FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

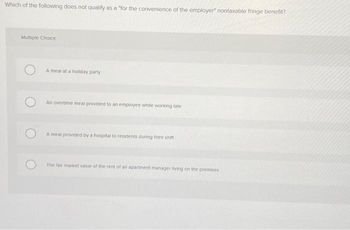

Transcribed Image Text:Which of the following does not qualify as a "for the convenience of the employer" nontaxable fringe benefit?

Multiple Choice

A meal at a holiday party

An overtime meal provided to an employee while working late

A meal provided by a hospital to residents during their shifti

The fair market value of the rent of an apartment manager living on the premises

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Let’s say someone applies for an apartment and the landlord informs them that based on their credit report, they are not going to rent them an apartment. According to FCRA, what information must they legally provide you about that decision.arrow_forwardHolton's Nursery has the following amounts listed on their Form 941: (Assume no Section 125 health insurance and that none of the employees had exceeded the Social Security wage base.) 2 Wages, tips, and other compensation 3 Federal income tax withheld from wages, tips, and other compensation 4 If no wages, tips, and other compensation are subject to social security or Medicare tax 5a Taxable social security wages 5a (1) Qualified sick leave wages 5a (il) Qualified family leave wages 5b Taxable social security tips Sc Taxable Medicare wages & tips 5d Taxable wages & tips subject to Additional Medicare Tax withholding What amount belongs in Column 2, Line 5c? O $6,668.60 O $1,559.59 O $3.119.19 Column 1 107,558.13 0.124= * 0.062 = x 0.062 * 0.124 107,558.13 x 0.029- * 0.009 Column 2 2 3 107,558.13 12,400.00 X Check and go to line 6.arrow_forwardTitle VII is the only law regulating equal employment opportunities. Truc Falsearrow_forward

- Regarding a self-employed individual, which statement is true? (a) A primary care physician who decided to train in plastic surgery would not be able to deduct the cost of doing so. (b) An engineer could deduct the cost of going to law school as long as she disavows ever taking the bar exam – she’s going to law school only to learn about patent law (“Helpful in my engineering career!”). (c) A CPA who was tired of doing audit work and went back to UTD to take or retake every graduate tax course in order to begin shifting her practice toward tax work could deduct the cost of doing so. (d) None of the above statements is true.arrow_forwardPlease do not give solution in image format ?arrow_forwardNonearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education