Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

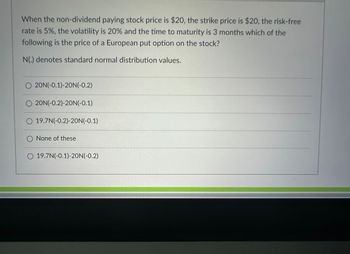

Transcribed Image Text:When the non-dividend paying stock price is $20, the strike price is $20, the risk-free

rate is 5%, the volatility is 20% and the time to maturity is 3 months which of the

following is the price of a European put option on the stock?

N(.) denotes standard normal distribution values.

O 20N(-0.1)-20N(-0.2)

20N(-0.2)-20N(-0.1)

O 19.7N(-0.2)-20N(-0.1)

O None of these

O 19.7N(-0.1)-20N (-0.2)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Nikularrow_forwardLet S = $100, K = $95, \sigma = 30%, r = 8%, T = 1, and \delta = 0. For simplicity, let u = 1.3, d = 0.8 and n = 2 (that is, 2 periods). When constructing the binomial tree for the European call option, what is A (Stock Share Purchased in the replicating portfolio) at the first node (Time 0)? Question 11 options: 0.1789 0.3886 1.0000 0.2550 0.6912arrow_forwardIn a financial market a stock is traded with a current price of 50. Next period the priceof the stock can either go up with 30 per cent or go down with 25 per cent. Risk-freedebt is available with an interest rate of 8 per cent. Also traded are European optionson the stock with an exercise price of 45 and a time to maturity of 1, i.e. they maturenext period.i) Find prices of Arrow-Debreu securities.arrow_forward

- A stock is trading at $300 per share and a call option with strike $300 is priced $10 per share. If hedge ratio is 0.4, what's the call option elasticity? A. -20 B. -18 C. 15 D. 12arrow_forwardb) Suppose you are given the following information: Current market price of a share= R200 000 Option’s exercise price = R300 000 Time until the option expires= 5 yrs Risk free rate =4% Standard deviation of the returns on the share= 0.35 Required: i. Calculate d1 and d2 ii. Suppose N(d1) =0.7517 and N(d2) =0.4602; calculate the price of the call option on the sharearrow_forwardSuppose there is also a 1-year European put option on the same stock as in Question 3 with exercise price $30. The current stock price is also $25 and the stock price, in 1 year, will be either $35 (up by 40%) or $20 (down by 20%). The interest rate is 8%. This stock does not pay dividend. What is the value of the put option? Please use risk neutral probability method and assume discrete discounting. (2) What is put-call parity in option pricing? What needs to be true in order for put-call parity to hold?arrow_forward

- Suppose a non-dividend paying stock is trading at $175 per share and has a volatility of 20%. What is the fair price of a 3-month European call option with a strike price of $190 per share using 1 binomial period? Assume the risk-free rate is 1%. Round to the nearest $0.01.arrow_forward(a) The table below gives information about European options with a maturity date of 6 months. Type Of option Strike Price Call 65 Call 58 Put 65 Premium 5 8 4 (i) Devise the payoff profile of the hedging strategy from the above for an investor betting on an increase in the stock price and calculate the payoff if the stock price increases to $66 after 6 months. (8 marks) (ii) Suppose that another investor expects a big stock price movement but is not sure of the direction. She however bets that the downward movement is more likely. Devise the corresponding trading strategy and calculate the payoff if the stock price is $55 after 6 months. (8 marks) (b) By analysing the pay off profiles of a protective put strategy and a straddle, discuss in what ways these strategies shield the investor from potential losses.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education