ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

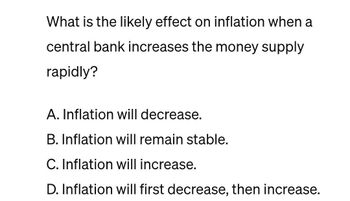

Transcribed Image Text:What is the likely effect on inflation when a

central bank increases the money supply

rapidly?

A. Inflation will decrease.

B. Inflation will remain stable.

C. Inflation will increase.

D. Inflation will first decrease, then increase.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Which of these methods to control inflation is related to monetary policy? a. setting price ceilings to key commodities b. reducing the money supply in the economy c. charging pollution fees on industries d. increasing tax rates and imposing new taxesarrow_forwardpolicy is when a central bank acts to increase the money supply in an effort to stimulate the economy. Select one: a.Deflationary monetary b.Expansionary monetary c.Contractionary fiscal d.Cyclical monetary e.Countercyclical fiscalarrow_forwardThe Federal Open Market Committee a. by law must focus on maintaining low inflation rather than stabilizing output b. by law must focus on stabilizing output rather than maintaining low inflation. c. by law must follow a mechanical rule that takes into account deviations of unemployment from its natural rate and deviations of inflation from a target. d. operates with almost complete discretion over monetary policy.arrow_forward

- Need qualitiey answer.absulately upvotearrow_forwardIn the short run, expansionary monetary or fiscal policy is expected to O increase; decrease. inflation and output. increase; increase. decrease; decrease. O decrease; increase.arrow_forward1. What are the main reasons that the U.S. inflation surged last year? 2. What is the monetary policy the Fed (central bank of the U.S.) uses to control inflation? 3. How did the monetary policy cause the bankruptcy of Silicon Valley Bank?arrow_forward

- Money neutrality is the idea that a. any policy can have intended and unintended consequences b. in the long-run, markets will clear and return the economy to equilibrium regardless of what happens to the money supply. c. there are two types of variables, nominal and real, and only nominal variables are affected by the money supply. d. nominal and real interest rates are unrelated. During the middle of the 20th century, income inequality in developed economies generally fell. The reason for this was a. average incomes didn't rise but welfare systems redistributed income. b. that returns to assets held by high income earners fell steadily. c. incomes overall rose but taxation systems were slowly made more and more progressive. d. a rise in average income with incomes of the bottom deciles rising faster than the top.arrow_forwardMoney demand is likely to increase the most during which part of the business cycle? A. peak B. recession C. contraction D. trough E. recoveryarrow_forwardWhat do monetarists predict will happen in the short run and in the long run as a result of each of the following? (In each case assume the economy is currently in long-run equilibrium). (a) Velocity rises. (b) Velocity falls. (c) The money supply rises. (d) The money supply falls.arrow_forward

- What do monetarists predict will happen in the short run and in the long run as a result of each of the following? (In each case, assume the economy is currently in long-run equilibrium).(a) Velocity rises. (b) Velocity falls.(c) The money supply rises. (d) The money supply falls.arrow_forwardIncreases in the rate of inflation Select one: a. Always coincide with a decrease in the unemployment rate b. Are more pronounced in periods of recession c. Generally are inversely related to the output gap d. Generally do not occur in periods of high growth in money supplyarrow_forwardThe Fed increases the amount of OMO purchases: a)Inflation increases b)Inflation decreases c)Inflation stays the same d)Can't tellarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education