, and actual inflation turns out to be 3%. In this case, the: a. ex ante real interest rate is 4%. b. ex post real interest rate is 4%. c. ex ante real interest rate is 6%. d. ex post real interest rate is 2%arrow_forward6. Taylor just received a 3% pay increase but the current rate of inflation is 4%. We can say that Taylor’s real wage has Select one: a. remained the same b. fallen by 1% c. risen by 1%.arrow_forward

- Don't use chatgpt, I will 5 upvotes 27.If the nominal interest rate in=10% and the real interest rate ir=5%, then the expected rate of inflation re is a. 2% b. 3% C. 4% d. 5% e. 6% 28.There are 130 million workers in the labor force; the unemployment rate is 5%. There are ________million of unemployed workers. a. 3 b. 6.5 c. 9.86 d. 11.5 e. 45.6arrow_forwardPLS HELP ASAP ON BOTHarrow_forwardplease answer correct asap plz both are question Dont answer by pen pepararrow_forward

- The reference base period is a period for which the is defined to equal Currently, the reference base period is 1982-1984. O A. inflation rate; 1 percent O B. PPI; 110 O C. interest rate; 1 percent O D. CPI; 100 Click to select your answer. DIarrow_forwardQUESTION 2 If inflation is 4 percent per year and you receive a 3 percent raise in income, then your: a. Real income rises, but nominal income falls. O b. Real income falls, but nominal income rises O C. Real and nominal incomes both fall d. Real and nominal incomes both rise.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education