MATLAB: An Introduction with Applications

6th Edition

ISBN: 9781119256830

Author: Amos Gilat

Publisher: John Wiley & Sons Inc

expand_more

expand_more

format_list_bulleted

Question

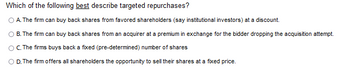

Transcribed Image Text:Which of the following best describe targeted repurchases?

OA. The firm can buy back shares from favored shareholders (say institutional investors) at a discount.

B. The firm can buy back shares from an acquirer at a premium in exchange for the bidder dropping the acquisition attempt.

C. The firms buys back a fixed (pre-determined) number of shares

O D. The firm offers all shareholders the opportunity to sell their shares at a fixed price.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Investing activities include all of the following except loans made to others and collected. purchases and sales of another company’s stock. issuing and repaying debt. purchases and sales of property and equipment.arrow_forwardWe know the following two commands in Excel: PMT(rate, nper, PV, FV) FV(rate, nper, pmt, PV) Which of the following Excel commands gives the monthly payment on a house that cost $255,000 with a down payment of $22,725. The loan was a conventional 30-year loan with an annual interest rate of 3.1%. 1 =PMT(0.031/12,30,-255000,-22725) 2 =FV(0.031/12,30,-255000,-22725) 3 =PMT(0.031/12,360,-232275,0) 4 =FV(3.1/12,360,-22725,-255000) 5 =PMT(3.1/12,360,0,-232275)arrow_forwardBond X is a premium bond making semiannual payments. The bond pays a coupon rate of 6.8 percent, has a YTM of 6.2 percent, and has 13 years to maturity. Bond Y is a discount bond making semiannual payments. This bond pays a coupon rate of 6.2 percent, has a YTM of 6.8 percent, and also has 13 years to maturity. The bonds have a par value of $1, 000. What is the price of each bond today? If interest rates remain unchanged, what do you expect the price of these bonds to be 1 year from now? In 3 years? In 8 years? In 12 years? In 13 years? What's going on here? Illustrate your answers by graphing bond prices versus time to maturity. Do this without using excel, showing all work.arrow_forward

- Suppose you are thinking about purchasing a small office building for $1,500,000. The 30 year fixed rate mortgage that you have arranged covers 80% of the purchase price and has an interest rate of 8%. Assume you were to default and go into foreclosure in year 10 of this loan. If the lender was able to sell this property for $700,000, how much does the lender stand to lose in the absence of PMI? Multiple Choice $0 $260,000 $92,696 $352,696arrow_forward- Once answered correctly will UPVOTE!!arrow_forwardIan won the lottery; however, the lottery company gave her the following two options to receive her prize money: ● Option (a): $8,000 in four months and $18,000 in nine months. • Option (b): $3,000 immediately and $24,000 in twelve months. Assume that money earns 4.75% p.a. simple interest and use today as the focal date. a. What was the equivalent value of the payments under option (a) at the focal date? Round to the nearest cent b. What was the equivalent value of the payments under option (b) at the focal date? Round to the nearest cent c. Which option would be economically better for Ian and by how much? O a. Option (a) O b. Option (b) is better by Round to the nearest cent SAVE PROGarrow_forward

- Sapling Independent is a small bank located in Hong Kong. Sapling Independent is interested in increasing the number of mortgages it writes, but it is constrained by how many deposits it has. It has decided to borrow 12,000,000 euros from a large German bank for one year. The German bank is going to charge Sapling Independent an interest rate of 2.5%per year. The German bank insists on being repaid in euros. After Sapling Independent borrows the money, it is going to have to convert the money into Hong Kong dollars at an exchange rate of 11.5 HK dollars/euro.11.5 HK dollars/euro. Then, Sapling Independent is going to lend all the money at an interest rate of 7.0% per year. At the end of one year, all the money that Sapling Independent lent will be repaid, plus interest. Finally, at the end of one year, Sapling Independent is going to have to repay its loan to the German bank in euros. At the end of the year, the exchange rate is 10.0 HK dollars/euro.10.0 HK dollars/euro. What is…arrow_forwardPlease answer this questionarrow_forward. Suppose Calvin Cordozar Broadus, Jr. (aka Snoop Doggy Dogg) is considering moving his family to Manhattan. His real s managed to locate a penthouse apartment that overlooks Central Park for $2.4 million. He will have $2.1 million from urrent home as a down payment. Snoop would like to finance the remainder of the cost and his banker has presented O-year fixed-rate mortgage at 8% or a 20-year fixed-rate mortgage at 7.5%. monthly mortgage payment for the 30-year loan. indredths place)arrow_forward

- RunHeavy Corporation (RHC) is a corporation that manages a local band. It had the following activities during its first month. RHC was formed with an investment of $11,900 cash, paid in by the leader of the band on January 3 in exchange for common stock. On January 4, RHC purchased music equipment by paying $2,300 cash and signing an $9,600 promissory note payable in three years. On January 5, RHC booked the band for six concert events, at a price of $2,800 each, but no cash was collected yet. Of the six events, four were completed between January 10 and 20. On January 22, cash was collected for three of the four events. The other two bookings were for February concerts, but on January 24, RHC collected half of the $2,800 fee for one of them. On January 27, RHC paid $3,440 cash for the band’s travel-related costs. On January 28, RHC paid its band members a total of $2,490 cash for salaries and wages for the first three events. As of January 31, the band members hadn’t yet been paid…arrow_forwardConsider two options for purchasing a Honda Fit LX: one is a brand new 2020 model with a manufacturer’s suggested retail price (MSRP) of $17,945, and the other is a preowned, two-year old model listed for $15,000. Suppose you have saved $1500 for a down payment and the dealer has already included any applicable fees, including taxes, in the advertised price. You plan on taking 5 years to pay off the loan.The table below shows the price and interest rate for each option.Determine the finance charge for each purchasing option. This would be the difference between the total paid and the amount financed.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning

Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON

Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman

The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

MATLAB: An Introduction with Applications

Statistics

ISBN:9781119256830

Author:Amos Gilat

Publisher:John Wiley & Sons Inc

Probability and Statistics for Engineering and th...

Statistics

ISBN:9781305251809

Author:Jay L. Devore

Publisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...

Statistics

ISBN:9781305504912

Author:Frederick J Gravetter, Larry B. Wallnau

Publisher:Cengage Learning

Elementary Statistics: Picturing the World (7th E...

Statistics

ISBN:9780134683416

Author:Ron Larson, Betsy Farber

Publisher:PEARSON

The Basic Practice of Statistics

Statistics

ISBN:9781319042578

Author:David S. Moore, William I. Notz, Michael A. Fligner

Publisher:W. H. Freeman

Introduction to the Practice of Statistics

Statistics

ISBN:9781319013387

Author:David S. Moore, George P. McCabe, Bruce A. Craig

Publisher:W. H. Freeman