Principles of Economics 2e

2nd Edition

ISBN: 9781947172364

Author: Steven A. Greenlaw; David Shapiro

Publisher: OpenStax

expand_more

expand_more

format_list_bulleted

Question

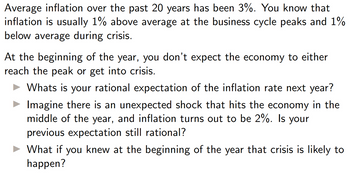

Transcribed Image Text:Average inflation over the past 20 years has been 3%. You know that

inflation is usually 1% above average at the business cycle peaks and 1%

below average during crisis.

At the beginning of the year, you don't expect the economy to either

reach the peak or get into crisis.

► Whats is your rational expectation of the inflation rate next year?

Imagine there is an unexpected shock that hits the economy in the

middle of the year, and inflation turns out to be 2%. Is your

previous expectation still rational?

► What if you knew at the beginning of the year that crisis is likely to

happen?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The total price of purchasing a basket of goods in the United Kingdom over four years is: year 1=940, year 2=970, year 3=1000, and year 4=1070. Calculate two price indices, one using year 1 as the base year (set equal to 100) and the other using year 4 as the base year (set equal to 100). Then, calculate the inflation rate based on the first price index. If you had used the other price index, would you get a different inflation rate? If you are unsure, do the calculation and find out.arrow_forwardu are considering the choice between investing $50,000 in a conventional 1-year bank CD offering an interest rate of 5% and a 1-year Inflation-Plus CD offering 1.5% per year plus the rate of inflation. Which is the safer investment? Can you tell which offers the higher expected return? If you expect the rate of inflation to be 3% over the next year, which is the better investment? Why? If we observe a risk-free nominal interest rate of 5% per year and a risk-free real rate of 1.5% on inflation-indexed bonds, can we infer that the market's expected rate of inflation is 3.5% per year?arrow_forwardSuppose that the nominal interst rate is 7 percent and the real interest rate is 5 percent. Instructions: round your answers to the nearest whole number. What is the inflation premium? (in percentage) Given the level of inflation, how many years would it take for the price level to double?arrow_forward

- Suppose two parties agree that the expected inflation rate for the next year is 6 percent. Based on this, they enter into a loan agreement where the nominal interest rate to be charged is 6 percent. If inflation for the year turns out to be 4 percent, who gains and who loses? Instructions: Enter your responses as whole numbers. The ex ante real interest rate is 10 percent. This is what borrowers think they are paying and lenders think they are earning. With the actual inflation of 4 percent, the ex post real interest rate will be percent.arrow_forwardgi i need help for question 8 i don,t understand how to do that and also this question is for macroeconomicarrow_forwardHandwritten solution not required correct answer will get instant upvote.arrow_forward

- Que 15: What is inflation targeting?arrow_forwardmake a table of values that shows the percentages decreases in buying power for inflation rate in whole numbers from 1% theough 10%arrow_forwardWhile hyperinflations are always caused by rapid growth in the money supply, they can be intensified by the actions of households and firms trying to protect themselves from inflation by spending money as soon as they receive it. During a hyperinflation, the velocity of money is likely to Use the quantity equation to show how the change in vel Holding the growth rate of real GDP constant, this chang increase remain unchanged decrease ▼inflation image 1arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax

Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax

Principles of Economics 2e

Economics

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:OpenStax