Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

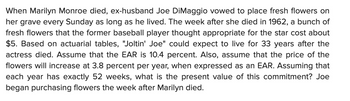

Transcribed Image Text:When Marilyn Monroe died, ex-husband Joe DiMaggio vowed to place fresh flowers on

her grave every Sunday as long as he lived. The week after she died in 1962, a bunch of

fresh flowers that the former baseball player thought appropriate for the star cost about

$5. Based on actuarial tables, "Joltin' Joe" could expect to live for 33 years after the

actress died. Assume that the EAR is 10.4 percent. Also, assume that the price of the

flowers will increase at 3.8 percent per year, when expressed as an EAR. Assuming that

each year has exactly 52 weeks, what is the present value of this commitment? Joe

began purchasing flowers the week after Marilyn died.

Transcribed Image Text:O

O

O

O

O

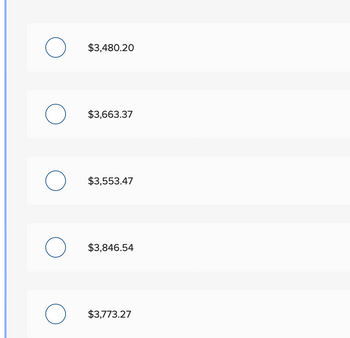

$3,480.20

$3,663.37

$3,553.47

$3,846.54

$3,773.27

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- In nine years, when he is discharged from the Air Force, Steve wants to buy a $17,000 power boat Click here to view Exhibit 14B-1 and Exhibit 148-2, to determine the appropriate discount factor(s) using tables. Required: What lump-sum amount must Steve invest now to have the $17,000 at the end of nine years if he can invest money at: (Round your final answer to the nearest whole dollar amount.) 1. Eight percent 2. Eleven percent $ Present Value 8,500arrow_forwardMeredith, who is single, would like to contribute $6,000 annually to her Roth IRA. Her AGI is $130,000. In your computations, round any division to four decimal places. Round your final answers to the nearest dollar. Question Content Area a. What is the maximum amount that Meredith can contribute?arrow_forwardWhen Marilyn Monroe died, ex-husband Joe DiMaggio vowed to place fresh flowers on her grave every Sunday as long as he lived. The week after she died in 1962, a bunch of fresh flowers that the former baseball player thought appropriate for the star cost about $10. Based on actuarial tables, “Joltin’ Joe” could expect to live for 25 years after the actress died. Assume that the EAR is 8.8 percent. Also, assume that the price of the flowers will increase at 3.7 percent per year, when expressed as an EAR. Assume that each year has exactly 52 weeks and Joe began purchasing flowers the week after Marilyn died. What is the present value of this commitment? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forward

- When Marilyn Monroe died, ex-husband Joe DiMaggio vowed to place fresh flowers on her grave every Sunday as long as he lived. The week after she died in 1962, a bunch of fresh flowers that the former baseball player thought appropriate for the star cost about $6. Based on actuarial tables, "Joltin' Joe" could expect to live for 36 years after the actress died. Assume that the EAR is 11.4 percent. Also, assume that the price of the flowers will increase at 4.7 percent per year, when expressed as an EAR. Assuming that each year has exactly 52 weeks, what is the present value of this commitment? Joe began purchasing flowers the week after Marilyn died. Please answer fast i give you upvote.arrow_forward1 Ann and Sue sell their recreation property. They make $245,000 on the sale and deposit it immediately into a retirement fund. The fund earns 2.45%, compounded monthly, for the entire time. Exactly ten years after the sale, Ann retires. They now want to start supplementing their income with payments from the retirement fund. They want the payments to start one month after Ann retires. They want these payments to last for 5 years. How much can they withdraw per month from the retirement fund? (ANNUITY)arrow_forwardA widow currently has a $84,000 investment that yields 6 percent annually. Can she withdraw $21,000 for the next five years? Use Appendix D to answer the question. Round your answer to the nearest dollar.The maximum amount that can be withdrawn is $ so she -Select-cancannotItem 2 withdraw $21,000 for the next five years.arrow_forward

- Bilbo Baggins wants to save money to meet three objectives. First, he would like to be able to retire 30 years from now with retirement income of $16,000 per month for 25 years, with the first payment received 30 years and 1 month from now. Second, he would like to purchase a cabin in Rivendell in 10 years at an estimated cost of $375,000. Third, after he passes on at the end of the 25 years of withdrawals, he would like to leave an inheritance of $1.5 million to his nephew Frodo. He can afford to save $2,150 per month for the next 10 years. If he can earn an EAR of 10 percent before he retires and an EAR of 7 percent after he retires, how much will he have to save each month in Years 11 through 30? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forwardAmi has decided to be cryogenically frozen at the time of her death so that she can be resurrected once medical science has advanced far enough to keep her alive. In preparation, Ami places $161,367 into an investment account which earns an 7.4% rate of return per year. To her amazement, she is one day brought back to life. "How long has it been?" she asks. "245 years" the strangely dressed person replies. How much money is sitting in Ami's investment account? You are welcome to round to the nearest whole number. You need to be within $1 million of the correct answer.arrow_forwardCarrie, age 55, is an employee of Rocket, Inc. (Rocket). Rocket sponsors a SEP IRA and would like to contribute the maximum amount to Carrie’s account for the plan year. If Carrie earns $14,000 per year from Rocket, what is the maximum contribution Rocket can make on her behalf to the SEP IRA? a. $3,500. b. $14,000. c. $19,500. d. $57,000.arrow_forward

- Rachel is 20 years old. She plans on retiring in 40 years when she will be 60 years old. Rachel believes she will live until she is 105. In order to live comfortably, she needs a substantial retirement income. She wants to receive a weekly income of $5,000 during retirement. The payments will be made at the beginning of each week during her retirement. Also, Rachel has pledged to make an annual donation to her favorite charity during her retirement. There will be a total of 45 payments. The payments will be made at the end of each year. The first annual payment will be for $20,000. Rachel wants the annual payments to increase by 3% per year. The payments will end when she dies. In addition, she would like to establish a scholarship at Toronto Metropolitan University. The first payment from scholarship would be $50,000. The first scholarship payment would be made 7 years after she retires. Thereafter scholarship payments will be made every year. She wants the payments to continue after…arrow_forwardA wealthy graduate of a local university wants to establish a scholarship to cover the full cost of one student each year in perpetuity at her university. To adequately prepare for the administration of the scholarship, the university will begin awarding it starting in three years. The estimated full cost of one student this year is $38,000 and is expected to stay constant in real terms in the future. If the scholarship is invested to earn an annual real return of 5 percent, how much must the donor contribute today to fully fund the scholarship?arrow_forwardVijayarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education