Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

2. A firm purchased a machine with a life of four years. Depreciating the machine using straight-line depreciation over the four years yields an NPV = -$10. The initial investment was $1000, cost of capital = 15%, and tax rate = 34%. If the firm is allowed to

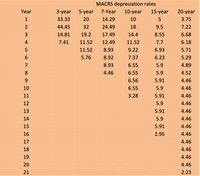

Transcribed Image Text:The table outlines the Modified Accelerated Cost Recovery System (MACRS) depreciation rates for various asset classes over different time periods: 3-year, 5-year, 7-year, 10-year, 15-year, and 20-year. The MACRS system is used for tax purposes in the United States and allows for the accelerated depreciation of property.

### MACRS Depreciation Rates

| Year | 3-year | 5-year | 7-year | 10-year | 15-year | 20-year |

|------|--------|--------|--------|---------|---------|---------|

| 1 | 33.33 | 20 | 14.29 | 10 | 5 | 3.75 |

| 2 | 44.45 | 32 | 24.49 | 18 | 9.5 | 7.22 |

| 3 | 14.81 | 19.2 | 17.49 | 14.4 | 8.55 | 6.68 |

| 4 | 7.41 | 11.52 | 12.49 | 11.52 | 7.7 | 6.18 |

| 5 | | 11.52 | 8.93 | 9.22 | 6.93 | 5.71 |

| 6 | | 5.76 | 8.92 | 7.37 | 6.23 | 5.29 |

| 7 | | | 8.93 | 6.55 | 5.9 | 4.89 |

| 8 | | | 4.46 | 6.55 | 5.9 | 4.52 |

| 9 | | | | 6.56 | 5.91 | 4.46 |

| 10 | | | | 6.55 | 5.9 | 4.46 |

| 11 | | | | 3.28 | 5.91 | 4.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Nguyen Company has an opportunity to purchase an asset that will cost company $59,000. The asset is expected to add $23,000 per year to the company’s net income. Assuming the asset has a five-year useful life and zero salvage value, the unadjusted rate of return based on the average investment will be ?arrow_forward1.arrow_forward5. Does your company want to purchase this machine that will provide cost savings of $100,000 annually for its useful life (8 years)? The cost is $250,000; tax rate is 36% and discount rate is 14%. Compute straight-line depreciation for 8 years with zero salvage value. Calculate the cash flows and determine the NPV and IRR. Does your company want to buy this machine?arrow_forward

- XYZ Company has an opportunity to purchase and asset that will cost the company $60,000. The asset is expected to add $12,000 per year to the company’s net income. Assuming the asset has a 5-year useful life and a zero salvage value, the unadjusted rate of return will be?arrow_forwardProvide please answer in text Formatarrow_forwardA company plans to purchase a computer network control (CNC) machine for $650,000.00. If the company makes a profit from the products of the machine of $265,000.00 at years three and four and the company will be able to sell the machine at year four for $125,000.00 ( salvage value). The company wants to know if they will be able to recover the cost of the machine if the interest rate is 4% ? Provide them with the future value of the transactions to answer their question (if the number is negative it will not pay back, if it is positive it will). SOLVE IN EXCELarrow_forward

- Assume XYZ wishes to purchase a machine for $500k that will produce widgets which will sell for $50 each. Assume variable costs of $30/unit and other fixed costs will be $100k per year. Assume a tax rate of 25%, and assume that assets purchased will be in a CCA class with a rate of 20%. Assume further the assets purchased will have a salvage value of $20,000 after the 5 year life of the project, and that interest rates are 10%. a. Compute the after-tax contribution margin. b. Find the PV break-even volume.arrow_forwardBelmont Corp. is considering the purchase of a new piece of equipment. The cost savings from the equipment would result in an annual increase in net income after tax of $290,000. The equipment will have an initial cost of $1,000,000 and have an 8 year life. If there is no salvage value of the equipment, what is the accounting rate of return? Multiple Choice 21.5% 29.0% 58.0% 24.0%arrow_forwardD1. Answer ASAP. Please complete all parts correctly.arrow_forward

- A company has purchased a machine (CCA rate 24%) at $300,000 and has a tax rate of 33.00%. By how much will the NPV change if the company is able to obtain a $13,000 salvage value for its machine at the end of the project's life in Year 4? Assume a discount rate of 11.20% and that all else remains the same. Question 10Answer a. $8,502 b. $10,415 c. -$1,913 d. $6,589 e. $10,075arrow_forwarda) Titiwangsa Corporation is using a computer where its original cost was RM25,000. The machine is now 5 years old and has a current market value of RM5,000. The computer is being depreciated over a 10-year life toward zero salvage value. Depreciation is on straight line basis. Management is contemplating to purchase a new computer which will cost RM50,000 and the estimated salvage value is RM1,000. Expected savings from the new computer is RM3,000 a year. Depreciation is on straight line basis over a seven-year life and the cost of capital is 10%. If the tax rate is 50%, should the firm replace the asset?arrow_forward29. X Corporation is considering buying a $25,000 machine. Its estimated useful life is 5 years, with no salvage value. X anticipates annual net income after taxes of $1,500 from the new machine. What is the rate of return on average investment, assuming that X uses straight-line depreciation and that the net income is earned uniformly throughout each year? A. 6.0% B. 8.0% C. 12.0% D. 26.0% E. 52.0%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education