Exploring Finance: Coupon Bonds.

Conceptual Overview: Explore the value of fixed-interest coupon bonds of different terms.

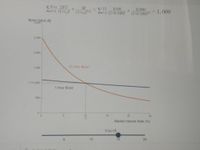

This graph shows the value of 10% coupon bonds of different terms across differing market interest rates. Each bond pays INT = $100 at the end of each year and returns M = $1,000 at maturity. For comparison, the blue line depicts the value of a one-year bond. The term of the other bond in years may be changed using the slider. Drag on the graph to change the current market interest rate (rd) at which the bond (orange curve) is evaluated.

|

3. What is the value of a 10-year 10% $1,000 bond when the market interest rate is 10%?

4. For a 10% $1,000 coupon bond, when the market interest rate is greater than 10%, the

5. For a 10%, $1,000 coupon bond, a longer term bond (say, 15 years) is:

|

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

- 1. Pricing a bond in the secondary market: For each question, use the three methods we learned in class: plug in the values in the formula, handwrite the keys you enter in the Financial Calculator, and use Excel (formula and arguments). Use the Table below for each answer. a. Find the price of a 10-year 10% coupon (paid semiannually). The current yield to maturity is 5%. b. Find the price of a 10-year 5 % coupon (paid semiannually). The current yield to maturity is 10%. c. Based on your answers, discuss the relationship between coupon rate, yield to maturity, and bond price. FORMULA (Plug in the corresponding values in the formula below) 2 Financial Calculator (Indicate the keys you enter and write the answer) 3 Excel (Write the function and arguments in Excel)arrow_forwardPlease show detailed steps and correctarrow_forwardneed answer in step by steparrow_forward

- Please answer all 4 prices with explanations thxarrow_forwardAssume coupons are paid annually. Here are the prices of three bonds with 10-year maturities. Assume face value is $100. Bond Coupon (%) 2 4 8 a. What is the yield to maturity of each bond? b. What is the duration of each bond? Price (%) 80.22 96.79 135.42 Complete this question by entering your answers in the tabs below. Required A Bond Coupon (%) 2 4 8 Required B What is the yield to maturity of each bond? Note: Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places. YTM % % %arrow_forwardUsing the expectations hypothesis theory for the term structure of interest rates, determine the expected return for securities with maturities of two, three, and four years based on the following data. (Input your answers as a percent rounded to 2 decimal places.) 1-year T-bill at beginning of year 1 1-year T-bill at beginning of year 2 1-year T-bill at beginning of year 3 1-year T-bill at beginning of year 4 2-year security 3-year security 4-year security Expected Return Interest Rate 58 78 10% 128arrow_forward

- (Bond Valuation Problem) A $1,000 par value bond with a coupon interest rate of 12.8 percent per year paid semiannually matures in 25 years. Draw a CF diagram corresponding to this information and then complete the table below by filling in the prices and YTMs that correspond to the given YTM’s and prices respectively. Show all the work for part D – both the PVAt and PV calculations. Then check your answer using your calculator’s TVM solver menu or function keys. PRICE YTM A. ______________ ___0%____ B. __$1,000______ __________ C. __$ 917.19_____ __________ D. ______________ ___16%____ Step By Step explanation please, I need to be able to see how we arrived at the answers as if I was writing them on a sheet of paper.arrow_forwardThe following table summarizes prices of various default-free zero-coupon bonds (expressed as a percentage of the face value): a. Compute the yield to maturity for each bond. b. Plot the zero-coupon yield curve (for the first five years). c. Is the yield curve upward sloping, downward sloping, or flat? a. Compute the yield to maturity for each bond. The yield on the 1-year bond is 3.92 %. (Round to two decimal places.) Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Maturity (years) Price (per $100 face value) 1 $95.51 2 3 $91.10 $86.55 $81.69 $76.45 Print Dondayarrow_forwardBond A is a premium bond with a 9 percent coupon. Bond B is a 5 percent coupon bond currently selling at a discount. Both bonds make annual payments, have a YTM of 6 percent, and have five years to maturity. The face value is $1000 for both bonds. a. Why is the capital gain yield of the premium bond different from that of the discount bond? Which bond is better in terms of yields? b. What is the holding period return for each bond, if both bonds are held over the next year and sold at the year ned?arrow_forward

- please don't solve excel version. Please make a classic transactional solution with formulas.arrow_forward1) Explain the concept of interest rate risk in bond investment 2) show a numerical example of it by calculating % changes in price for 1 year and 3-year annual coupon bonds. Assume coupon interest rate = 12%, Yield to Maturity = 6%, Face value= 100. Use 2% increase in YTM (i.e., 6% → 8%).arrow_forwardUsing the expectations hypothesis theory for the term structure of interest rates, determine the expected return for securities with maturities of two, three, and four years based on the following data. Note: Input your answers as a percent rounded to 2 decimal places. 1-year T-bill at beginning of year 1 1-year T-bill at beginning of year 21 1-year T-bill at beginning of year 3 1-year T-bill at beginning of year 4 2-year security 3-year security 4-year security Expected Return % % % Interest Rate 7% 9% 10% 12%arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education