ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

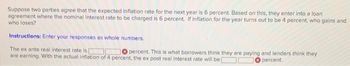

Transcribed Image Text:Suppose two parties agree that the expected inflation rate for the next year is 6 percent. Based on this, they enter into a loan

agreement where the nominal interest rate to be charged is 6 percent. If inflation for the year turns out to be 4 percent, who gains and

who loses?

Instructions: Enter your responses as whole numbers.

The ex ante real interest rate is

10 percent. This is what borrowers think they are paying and lenders think they

are earning. With the actual inflation of 4 percent, the ex post real interest rate will be

percent.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 1. The index number representing the price level changes from 110 to 115 in 2019, and then from 115 to 120 in 2020. Since the index number increases by 5 this year, is five the inflation rate each year? Is the inflation rate the same each year?. NOTE: Explain and support the answer with calculations. 2. The total price of purchasing a basket of goods over four years is; year 1 - P940 year 2 - P970 year 3 - P1,000 year 4 - P1,070 Calculate two price indicates, one using year 1 as the base year (set equal to 100) and the other using the year 4 as the base year (set equal to 100). NOTE: Explain and support the answer with calculations.arrow_forwardMakayla bought a $1,000, 5-year inflation - indexed bond that had a real interest rate of 5.10% when the CPI was 248.615. A year later, the CPI decreased to 219.313. What amount of interest (rounded to the nearest cent) will she receive? a. $ 57.81 b. $51.00 c. $44.99 d. $ 27.10arrow_forwardThe table below shows the annual change in the average nominal wage and inflation rate since 2008. a. Compute the percentage change in real income for each year shown in the table. Instructions: In part a, round your answers to two decimal places. In parts b and c, enter your answers as a whole number. If entering a negative number, include a minus sign. Percentage Changes in Nominal Income and Prices Year 2008 2009 2010 2011 2012 2013 Annual Inflation Rate (percent) 3.92% -0.36 1.66 3.24 2.11 1.48 Annual Nominal Wage Growth (percent) 0.34% -1.24 -0.76 1.4 2.76 2.28 Annual Real Wage Growth (percent) (0.39) x % (0.88) ♥ 2.42 x 9.87 x b. Of the years listed above, the paycheck of the average worker declined in 2 c. Of the years listed above, the purchasing power of the average worker declined in of the six years. 4 of the six years. d. The average real income of households can increase whether the nominal wage increases or decreasesarrow_forward

- Suppose you'll have an annual nominal income of $20,000 for each of the next three years, and the inflation rate is 5 percent per year. Hint: Present value = Future value = (1 + Growth in prices)* = Real value of next year's income = Next year's income ÷ (1+ Growth in prices) Instructions: Round your responses to the nearest whole dollar. a. Find the real value of your $20,000 salary for each of the next three years. Year 1: $ Year 2: $ Year 3: $ b. If you have a COLA in your contract, what is the real value of your salary for each year? Year 1: $ 19047 Year 2: $ 18144 Year 3: $ 17276arrow_forwardjust answer part c , d and e notice that you can do it without the answer of part a and barrow_forwardThe real interest rate is 6 percent a year and the income tax rate is 50 percent. With no inflation, what is the real after-tax interest rate? If the inflation rate rises to 4 percent a year, what is the real after-tax interest rate?arrow_forward

- A. Find the real value of your 40,000 salary for each of the next three year's. year1? year2? year3? b. If you have a cola in your contract, and the inflation rate is 5 percent, what is the real value of your salary for each year? year1? year2? year3?arrow_forwardA price index for a basket of goods over four years was calculated to be: 2014 = 92, • 2015 =97, • 2016=100, • 2017=107. Calculate the inflation rate for each year so that you will enter: Blank #1 = Inflation Rate for 2015 Blank #2 = Inflation Rate for 2016 • Blank #3 = Inflation Rate for 2017 What is the base year in this scenario? • Blank #4 = Base year for this basket %3D Round to two decimal places Blank # 1 Blank # 2 Blank # 3 Blank # 4arrow_forwardWhich of the following describes the interest rate on an investment after calculating the impact of inflation?O NominalO RealO FinancialO Profitarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education