FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

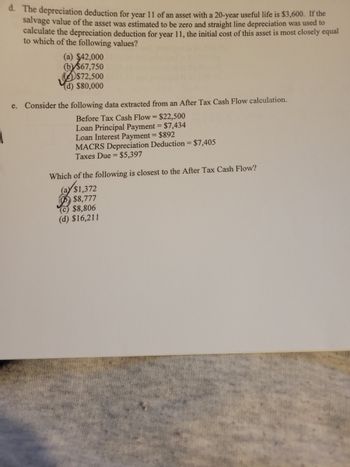

Transcribed Image Text:d. The depreciation deduction for year 11 of an asset with a 20-year useful life is $3,600. If the

salvage value of the asset was estimated to be zero and straight line depreciation was used to

calculate the depreciation deduction for year 11, the initial cost of this asset is most closely equal

to which of the following values?

(a) $42,000

(b) $67,750

$72,500

(d) $80,000

e. Consider the following data extracted from an After Tax Cash Flow calculation.

Before Tax Cash Flow = $22,500

Loan Principal Payment = $7,434

Loan Interest Payment = $892

MACRS Depreciation Deduction = $7,405

Taxes Due = $5,397

Which of the following is closest to the After Tax Cash Flow?

(a) $1,372

$8,777

(c) $8,806

(d) $16,211

Expert Solution

arrow_forward

Step 1: Initial Cost:

Since multiple questions have been posted, only the first question will be solved as per the guidelines. To get the other questions resolved, kindly re-post that question.

Initial cost is the amount provided by the buyer to acquire a particular item from the seller. This cost includes all those expenses paid to safely place the asset in its working position.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A certain office equipment has a first cost of P 20,000 and a salvage value of P 1,000 at the end of 10 years. Determine its book value at the end of 6 years using Straight-line Method. 8,600.00 3,311.00 1,657.38 9,280.00 11,400.00 1,000.00arrow_forwardThe initial cost of a piece of construction equipment is P30,000,000 having a useful life of 10 years. The estimated salvage value of the equipment at the end of the useful life is P450,000. Determine accumulated depreciation at the end of 5th year using Sinking fund method, if interest rate is 8.2 % per year?arrow_forward21. Help me selecting the right answer. Thank youarrow_forward

- What is the after-tax salvage value of a 3-year MACRS machine with the $10,000 purchase price if it is sold after 3 years at a salvage value of $500? The annual depreciation rates are 33.33%, 44.45%, 14.81%, and 7.41%, and the tax rate is 25%. A) $935.25 B) $741 C) $560.25 D) -$60.25 E) -$241arrow_forwardGiven a cost of a depreciable fixed asset of $24,000 with a salvage value of $2,000 and a life of 5 years, what is the annual depreciation of the fixed asset using the straight-line method? What would be the depreciation in the second year if it used the declining balance method at double the straight-line rate? In regards to question #1, if the company used the straight-line method and sold the asset after 4 years for $7,000, what would be the journal entry needed to record the transaction? What if they sold it for $5,000?arrow_forward6666- Please I want solution of all sub-part questions. Thanksarrow_forward

- Quantities at which revenues and costs are equal. breakeven point inflection point knee point saturation point Amount of money available for capital investment projects capital budget cash flow capital recovery cost of capital Tax on the use of cars and buses on the road. toll tarif VAT green tax capital recovery cost of capital Interest rate paid for the use of capital funds. depreciation rate first cost cost of capital inflation rate It is an extreme form of inferior good. It arises ecause the income effect is opposite to and outweighs the substitution effect. giffen good merit good disguised good kability Number of years at which the annual worth of costs is at minimum. payback period life-cycle economic service life net present valuearrow_forwardA $100,000 asset has a $20,000 salvage value after its 10-year useful life. The depreciation allowance using straight-line depreciation is closest to what value? (a) $2000 (b) $8000 (c) $10,000 (d) $12,000?arrow_forward9. How much should be the balance of the accumulated depreciation for these machineries on December 31, 2021? a. ₱ 7,040,000 b. ₱ 5,840,000 c. ₱ 6,160,000 d. ₱ 6,400,000arrow_forward

- 5.Suppose that the purchase price of a piece of equipment is $1million.its salvage value at the end of its 5 years service life is $500000.Depreciate this asset using straight line depreciation and declining balance depreciation.arrow_forwardYour company has purchased a large new trucktractor for over-the-road use (asset class 00.26). It has a cost basis of $179,000. With additional options costing $14,000, the cost basis for depreciation purposes is $193,000. Its MV at the end of six years is estimated as $36,000. Assume it will be depreciated under the GDS: a. What is the cumulative depreciation through the end of year two? b. What is the MACRS depreciation in the second year? c. What is the BV at the end of year one? Click the icon to view the partial listing of depreciable assets used in business. Click the icon to view the GDS Recovery Rates (rk). a. The cumulative depreciation through the end of year two is $ (Round to the nearest dollar.) b. The MACRS depreciation in the second year is $ (Round to the nearest dollar.) c. The BV at the end of year one is $ (Round to the nearest dollar.)arrow_forward17 Your company purchased an asset with a total cost of $300,000. The asset has an expected useful life of 20 years. The asset also has an expected residual value of $50,000. Please prepare the depreciation amounts for the first 3 years of the asset’s life using Straight-Line Method and Double Declining Balance methods. Please detail the depreciation amount and the ending book value for each year.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education