Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

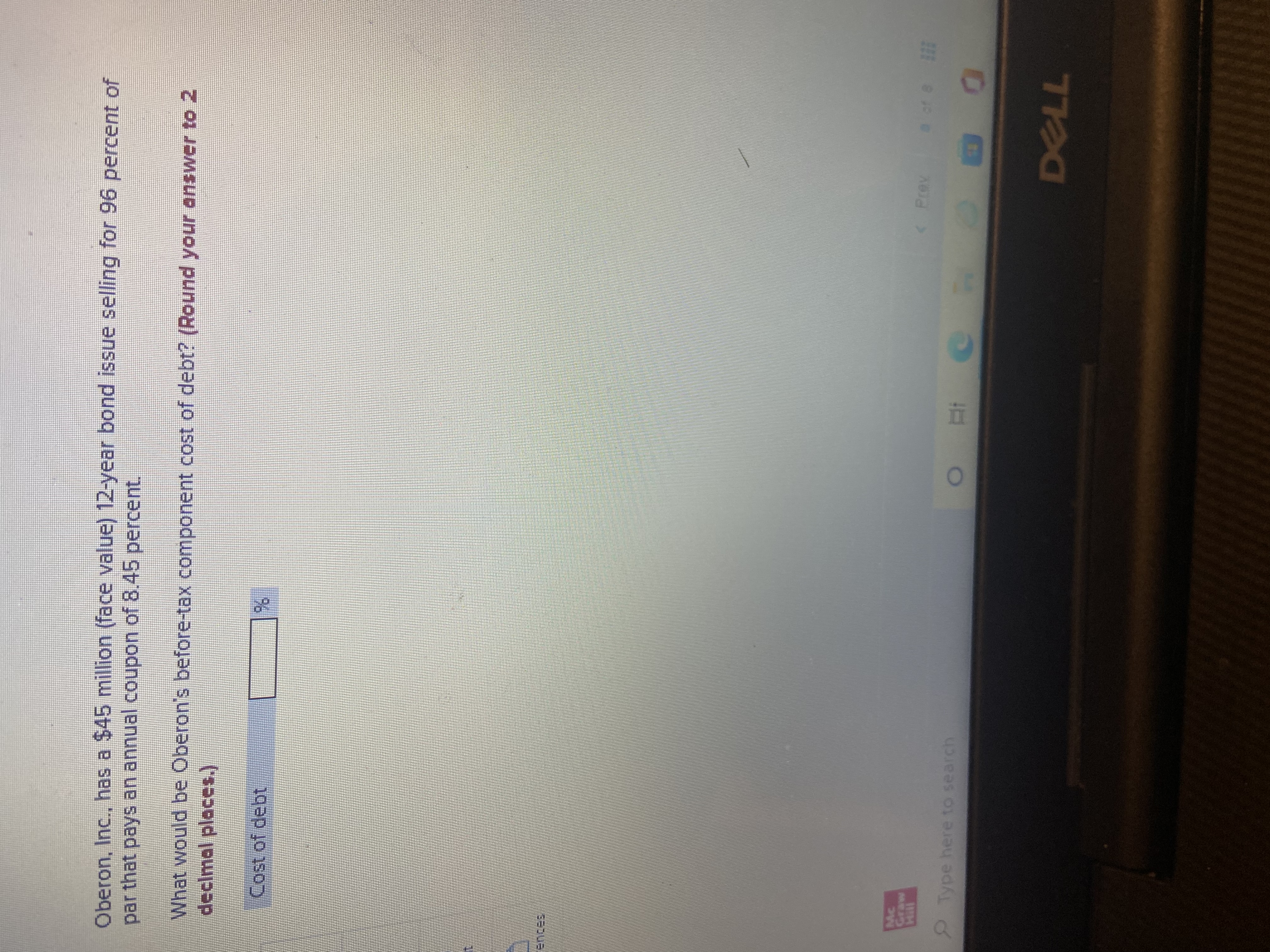

Transcribed Image Text:Oberon, Inc., has a $45 million (face value) 12-year bond issue selling for 96 percent of

par that pays an annual coupon of 8.45 percent,

What would be Oberon's before-tax component cost of debt? (Round your answer to 2

declmal places.)

Cost of debt

96

Mc

2Type here to search

五

7734

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- What is the alternative minimum tax (AMT) rate for individuals? 1 %. 7%. 12.3%. 20%.arrow_forwardWhich of the following statements regarding the tax deductibility of points related to a home mortgage is correct? (See image for answers)arrow_forwardWhat would be the marginal tax rate for a single person who has a taxable income of: a) $31,560 b) $58,150 c) $66,450 d) $100,580 DO NOT INCLUDE % SIGNarrow_forward

- What will be the total tax (Federal + Provincial) for a taxable income of $92,340? Do calculation and choose answer. (Use the Federal Tax Rates for 2023 and Sample Question.) $28,447.08 $21,913.54 $18,642.60 $25,228.96arrow_forwardFirm E must choose between two alternative transactions. Transaction 1 requires a $9,150 cash outlay that would be nondeductible in the computation of taxable income. Transaction 2 requires a $14,800 cash outlay that would be a deductible expense. Required: a. Determine the after-tax cost for each transaction. Assume Firm E's marginal tax rate is 25 percent. b. Determine the after-tax cost for each transaction. Assume Firm E's marginal tax rate is 45 percent.arrow_forward4.arrow_forward

- What would the effect of the failure in the ratio measurement?arrow_forward. What is the 'low income tax offset' (LITO)? What is the maximum LITO amount payable toeligible taxpayers? PLEASE PUT 3 REFERENCESarrow_forwardWhich of the following taxes has a ceiling? Choose the best answer. Group of answer choices Both Social Security Tax and Unemployment Tax Social Security Tax Unemployment Tax Medicare Taxarrow_forward

- am. 35.arrow_forwardA taxpayer is itemizing their return and they're trying to calculate the deductible amount of state income taxes paid. They have $4,000 from their Form(s) W-2 and they paid an outstanding balance in the current year for the prior year's balance of $2,500. What is the total amount of Line 5 income taxes that they can itemize? (Do not consider SALT limitations for this question) 2500 4000 6500arrow_forwardBriefly explain the precise difference between a refundable vs. a nonrefundable tax credit. Provide one or two examples of each category.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education