ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

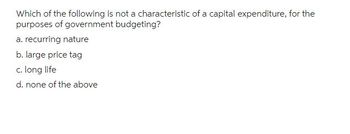

Transcribed Image Text:Which of the following is not a characteristic of a capital expenditure, for the

purposes of government budgeting?

a. recurring nature

b. large price tag

c. long life

d. none of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Pls help with below homework.arrow_forwardDistinguish between Capital Budget and Revenue Budget. Explain the components of both these Budgetsarrow_forwardGovernment consumption expenditures equal A. government outlays minus transfer payments. B. the government primary deficit plus net interest payments. C. government outlays minus net interest payments. D. government purchases minus government investment.arrow_forward

- B. Critically compare the principles of the IRR and net present value methods including their advantages and disadvantages. Relate the answer to the above casarrow_forwardCapital Budgeting Part I) Capital budgeting is the process of deciding: O A. between financing with debt or equity O B. which projects to take C. which financial assets to purchasearrow_forwardQuestion 6 of 9 Due to a restricted budget, a company can only undertake one of the following projects: Project X: This project has an initial investment of $800,000 and annual profits of $400,000 in year 1, $375,000 in year 2 and $300,000 in year 3. Project Y: This project has an initial investment of $800,000 and a profit of $1,150,000 in year 3. a. Calculate the IRR for Project X. % Round to two decimal places b. Calculate the IRR for Project Y. % Round to two decimal places c. Which project should the company undertake? (click to select)Project XProject Yarrow_forward

- Describe the investment decisions made in the private sector?arrow_forwardWhat is the 'mps' ? a) 1/3 b) 2/3 c) 3/2 d) 1/2 e) 4arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forward

- 2 96 nts Turning Point (A) (B) (C) (D) (E) 1 The data in the accompanying table give the dates of successive turning points in U.S. economic activity and the corresponding levels of real GDP at the time. Date Jan 1980 July 1980 July 1981 November 1982 July 1990 The economy experienced an expansion that lasted from Multiple Choice Seved Help Real GDP (2012 $ billions) 6,837.6 6,688.8 6,978.1 6,794.9 9,398.5 Save & Exit Submitarrow_forward28. What is the level of investment, I? (A) $250 billion. (B) $305 billion. (C) $345 billion. (D) $555 billion. The next two questions involve the following information. The real interest rate, r, is the nominal interest rate, i, minus inflation, 7. In formal terms, r = i- T. For example, if an investment offers an annual return of 5 percent, and inflation is 2 percent, then the real interest rate is 3 percent. 29. You purchase a $1,000 face-value bond for $800. The coupon is $100 per year, and inflation is 4 percent per year. What is the nominal yield on the bond? (A) 6 percent. (В) 8.5 рercent. (C) 10 percent. (D) 12.5 percent. 30. You purchase a $1,000 face-value bond for $800. The coupon is $100 per year, and inflation is 4 percent per year. What is the real coupon rate on the bond? (A) 6 percent. (В) 8.5 percent. (C) 10 percent. (D) 12.5 percent.arrow_forwardDefine IRR method of capital budgeting. What are some of the problems associated with using IRR approach for mutually exclusive projects? Briefly explain with examples. How do managers deal with those problems?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education