ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

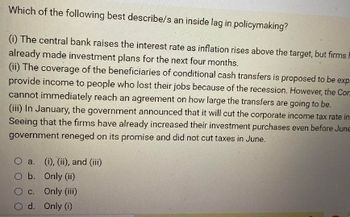

Transcribed Image Text:Which of the following best describe/s an inside lag in policymaking?

(1) The central bank raises the interest rate as inflation rises above the target, but firms i

already made investment plans for the next four months.

(ii) The coverage of the beneficiaries of conditional cash transfers is proposed to be exp

provide income to people who lost their jobs because of the recession. However, the Comm

cannot immediately reach an agreement on how large the transfers are going to be.

(iii) In January, the government announced that it will cut the corporate income tax rate in

Seeing that the firms have already increased their investment purchases even before June

government reneged on its promise and did not cut taxes in June.

O a.

O b.

O c.

d.

(i), (ii), and (iii)

Only (ii)

Only (iii)

Only (1)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- f Question 2: Show the effect of the following transactions of May 2021 on the accounting equation: 2 6 11 The owner, Ms. Rose Petals, contributed R80 000 as capital contribution. Issued receipt no. 57. According to the cash register roll, the business received R5 300 for services rendered. Cashed a cheque (Cheque 03) to pay the wages of her 2 workers. They each earn R1000 per week. 30 Paid Mogale City for the water and electricity, R2 000 per cheque. Day Assets Owner's Equity + Liabilities Effect Reason Effect Reason Effect Reason (14)arrow_forwardPls help ASAP on botharrow_forwardN3 The retirement income payable from which of the following retirement income benefit programs is independent of the performance of any underlying investinent portlolio? A. RRSP B. CPP c. DCPP D. TFSAarrow_forward

- 1. Individual Problems 1-11 The owners of a small manufacturing concern have hired a vice president to run the company with the expectation that he will buy the company after five years. For the first $150,000 of profit, the vice president's compensation is a flat annual salary of $50,000 plus 50% of company profits. Beyond the first $150,000 in profits, the vice president's compensation is the salary he receives at $150,000 profit plus 20% of company profits in excess of $150,000. On the following graph, use the purple points (diamond symbols) to plot the vice president's salary as a function of annual profit, for the profits levels of $0, $50,000, $100,000, $150,000, $200,000, $250,000, and $300,000. MANAGER SALARY (Thousands of dollars) 250 725 200 175 110 125 100 Total VP Salaryarrow_forwardPLS HELP ASAP ON BOTHarrow_forwardP(s/1b) $10 $8 $5 A B 20 50 80 Q(lbs) Refer the figure in the diagram. The movement of point a to point b (or vice versa) represents: a shift in supply O a change in demand a shift of demand a change in quantity demanded O 0arrow_forward

- 1)How many years will it take to pay off a$525debt, with monthly payments of$15at the end of each month if the interest rate is18%, compounded monthly? i)3.1667 ii)6.1667 iii)5.1667 iv) 4.1667 2)Company A has fixed expenses of$15,000per year and each unit of product has a$0.20product at a$0.50variable cost. At what number of units of annual production will Company A have the same overall cost as Company B? i) 14,286 units ii) 66,666 units iii) 33,333 units iv) 28,572 units 3)The Profit From the monthly sale of x tons of a product, in thousands of dollars, is given by the function:P(x)=−0.05x²+1.6x−3. The maximum possible profit is i)$11,800 ii)$9,800 iii)$12,800 iv)$10,800 i need above 3 three i will 10 upvotes plz urgent no use excel only typing.arrow_forward1arrow_forwardPLS HELP ASAP ON BOTHarrow_forward

- expenditures, income 2-888R8÷ 120 110 100 90 80 70 60 50 40 30 20 10 0 -10 -20 -30 II 10-20 30 40 50 60 II 05. What will be the level of savings at an income level of 40? O (a) zero (b) 40 (c)-20 O (d) 20 40 50 60 70 IE income: Q C S +444 70 80 90 100 110 120 DO Qarrow_forward2. Consider an overlapping generations model with a pay-as-you-go pension system. The government collects the contributions from young generation and transfers them to old generation. d is the contribution from a young person to the pension system. b is the benefit received by old person. (a) Derive the following intertemporal budget constraint, b 1 + rt+1 C₁t + St C2t+1 1 + rt+1 (b) Derive the following saving function, 1 ·(wt – d) 2+p = = Wt d + 1+p (2 + p)(1+rt+1) - bl.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education