ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

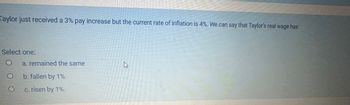

Transcribed Image Text:Taylor just received a 3% pay increase but the current rate of inflation is 4%. We can say that Taylor's real wage has

Select one:

O

O

a. remained the same

b. fallen by 1%

c. risen by 1%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Handwritten solution not required correct answer will get instant upvote.arrow_forwardPlease help solvearrow_forwardWhen inflation falls, people Select one: O a. make less frequent trips to the bank and firms make more frequent price changes O b. make more frequent trips to the bank and firms make less frequent price changes Oc. make less frequent trips to the bank and firms make less frequent price changes O d. make more frequent trips to the bank and firms make more frequent price changes ge en this pagearrow_forward

- High and unexpected inflation has a greater cost O for those who have fixed nominal wages than for those who have nominal wages that adjust with inflation. for those who borrow than for those who save. O All of the above are correct. O for those who hold a little money than for those who hold a lot of money.arrow_forwardFirms require capital to invest in productive opportunities. The best firms with the most profitable opportunities can attract capital away from inefficient firms with less profitable opportunities. Investors supply firms with capital at a cost called the interest rate. The interest rate that investors require is determined by several factors, including the availability of production opportunities, the time preference for current consumption, risk, and inflation. Suppose the Federal Reserve (the Fed) decides to tighten credit by contracting the money supply. Use the following graph by moving the black X to show what happens to the equilibrium level of borrowing and the new equilibrium interest rate. INTEREST RATE, r (Percent) 0 16 0 D S2 CAPITAL (Billions of dollars) S1 8 Equilibriumarrow_forwardIf an economy always has inflation of 10 percent peryear, which of the following costs of inflation will itNOT suffer?a. shoeleather costs from reduced holdings of moneyb. menu costs from more frequent price adjustmentc. distortions from the taxation of nominal capitalgainsd. arbitrary redistributions between debtors andcreditorsarrow_forward

- Typed plzzzz Asaparrow_forwardon The quality change bias is most likely to put The quality change bias is most likely to put_ into the CPI and so.... into the CPI and so O a. a downward bias; understate O b. a random bias; randomly overstate or understate O c. an upward bias; understate O d. a downward bias; overstate e. an upward bias; overstate Clear my choice the inflation rate.arrow_forwardWhat causedthe Great Inflation of the 1970s, and why has inflation been so much lowerin recent decades?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education