MATLAB: An Introduction with Applications

6th Edition

ISBN: 9781119256830

Author: Amos Gilat

Publisher: John Wiley & Sons Inc

expand_more

expand_more

format_list_bulleted

Question

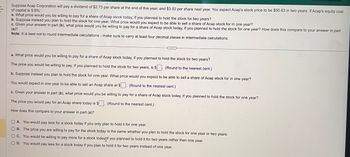

Transcribed Image Text:Suppose Acap Corporation will pay a dividend of $2.73 per share at the end of this year, and $3.02 per share next year. You expect Acap's stock price to be $50.63 in two years. If Acap's equity cost

of capital is 9.8%:

a. What price would you be willing to pay for a share of Acap stock today, if you planned to hold the stock for two years?

b. Suppose instead you plan to hold the stock for one year. What price would you expect to be able to sell a share of Acap stock for in one year?

c. Given your answer in part (b), what price would you be willing to pay for a share of Acap stock today, if you planned to hold the stock for one year? How does this compare to your answer in part

(a)?

Note: It is best not to round intermediate calculations - make sure to carry at least four decimal places in intermediate calculations.

...

a. What price would you be willing to pay for a share of Acap stock today, if you planned to hold the stock for two years?

The price you would be willing to pay, if you planned to hold the stock for two years, is $

(Round to the nearest cent.)

b. Suppose instead you plan to hold the stock for one year. What price would you expect to be able to sell a share of Acap stock for in one year?

You would expect in one year to be able to sell an Acap share at $. (Round to the nearest cent.)

c. Given your answer in part (b), what price would you be willing to pay for a share of Acap stock today, if you planned to hold the stock for one year?

The price you would pay for an Acap share today is $. (Round to the nearest cent.)

How does this compare to your answer in part (a)?

OA. You would pay less for a stock today if you only plan to hold it for one year.

OB. The price you are willing to pay for the stock today is the same whether you plan to hold the stock for one year or two years.

OC. You would be willing to pay more for a stock today if you planned to hold it for two years rather than one year.

O D. You would pay less for a stock today if you plan to hold it for two years instead of one year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Similar questions

- If Roberta's husband were to die, she and her children could live on $52,500 per year. Roberta earns $13,900 annually and estimates additional income of $3,500 from other sources. How much insurance should she purchase on her husband to cover the shortfall, assuming a 4.9% prevailing interest rate? Round to the nearest $1,000.arrow_forwardA new investment opportunity for you is an annuity that pays $850 at the beginning of each year for 3 years. You could earn 5.5% on your money in other investments with equal risk. What is the most you should pay for the annuity?arrow_forwardJames has an investment worth $175,609.50. The investment will make a special payment of X to James in 1 month from today and the investment also will make regular, fixed monthly payments of $1,440.00 to James forever. The expected return for the investment is 1.23 percent per month and the first regular, fixed monthly payment of $1,440.00 will be made to James in one month from today. What is X, the amount of the special payment that will be made to James in 1 month? An amount less than $58,600.00 or an anmount greater than $179,600.00 An amount equal to or greater than $58,600.00 but less than $88,950.00 An amount equal to or greater than $88,950.00 but less than $146,400.00 An amount equal to or greater than $146,400.00 but less than $176,000.00 O An amount equal to or greater than $176,000.00 but less than $179,600.00 Com SHEMAarrow_forward

- A loan of $26,000 is paid off in 36 payments at the end of each month in the following way: Payments of $650 are made at the end of the month for the first 12 months. Payments of $650 + x are made at the end of the month for the second 12 months. Payments of $650 + 2x are made at the end of the month for the last 12 months. What should x be if the nominal monthly rate is 12.2%?arrow_forwardIf you have a reducing balance loan at 7.5% and you repay it each month, paying $850 a month. How much interest have you paid by the end of the second month?arrow_forwardA couple wants to start a business which needs a capital of $190,000. They decided to approach PNC bank who offered to provide the needed capital at 7% compounded monthly for 15 years. How much should the couple pay monthly if they want to clear the loan in 15 years?arrow_forward

- 1) Ian placed $2900 in a one-year CD at the bank. The bank is paying simple interest of 6% for one year on the CD. How much insterest will Ian earn in one year?arrow_forward3. Mona needs a loan of $7500 for 6 years. a. How much interest will each plan charge? Plan A: 10% per year, compounded semi-annually Plan B: 8.1% per year, compounded quarterly Plan A b. Calculate the difference in the amount of interest between the two plans. Which plan will require her to pay the least amount of interest? Mona should select: Plan A Plan B Plan B because it charges $ less interest.arrow_forwardAn investment company pays 5% compounded semiannually. You want to have $ 18 000 in the future.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning

Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON

Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman

The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

MATLAB: An Introduction with Applications

Statistics

ISBN:9781119256830

Author:Amos Gilat

Publisher:John Wiley & Sons Inc

Probability and Statistics for Engineering and th...

Statistics

ISBN:9781305251809

Author:Jay L. Devore

Publisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...

Statistics

ISBN:9781305504912

Author:Frederick J Gravetter, Larry B. Wallnau

Publisher:Cengage Learning

Elementary Statistics: Picturing the World (7th E...

Statistics

ISBN:9780134683416

Author:Ron Larson, Betsy Farber

Publisher:PEARSON

The Basic Practice of Statistics

Statistics

ISBN:9781319042578

Author:David S. Moore, William I. Notz, Michael A. Fligner

Publisher:W. H. Freeman

Introduction to the Practice of Statistics

Statistics

ISBN:9781319013387

Author:David S. Moore, George P. McCabe, Bruce A. Craig

Publisher:W. H. Freeman