Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

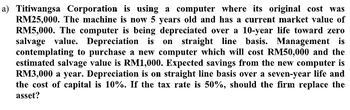

Transcribed Image Text:a) Titiwangsa Corporation is using a computer where its original cost was

RM25,000. The machine is now 5 years old and has a current market value of

RM5,000. The computer is being depreciated over a 10-year life toward zero

salvage value. Depreciation is on straight line basis. Management is

contemplating to purchase a new computer which will cost RM50,000 and the

estimated salvage value is RM1,000. Expected savings from the new computer is

RM3,000 a year. Depreciation is on straight line basis over a seven-year life and

the cost of capital is 10%. If the tax rate is 50%, should the firm replace the

asset?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Which values am I supposed to use for the depreciation?arrow_forwardSunland Inc. wants to replace its current equipment with new high-tech equipment. The existing equipment was purchased 5 years ago at a cost of $122,000. At that time, the equipment had an expected life of 10 years, with no expected salvage value. The equipment is being depreciated on a straight-line basis. Currently, the market value of the old equipment is $40,100. The new equipment can be bought for $175,880, including installation. Over its 10-year life, it will reduce operating expenses from $193,900 to $145,000 for the first six years, and from $204,800 to $191,300 for the last four years. Net working capital requirements will also increase by $20,700 at the time of replacement. It is estimated that the company can sell the new equipment for $24,900 at the end of its life. Since the new equipment's cash flows are relatively certain, the project's cost of capital is set at 9 %, compared with 15% for an average - risk project. The firm's maximum acceptable payback period is 5…arrow_forwardA company purchased a machine 6 years ago for $500m and a salvage value of $30m. The machine has a useful life of 18 years. Now, the company has found another machine with a price of $700m which generates $25m in cost savings and $12m in revenue. This machine has a useful life of 10 years with no salvage value. If the company chooses to purchase the new equipment, it can sell the old equipment for $400m. The company's tax rate is 21% and the discount rate is 17%. Calculate the cash flow in year 0 assuming the company purchases the new equipment, calculate the incremental cash flow per year and calculate the IRR and NPV of the equipment.arrow_forward

- am. 214.arrow_forwardCoparrow_forwardInternational Soup Company is considering replacing a canning machine. The old machine is being depreciated by the straight-line method over a 10-year recovery period from a depreciable cost basis of $120,000. The old machine has 5 years of remaining usable life, at which time its salvage value is expected to be zero, and it can be sold now for $40,000. This machine has a current book value of $60,000. The purchase price of the new machine is $250,000. Employees were sent to a training course last year on how to use the new machine; this training cost $5,000. The new machine has a 5-year life and an expected salvage value of $25,000. Annual savings of electricity, labor, and materials from use of the new machine are estimated at $40,000. The company is in a 40 percent tax bracket and its cost of capital is 16 percent. The MACRS depreciation method will be used and the recovery percentages for assets with a 5-year class life are given below: What is the initial cash outlay for the…arrow_forward

- A company plans to purchase a computer network control (CNC) machine for $650,000.00. If the company makes a profit from the products of the machine of $265,000.00 at years three and four and the company will be able to sell the machine at year four for $125,000.00 ( salvage value). The company wants to know if they will be able to recover the cost of the machine if the interest rate is 4% ? Provide them with the future value of the transactions to answer their question (if the number is negative it will not pay back, if it is positive it will). SOLVE IN EXCELarrow_forwardCisco Systems is purchasing a new bar code - scanning device for its service center in San Francisco. The table on the right lists the relevant initial costs for this purchase. The service life of the system is 4 years and its salvage value for depreciation purposes is expected to be about 23% of the hardware cost. a. What is the cost basis of the device? b. What are the annual depreciations of the device if (i) the SL method is used? (ii) the 150% DB method is used? (iii) the 200% DB method is used? c. Calculate the book values of the device at the end of 4 years using all the methods above. Answers: (Round to the nearest dollar) (a) The cost basis of the device is $ (b) Annual depreciaitions and book values: (Round to the nearest dollar) Year 1 2 3 4 Book values at end of year 4 SL 69 69 69 69 69 150% DB 69 $ $ 200% DB 69 69 69 12 Cost Item Hardware Training Installation Cost $160,000 $16,000 $17,000arrow_forward6. The Imperial Chemical Company is considering purchasing a chemical analysis machine worth $13,000. Although the purchase of this machine will not produce any increase in sales revenues, it will result in a reduction of labour costs. In order to operate the machine properly, it must be calibrated each year. The machine has an expected life of 6 years, after which it will have no salvage value. The following table summarizes the annual savings in labour cost and the annual maintenance costs in calibration over 6 years: Net Cash Flow ($) Costs ($) Year (n) 0 Savings ($) 13,000 -13,000 1 2,300 6,000 3,700 2 2,300 7,000 4,700 3 2,300 9,000 6,700 4 2,300 9,000 6,700 5 2,300 9,000 6,700 6 2,300 9,000 6,700 Find the internal rate of return for this project. [6]arrow_forward

- Henrie's Drapery Service is investigating the purchase of a new machine for cleaning and blocking drapes. The machine would cost $151,640, including freight and installation, Henrie's estimated the new machine would increase the company's cash inflows, net of expenses, by $40,000 per year. The machine would have a five-year useful life and no salvage value. Required: 1. What is the machine's internal rate of return? Note: Round your answer to the nearest whole percentage.arrow_forwardRahularrow_forwardSheridan Corp. is considering purchasing one of two new diagnostic machines. Either machine would make it possible for the company to bid on jobs that it currently isn't equipped to do. Estimates regarding each machine are provided here. Original cost Estimated life Salvage value Estimated annual cash inflows Estimated annual cash outflows Net present value Machine A $78,200 8 years Profitability index 0 $19,800 $5,130 Click here to view the factor table. Calculate the net present value and profitability index of each machine. Assume a 9% discount rate. (If the net present value is negative, use either a negative sign preceding the number eg-45 or parentheses eg (45). Round answer for present value to 0 decimal places, e.g. 125 and profitability index to 2 decimal places, eg. 10.50. For calculation purposes, use 5 decimal places as displayed in the factor table provided.) Machine A Machine B $182,000 8 years $39,600 $10,180 Machine Barrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education