FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

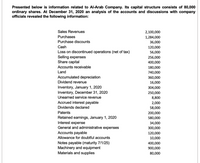

Transcribed Image Text:Presented below is information related to Al-Arab Company. Its capital structure consists of 80,000

ordinary shares. At December 31, 2020 an analysis of the accounts and discussions with company

officials revealed the following information:

Sales Revenues

2,100,000

Purchases

1,284,000

Purchase discounts

36,000

Cash

120,000

Loss on discontinued operations (net of tax)

Selling expenses

Share capital

56,000

256,000

400,000

Accounts receivable

180,000

Land

740,000

Accumulated depreciation

360,000

Dividend revenue

16,000

Inventory, January 1, 2020

Inventory, December 31, 2020

Unearned service revenue

304,000

250,000

8,800

Accrued interest payable

2,000

Dividends declared

58,000

Patents

200,000

Retained earnings, January 1, 2020

Interest expense

General and administrative expenses

Accounts payable

580,000

34,000

300,000

120,000

Allowance for doubtful accounts

10,000

Notes payable (maturity 7/1/25)

Machinery and equipment

Materials and supplies

400,000

900,000

80,000

Transcribed Image Text:Note: The amount of income taxes was ¥91,200, including the tax effect of the discontinued operations

loss which amounted to ¥24,000.

Instructions:

Prepare an income statement and retained earnings statement for 2020 for Al-Arab Company that

is presented in accordance with IFRS (including format and terminology). Then answer the

following questions:

1- The amount of cost of goods sold for 2020 equals?

2- The amount of gross profit for 2020 equals?

3- The amount of income from operations for 2020 equals?

4- The amount of income tax for 2020 equals?

5- The amount of income from continuing operations for 2020 equals?

6- The amount of net income for 2020 equals?

7- The amount of retained earnings on 31/12/2020 equals?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

where is the rest of teh answers

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

where is the rest of teh answers

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Tiger Ltd. has an authorized capital of 700,000 $1 ordinary shares, of which 300,000 have been issued as fully paid. The following information was extracted from the accounts for the year ended September 30, 2019: Details/Accts. $ DR $ CR Motor Vehicle at cost 1,750,000 Acc. Depreciation Motor Vehicle 450,000 Freehold premises at cost 400,000 Carriage inwards 35,500 Sales 4,500,000 Stock, October 1, 2018 95,000 Administration (Wages and Salaries) 170,000 Distribution (Wages and Salaries) 250,000 Motor vehicle running costs 350,000 Purchases 935,000 Returns inward 32,000 Returns outward 51,000 Directors’ remuneration 865,000 Auditors’ fees 120,000 General administrative expenses…arrow_forwardGM has the following balances at Dec31,2021: Operating Assets $ 1,200,000 Financial Assets 800,000 Operating Liabilities 200,000 Financial liabilities 1,400,000 Operating Income 200,000 Tax Rate % 40 Net Income 110,000 Preferred Stock dividends 10,000 Required: Calculate the following (use 2021 ending balances only): Return on Net Operating Assets – RNOA Return on Common Equity – ROCE Justify and analyze your findings in required (1)arrow_forwardC. Reither Co. reports the following information for 2025: sales revenue $700,000 cost of goodssold $500,000, operating expenses $80,000, and an unreliazed holding loss on available-for-sale debt securities of 2025 of $60,000. It declared and paid a cash dividend of $10,000 in 2025. C. Reither Co. has Janaury 1, 2025, balances in common stock $350,000; accumulated other comprehensive income $80,000; and retained earnings $90,000. It issued no stock during 2025. Prepare a statement of stockholders' equity. (Ignore income taxes).arrow_forward

- answer quicklyarrow_forwardHijab Alisha company has financial data for 2021 as follows: Calculate the firm's earnings available to common shareholders for 2021 and what is the net profit after tax for 2021arrow_forward17. Following data were taken from the records of Bassam Company for year 2020: Sales Revenues:$1,000,000; Rent revenues $6,000; Cost of Goods Sold $560,000, Selling expenses $70,000; Administrative and General Expenses $90,000; Interest expenses 20,000; Preference Shares Dividends declared and paid $60,000; Ordinary Shares Dividends declared and paid $80,000; tax rate 25%; No. of common shares outstanding 200,000 shares. Calculate Earnings per share (round answer to the nearest cent)?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education