ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

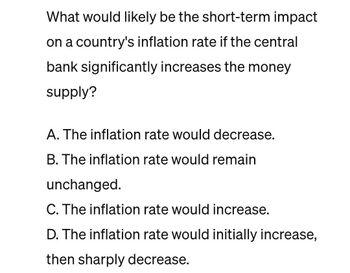

Transcribed Image Text:What would likely be the short-term impact

on a country's inflation rate if the central

bank significantly increases the money

supply?

A. The inflation rate would decrease.

B. The inflation rate would remain

unchanged.

C. The inflation rate would increase.

D. The inflation rate would initially increase,

then sharply decrease.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- What is the expected impact of a decline in the money supply to the US economy? A. Higher aggregate prices (inflation) B. Lower aggregate prices (deflation) C. There is no general relationship between the money supply and inflatonarrow_forwardthe money supply of Freedonia this year is $150 billion nominal GDP is $750 billion .assuming that velocity of money is stable. real GDP gross 2%this year. and money supply does not change what are the velocity, price level, and inflation ratearrow_forwardThe government of a country increases the growth rate of the money supply from 5 percent per year to 50 percent per year. a) What happens to prices? b) What happens to nominal interest rate? c) Why might the government be doing this?arrow_forward

- What is the inflation rate? Year Money supply GDP Assume that the velocity of money is constant. (Write your answer in percentage. If your answer is 0.0222, write 2.22.) 2015 1,200 12,000 2016 1,220 12,550arrow_forwardIf the Bank of Canada wanted to reduce inflation, it could Select one: a. increase the reserve requirement or implement an open market sale. b. increase the reserve requirement or implement an open market purchase. c. decrease the reserve requirement or implement an open market purchase. d. decrease the reserve requirement or implement an open market sale.arrow_forward9) Explain why inflation may tend to accelerate.arrow_forward

- What happens when a central bank pursues inflation targeting? A. The policy actions that central banks use to achieve the inflation target are kept secret. B. With inflation targeting, the United States would be more successful at achieving low and stable inflation. C. Many central banks achieve their inflation target at the expense of extremely high unemployment. D. The bank announces an explicit inflation target and the public is confident the bank's policy will achieve that target. thank you!!arrow_forward1. What are the main reasons that the U.S. inflation surged last year? 2. What is the monetary policy the Fed (central bank of the U.S.) uses to control inflation? 3. How did the monetary policy cause the bankruptcy of Silicon Valley Bank?arrow_forwardWhat do monetarists predict will happen in the short run and in the long run as a result of each of the following? (In each case assume the economy is currently in long-run equilibrium). (a) Velocity rises. (b) Velocity falls. (c) The money supply rises. (d) The money supply falls.arrow_forward

- a) Chose a tool the Central Bank (the Fed) might use to fight inflation. b) How would it be use? c) How would it cause inflation to fall?arrow_forwardThe Fed increases the amount of OMO purchases: a)Inflation increases b)Inflation decreases c)Inflation stays the same d)Can't tellarrow_forwardWhat happens when a central bank pursues inflation targeting? A. The policy actions that central banks use to achieve the inflation target are kept secret. B. With inflation targeting, the United States would be more successful at achieving low and stable inflation. C. Many central banks achieve their inflation target at the expense of extremely high unemployment. D. The bank announces an explicit inflation target and the public is confident the bank's policy will achieve that target.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education