Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN: 9781305654174

Author: Gary A. Porter, Curtis L. Norton

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

What the answer for 40

The first answer I had was

Ending Inventory C

Retained Earnings B

Cost of Goods Sold A

Net income B

The second I had was

Ending Inventory A

Retained Earnings B

Cost of Goods Sold A

Net income B

Both was wrong

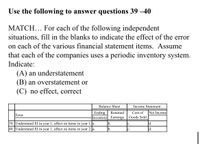

Transcribed Image Text:Use the following to answer questions 39 –40

MATCH... For each of the following independent

situations, fill in the blanks to indicate the effect of the error

on each of the various financial statement items. Assume

that each of the companies uses a periodic inventory system.

Indicate:

(A) an understatement

(B) an overstatement or

(C) no effect, correct

Balance Sheet

Income Statement

Net Income

Ending

Inventory Earnings

Retained

Cost of

Error

Goods Sold

39. Understated EI in year 1, affect on items in year 1.Ja.

b.

с.

d.

40. JUnderstated EI in year 1, affect on items in year 2.Ja.

b.

d.

с.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Use the following to answer questions 39 –40 MATCH... For each of the following independent situations, fill in the blanks to indicate the effect of the error on each of the various financial statement items. Assume that each of the companies uses a periodic inventory system. Indicate: (A) an understatement (B) an overstatement or (C) no effect, correct Balance Sheet Income Statement Net Income Ending Inventory Earnings Retained Cost of Error Goods Sold 39. Understated EI in year 1, affect on items in year 1.Ja. b. с. d. 40. JUnderstated EI in year 1, affect on items in year 2.Ja. b. d. с.arrow_forwardNeed answerarrow_forwardAssuming a companys year-end inventory were overstated by $5,000, indicate the effect (overstated/understated/no effect) of the error on the following balance sheet and income statement accounts. A. Income Statement: Cost of Goods Sold B. Income Statement: Net Income C. Balance Sheet: Assets D. Balance Sheet: Liabilities E. Balance Sheet: Equityarrow_forward

- Complete the missing pieces of Delgado Companys inventory calculations and ratios.arrow_forwardIndicate the effect of each of the following errors on the following balance sheet and income statement items for the current and succeeding years: beginning inventory, ending inventory, accounts payable, retained earnings, purchases, cost of goods sold, net income, and earnings per share. a. The ending inventory is overstated. b. Merchandise purchased on account and received was not recorded in the purchases account until the succeeding year although the item was included in inventory of the current year. c. Merchandise purchased on account and shipped FOB shipping point was not recorded in either the purchases account or the ending inventory. d. The ending inventory was understated as a result of the exclusion of goods sent out on consignment.arrow_forwardWhich method results in a balance sheet valuation of inventory method farthest away from its economic value? Select one: a. FIFO b. LIFO c. Weighted Average PreviousSave AnswersNextarrow_forward

- Inventory at the end of the year was inadvertently overstated. Which of the following statements correctly states the effect of the error on net income, assets, and stockholders' equity? a.net income is understated, assets are understated, and stockholders' equity is overstated b.net income is understated, assets are understated, and stockholders' equity is understated c.net income is overstated, assets are overstated, and stockholders' equity is overstated d.net income is overstated, assets are overstated, and stockholders' equity is understatedarrow_forwardGive me answerarrow_forwardH6. Lower of cost or market is an attribute used for the: a. initial measurement of accounts receivable b. subsequent measurement of inventory c. subsequent measurement of accounts receivable d. initial measurement of inventory Explain All wrong options and explain with full detailsarrow_forward

- 3 Under a periodic inventory system, if the beginning inventory is overstated Select one: a. working capital is understated. b. the current ratio is overstated. c. net income is understated. d. cost of goods sold is understated.arrow_forwardDo you agree with the following statements? Express your opinion on each statement. An inventory error that causes an understatement (or overstatement) for net income in one accounting period, if not corrected, will cause an overstatement (or understatement) in the next. Since an understatement (overstatement) of one period offsets the overstatement (understatement) in the next, such errors as said to correct themselves. Market usually means replacement cost of inventory when applied in the LMC. Cost of goods available for sale equals the inventory plus cost of sales.arrow_forwardDo you agree with the following statements? Express your opinion on each statement. An inventory error that causes an understatement (or overstatement) for net income in one accounting period, if not corrected, will cause an overstatement (or understatement) in the next. Since an understatement (overstatement) of one period offsets the overstatement (understatement) in the next, such errors are said to correct themselves. Market usually means replacement cost of inventory when applied in the LCM. Cost of goods available for sale equals ending inventory plus cost of sales.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...

Accounting

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub