Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Susan has purchased a whole life policy with a death benefit of $400,000. Assuming that she dies in 9 years and the average inflation has been 4 percent, what is the value of the

I need help using appropriate factor(s) from the tables provided & rounding time value factor to 3 decimal places and final answer to 2 decimal places.

Purchasing power of proceeds = ???

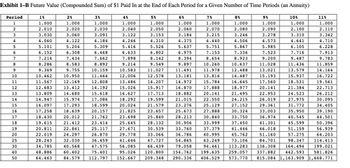

Transcribed Image Text:Exhibit 1-B Future Value (Compounded Sum) of $1 Paid In at the End of Each Period for a Given Number of Time Periods (an Annuity)

Period

1

3%

1.000

2.030

4%

1.000

2.040

3.091

3.122

4.184

4.246

5.309

5.416

6.468

6.633

7.662

7.898

8.892

9.214

10.159

11.464

12.808

14.192

15.618

17.086

18.599

20.157

21.762

23.414

25.117

26.870

36.459

47.575

75.401

112.797

2

3

4

5

6

7

8

9

OHNMASSI

10

11

12

13

14

15

16

17

18

19

20

25

30

40

50

1%

1.000

2.010

3.030

4.060

5.101

6.152

7.214

8.286

9.369

10.462

11.567

12.683

13.809

14.947

16.097

17.258

18.430

19.615

20.811

22.019

28.243

34.785

48.886

64.463

2%

1.000

2.020

3.060

4.122

5.204

6.308

7.434

8.583

9.755

10.950

12.169

13.412

14.680

15.974

17.293

18.639

20.012

21.412

22.841

24.297

32.030

40.568

60.402

84.579

10.583

12.006

13.486

15.026

16.627

18.292

20.024

21.825

23.698

25.645

27.671

29.778

41.646

56.085

95.026

152.667

5%

1.000

2.050

3.153

4.310

5.526

6.802

8.142

9.549

11.027

12.578

14.207

15.917

17.713

19.599

21.579

23.657

25.840

28.132

30.539

33.066

47.727

66.439

120.800

209.348

6%

1.000

2.060

3.184

4.375

5.637

6.975

8.394

9.897

11.491

13.181

14.972

16.870

18.882

21.015

23.276

25.673

28.213

30.906

33.760

36.786

54.865

79.058

154.762

290.336

7%

1.000

2.070

3.215

4.440

5.751

7.153

8.654

10.260

11.978

13.816

15.784

17.888

20.141

22.550

25.129

27.888

30.840

33.999

37.379

40.995

63.249

94.461

199.635

406.529

8%

1.000

2.080

3.246

4.506

5.867

7.336

8.923

10.637

12.488

14.487

16.645

18.977

21.495

22.953

24.215

26.019

29.361

27.152

30.324

33.003

36.974

33.750

37.450

41.301

41.446

46.018

45.762

51.160

73.106

84.701

113.283

136.308

337.882

259.057

573.770 815.084 1,163.909 1,668.771

9%

1.000

2.090

3.278

4.573

5.985

7.523

9.200

11.028

13.021

15.193

17.560

20.141

10%

1.000

2.100

3.310

4.641

6.105

7.716

9.487

11.436

13.579

15.937

18.531

21.384

24.523

27.975

31.772

35.950

40.545

45.599

51.159

57.275

98.347

164.494

442.593

11%

1.000

2.110

3.342

4.710

6.228

7.913

9.783

11.859

14.164

16.722

19.561

22.713

26.212

30.095

34.405

39.190

44.501

50.396

56.939

64.203

114.413

199.021

581.826

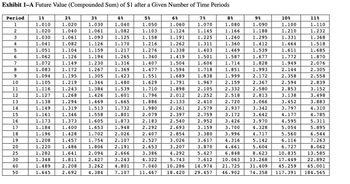

Transcribed Image Text:Exhibit 1-A Future Value (Compounded Sum) of $1 after a Given Number of Time Periods

1%

1.010

7%

1.070

1.020

1.145

1.030

1.225

1.041

1.311

1.051

1.403

1.062

1.501

1.072

1.606

1.083

1.718

1.094

1.838

1.105

1.967

1.116

2.105

1.127

2.252

1.138

2.410

1.149

2.579

2.759

2.952

Period

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

85

25

30

40

50

1.161

1.173

1.184

1.196

1.208

1.220

1.282

1.348

...

1.489

1.645

2%

1.020

1.040

1.061

1.082

1.104

1.126

1.149

1.172

1.195

1.219

1.243

1.268

1.294

1.319

1.346

1.373

1.400

1.428

1.457

1.486

1.641

1.811

2.208

2.692

3%

1.030

1.061

1.093

1.126

1.159

1.194

1.230

1.267

1.305

1.344

1.384

1.426

1.469

1.513

1.558

1.605

1.653

1.702

1.754

1.806

2.094

2.427

3.262

4.384

4%

1.040

1.082

1.125

1.170

1.217

1.265

1.316

1.369

1.423

1.480

1.539

1.601

1.665

1.732

1.801

1.873

1.948

2.026

2.107

2.191

2.666

3.243

4.801

7.107

5%

1.050

1.103

1.158

1.216

1.276

1.340

1.407

1.477

1.551

1.629

1.710

1.796

1.886

1.980

2.079

2.183

2.292

2.407

2.527

2.653

3.386

4.322

7.040

11.467

6%

1.060

1.124

1.191

1.262

1.338

1.419

1.504

1.594

1.689

1.791

1.898

2.012

2.133

2.261

2.397

2.540

2.693

2.854

3.026

3.207

4.292

5.743

10.286

18.420

3.159

3.380

3.617

3.870

5.427

7.612

8%

1.080

1.166

1.260

1.360

1.469

1.587

1.714

1.851

1.999

2.159

2.332

2.518

2.813

2.720

3.066

2.937

3.342

3.172

3.642

3.426

3.970

3.700

4.328

3.996

4.717

4.316

5.142

4.661

5.604

6.848

8.623

10.063 13.268

21.725 31.409

9%

1.090

1.188

1.295

1.412

1.539

1.677

1.828

1.993

2.172

2.367

2.580

14.974

29.457 46.902

10%

1.100

1.210

1.331

11%

1.110

1.232

1.368

1.518

1.685

1.870

2.076

2.305

2.558

2.839

3.152

3.498

3.883

4.310

4.177

4.785

4.595

5.311

5.054

5.895

5.560

6.544

6.116

7.263

6.727

8.062

10.835

13.585

17.449

22.892

45.259

65.001

74.358 117.391 184.565

1.464

1.611

1.772

1.949

2.144

2.358

2.594

2.853

3.138

3.452

3.797

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Your grandmother bought an annuity from Great-West Life Insurance Company for $361,220 when she retired. In exchange for the $361,220, Great-West will pay her $30,000 per year until she dies The interest rate is 6%. How long must she live after the day she retired to come out ahead (that is, to get more in value than what she paid in? -CHED She must live at least years. (Round up to the nearest whole year.)arrow_forwardDon't answer by pen paper and don't use chatgpt otherwise we will give dounvotearrow_forwardYou expect to receive an inheritance of $50,000 (actual) six years from now. What is its present worth at a real interest rate of 4% per year and an inflation rate of 3% per year. Please workout and do not use excel or if you use excel shows steps and formulas thank you!arrow_forward

- Billy Dan and Betty Lou were recently married and want to start saving for their dream home. They expect the house they want will cost approximately $255,000. They hope to be able to purchase the house for cash in 7 years. To determine the appropriate discount factor(s) using tables, click here to view Tables I. II. II. or IV in the appendix. Alternatively, if you calculate the discount factor(s) using a formula, round to six (6) decimal places before using the factor in the problem. Required a. How much will Billy Dan and Betty Lou have to invest each year to purchase their dream home at the end of 7 years? Assume an interest rate of 9 percent. b. Billy Dan's parents want to give the couple a substantial wedding gift for the purchase of their future home. How much must Billy Dan's parents give them now if they are to reach the desired amount of $255,000 in 9 years? Assume an interest rate of 9 percent. Complete this question by entering your answers in the tabs below. Required A…arrow_forwardNonearrow_forwardMarie wants to provide retirement income for her dependent parents for 35 years should she die. Marie earns $67,500 and feels that her parents could live on 65% of that amount. If the insurance funds could be invested at 5%, how much life insurance does she purchase using the desired income method? Group of answer choices $1,273,499 $1,450,087 $932,743 $877,500arrow_forward

- Bhupatbhaiarrow_forward2. math of interest. please solve correctlyarrow_forward4. Mr. Richman has offered to give the New Life Hospice Center $100,000 today or $300,000 when he dies. If the hospice center earns 14% on its investments, and it expects Mr. Richman to live for 12 years, which alternative should they take? Take the gift now or later? Discuss in narrative and include your calculations and citations with your answer.arrow_forward

- Ellen won a lottery that will pay her $100,000 a year for 20 years, or she can accept $1,500,000 today. A)Assuming she can earn 2.5% and maximizing her winnings is the only consideration, which offer should she accept? Show your calculations. B)Assuming she can earn 3%, what would be the lump sum today equivalent to the 20 payments of $100,000?arrow_forwardA favorite aunt wishes to establish a trust fund for her niece's math education. How much should she set aside now if she wants $45, 000, 7 years from now, and interest is compounded continuously at 5%? O $45,000(1.05)-7 O $45,000e -1.95 $45,000e-0.35 O $45,000e-0.05 O $45,000(1.05)- -0.35arrow_forwardUse a financial calculator or computer software program to answer the following questions: a) Melanie is trying to save money for retirement and has a future goal of $750,000 at the end of 20 years. Determine the present value of her goal using a discount rate of 12%. b) How would the present value change if the $750,000 is to be received at the end of 15 years instead? Explain the impact and show your work?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education