FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

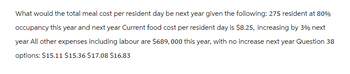

Transcribed Image Text:What would the total meal cost per resident day be next year given the following: 275 resident at 80%

occupancy this year and next year Current food cost per resident day is $8.25, increasing by 3% next

year All other expenses including labour are $689,000 this year, with no increase next year Question 38

options: $15.11 $15.36 $17.08 $16.83

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Chapter 8 Consumer Purchasing Strategies and Legal Protection Financial Planning Question 1arrow_forwardAccumulating a growing future sum Personal Finance Problem A retirement home at Deer Trail Estates now costs $145,000. Inflation is expected to cause this price to increase at 4% per year over the 25 years before C. L. Donovan retires. If Donovan earns 9% on his investments, ow large must an equal, end-of-year deposit must be to provide the cash needed to buy the home 25 years from now? The equal, annual end-of-year deposit to be made each year into the account is $ (Round to the nearest cent.)arrow_forwardQ37arrow_forward

- Nonearrow_forwardDo you want to be one of the first people to take a commercial flight to outer space which means that you need to save $3522922.  However, currently only have 2333723 in your savings account. Based on an analysis of your monthly budget, you can find a way to add 3437 per month to your account until you have enough. You can earn on average 12.2% APR in your account, compounded monthly how many years will you need to work before you can experience the weightlessness of the final frontier?arrow_forwardUse the following to answer questions 31 – 33 You want a new car. At the dealership, you find a car that you like. The dealership gives you two payment options: 1. Pay $23,000 in cash for the car today...OR Pay $370.41 at the end of each month for six years at 5% (0.41667% monthly for 72n). 2. How much CASH (in total) up paying if you choose to make monthly 31. $ will you end payments for the car? 32. How much interest (in total) $ will you pay if you choose to make payments instead of paying cash for the car today? 33. $ How much interest has accrued by the time the first car payment is due (round to two decimal places)?arrow_forward

- Problem 04.045 - Effort to save money for early retirement In an effort to save money for early retirement, an environmental engineering colleague plans to deposit $1300 per month, starting one month from now, into a fixed rate account that pays 8% per year compounded annually. How much will be in the account at the end of 16.00 years? At the end of 16.00 years, the account will be $ 500068arrow_forwardUsing the BA II Plus how do I find the solution to The Humpty Dumpty Food Store will be setting aside 35,000 each quarter starting next quarter, for the next four years. How much money will the firm have in four years if it can earn 6.25 % on its savings?arrow_forwardGolden Gate Novelties (GGN) sells souvenir key chains at the local airport. GGN charges $12.00 per chain. The variable cost for a chain, including the wholesale cost of the chain, packaging, the commission paid to the airport operator, and so on, is $10.40. The annual fixed cost for GGN is $15,000. Required: a. How many cases must Golden Gate Novelties sell every year to break even? Note: Do not round intermediate calculations. b. The owner of GGN believes that the company can sell 12,500 chains a year. What is the margin of safety in terms of the number of chains? a. Break-even point b. Margin of safety chains chainsarrow_forward

- plz solve it within 30-40 mins ill give you multiple upvotesarrow_forwardWhen purchasing a $100,000 house, a borrower is comparing two loan alternatives. The first loan is an 80% loan at 4% with monthly payments of $591.75 for 15 years. The second loan is 90% loan at 5% with monthly payments of $526.13 over 25 years. What is the incremental cost of borrowing the extra money assuming the loan will be held for the full term? O 6.50% O 13.21% O 7.20% O 13.70%arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education