FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

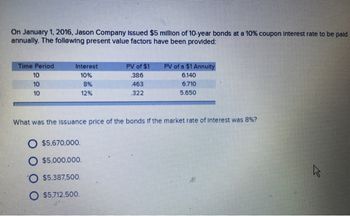

Transcribed Image Text:On January 1, 2016, Jason Company Issued $5 million of 10-year bonds at a 10% coupon Interest rate to be paid

annually. The following present value factors have been provided:

Time Period

10

10

10

Interest

10%

8%

12%

O $5,670,000.

O $5,000,000.

O $5.387,500.

O $5,712,500.

PV of $1

386

463

322

PV of a $1 Annuity

6.140

6.710

5.650

What was the Issuance price of the bonds if the market rate of Interest was 8%?

4

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- 1. What is the yield to maturity on the following bonds; all have a maturity of 10 years, a face value of 2000, and a coupon rate of 4 percent (paid semiannually). The bond's current prices are: a. $1,180 b. $ 2,400 c. Explain the relationship between yield to maturity and bond prices.arrow_forwardWhat are the steps and explanation for determining the current value of BondB that matures in 2 years and it has the same interest rate (yield) as Bond A. BondA matures in 1 year, has a current price (PV) of $800 and a face value (FV) of $1000.arrow_forwardUsing the following information, determine the real rate of interest: Rate % inflation 0.69 T-bill 5.00 10y T-Bond 6.00 10y AAA Corporate 6.41 10y AA Corporate 8.24arrow_forward

- Refer to Table 10-2. a. Assume the interest rate in the market (yield to maturity) goes down to 8 percent for the 10 percent bonds. Using column 2, indicate what the bond price will be with a 10-year, a 20-year, and a 25-year time period. b. Assume the interest rate in the market (yield to maturity) goes up to 12 percent for the 10 percent bonds. Using column 3, indicate what the bond price will be with a 10-year, a 20-year, and a 25-year period. c. Assume the interest rate in the market (yield to maturity) goes down to 8 percent for the 10 percent bonds. If interest rates in the market are going down, which bond would you choose to own? multiple choice 1 10 Years 20 Years 25 Years d. Assume the interest rate in the market (yield to maturity) goes up to 12 percent for the 10 percent bonds. If interest rates in the market are going up, which bond would you choose to own? multiple choice 2 10 Years 20 Years 25 Yearsarrow_forwardUsing the information in Question 14 above, estimate the price of the bond for a 200 basis-point increase in interest rates. O A. $936 B. ³. $1002 C. $964 D. $1012arrow_forwardIf you were to purchase a 12% bond when the market interest rate for such bonds was 11%, would you expect to pay more or less than the face amount for the bond? If you were to purchase a 12% bond when the market interest rate for such bonds was 13%, would you expect to pay more or less than the face amount for the bond? Explain your answers from above?arrow_forward

- What is assumed the be the face value aka par value aka principal aka loan amount of a bond? It's also assumed to be a bond's FV. 10% $0 $100 $1,000arrow_forwardTo calculate WACC of a firm, which of the following should be used as the cost of debt? - Bank deposit rate - Annual yield to maturity of the bond issued by this firm - Risk free rate - 3 Month T bill ratearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education