FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

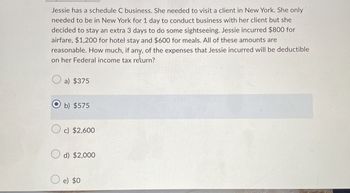

Transcribed Image Text:Jessie has a schedule C business. She needed to visit a client in New York. She only

needed to be in New York for 1 day to conduct business with her client but she

decided to stay an extra 3 days to do some sightseeing. Jessie incurred $800 for

airfare, $1,200 for hotel stay and $600 for meals. All of these amounts are

reasonable. How much, if any, of the expenses that Jessie incurred will be deductible

on her Federal income tax return?

a) $375

b) $575

c) $2,600

d) $2,000

e) $0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Jack is a commission salesperson. Jack is required to pay his own expenses and does not receive an allowance from his employer. During the year his gross salary was $60,000 and he received $20,000 in commissions. He incurred and paid the following expenses earning the income: Description Advertising Client entertainment Travel Costs Amount $10,000 11,000 10,000 What is Jack's maximum employment expense deduction under section 8 for 2022? Do not use commas or dollar signs. A/ What is Jack's maximum employment expense deduction under section 8 for 2022, if Jack does not receive commission income?arrow_forwardTamar owns a condominium near Cocoa Beach in Florida. In 2022, she incurs the following expenses in connection with her condo Insurance Advertising expense Mortgage interest Property taxes Repairs & maintenance : Utilities Depreciation $1,100 550 3,850 945 700 1,000 9,500 During the year, Tamar rented out the condo for 75 days, receiving $10,000 of gross income. She personally used the condo for 35 days during her vacation. Tamar's itemized deduction for nonrental taxes is less than $10,000 by more than the property taxes allocated to the rental use of the property. Problem 14-58 Parts a, b, c, d & e (Algo) Assume Tamar uses the IRS method of allocating expenses to rental use of the property. Required: a. What is the total amount of for AGI (rental) deductions Tamar may deduct in the current year related to the condo? b. What is the total amount of itemized deductions Tamar may deduct in the current year related to the condo? c. If Tamar's basis in the condo at the beginning of the…arrow_forwardMansi, a self-employed influencer, left her home in Georgia on Monday to fly to New York to meet with another influencer to discuss a "collab". She returned the next day. Her expenses are as follows: Airfare $500, lunch in New York at a restaurant with influencer $100, Taxi $50. How much can Mansi deduct? (Do not use commas or dollar signs. Round to the nearest dollar.)arrow_forward

- Mary owns a home with a with a replacement value of $331,195. She purchased home insurance in the amount of $200,000, and therefore does not meet the 80% rule. If Mary's deductible is $3,000 and a BBQ fire caused $75,000 worth of damage, how much will Mary have to pay herself?arrow_forwardPeter Marwick, an accountant and accrual basis taxpayer, performed accounting services in Year One for Ellie Vader. Peter gave Ellie a bill for $30,000 in Year One. Ellie paid Peter $5,000 in Year One, but Ellie disputes that she owes the other $25,000 because she thinks his work is shoddy. Ellie agreed to put $25,000 in escrow until she and Peter could resolve their legal dispute over Peter's fees. In Year Three after litigation, the dispute is resolved in Peter's favor and he gets the money out of escrow. How much income does Peter have and when? Question 9 options: Peter has $30,000 income in Year 1 because he is on the accrual method. Peter has no income in Year 1 because there is a contested liability. Ellie has $25,000 in cancellation of indebtedness income in Year 1. Peter has $5,000 income in Year 1 and $25,000 in Year 3 under the Claim of Right Doctrine.arrow_forwardRoxy operates a dress shop in Arlington, Virginia. Lisa, a Maryland resident, comes in for a measurement and purchases a $2,800 dress. Lisa returns to Virginia a few weeks later to pick up the dress and drive it back to her Maryland residence, where she will use the dress. Assuming that Virginia's sales tax rate is 5 percent and that Maryland's sales tax rate is 6 percent, what is Roxy's sales tax collection obligation? Multiple Choice $0 $140 to Virginia $140 sales tax to Virginia and $28 use tax to Maryland $168 to Marylandarrow_forward

- This year William provided $4,200 of services to a large client on credit. Unfortunately, this client has recently encountered financial difficulties and has been unable to pay William for the services. Moreover, William does not expect to collect for his services. William has "written off " the account and would like to claim a deduction for tax purposes. (Leave no answers blank. Enter zero if applicable.) a. What amount of deduction for bad debt expense can William claim this year if he uses the accrual method? Deductible amountarrow_forwardSimon rents his cottage when he and his family are not using it. It qualifies as a vacation home rental. In 2021, he had rental income of $5,200. His deductible expenses were: Advertising $350 Commissions $775 Depreciation (rental portion) $1,500 Maintenance (rental portion) $750 Mortgage interest (rental portion) $1,250 Pest control (rental portion) $300 Prior-year carryover $500 Real estate tax $800 What amount of unallowed expense will Simon carry forward to next year? $0 $500 $1,025 $1,500arrow_forwardT uses frequent flyer miles to take his family on a vacation. T received the miles duringbusiness travel paid for by his employer. The normal airfare for his vacation wouldhave cost $7,000.a. T must realize and recognize $7,000 as income.b. Although T has realized income, he will not be required to recognize it becausethe IRS has chosen, as a matter of administrative convenience, not to requiretaxpayers to recognize the value of frequent flyer tickets earned duringemployer-paid travel.c. Had T earned the frequent flyer miles during travel he had paid for himself, theissue of income realization and recognition would not arise.d. Both (a) and (c) are correct.e. Both (b) and (c) are correct. T buys a parcel of real estate for $100,000, which he finances by giving the seller a nonrecoursemortgage for the full purchase price. The debt is due in one balloon payment inYear 5. When the debt becomes due in Year 5, T decides to give the property back to theseller in satisfaction of the debt…arrow_forward

- In 2021, Carlos drives from his home in Los Angeles to Oregon to consult with a client. He works for 1 day and spends 3 days enjoying Oregon since the consultation was right before a 3-day weekend. His expenses were $175 to drive to Oregon and back, $600 for lodging, $50 for food from a convenience store on the day that he worked, and $125 for restaurant food on the other 3 days. How much of his travel expenses are deductible? $800 b.$350 c.$0 d.$200 e.$175arrow_forwardJessica is a professional consultant. She agrees to consulting services for Joe for $2,000. After she finishes, Joe does not have cash to pay Jessica, but he has an antique, collectible baseball card with a fair market value of $2,000 that he gives her to satisfy the payment. The baseball card cost Joe $500. How much should Jessica include in her gross income?arrow_forwardWai Yeung is a self-employed insurance Salesperson. She started her business on January 1, 2022, and ended her first taxation year on December 31, 2022. On July 1, she purchased a car for $36,000 plus 13% HST. The car is financed with a bank loan and interest costs amounted to $1,970 from July 1 to December 31. Wai incurred the following additional expenses relating to her automobile: Repairs and maintenance $ 400 Insurance 1,200 Gasoline 1,900 Parking while on business 500 During the period, Wai drove 16,000 Km, of which 12,000 Km were for business. Assume the car is not designated as immediate expensing property. Required: Complete the table below to answer the following questions. a. Determine the maximum amount that Wai can deduct from her business income for tax purposes in 2022. Show expenses as negative numbers. b. Calculate the maximum CCA that Wai can deduct in 2023 and 2024, assuming that business kilometres driven and total kilometres driven both remain constant and that she…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education