FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

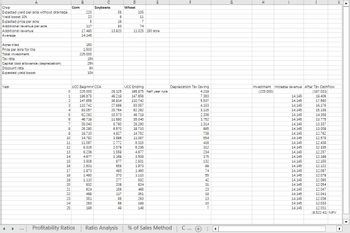

Transcribed Image Text:Crop

Expected yield per acre without drainage

Yield boost 10%

Expected price per acre:

Additional revenue per acre

Additional revenue

Average

A

Acres tiled

Price per acre for tile

Total investment

Tax rate

Capital cost allowance (depreciation)

Discount rate

Expected yield boost

Year

4

...

0

1

2

3

4

5

6

7

GRE22856456E5000

11

12

13

14

15

16

17

18

19

21

23

Corn

B

Profitability Ratios

220

22

5

117

17,490

14.145

150

1,500

225,000

15%

25%

6%

10%

UCC Beginnir CCA

225,000

196,875

147,656

110,742

83,057

62.292

46.719

35,040

26.280

19,710

14.782

11,087

8.315

6,236

4,677

3.508

2,631

1,973

1.480

1.110

832

624

468

C

Soybeans

351

263

198

58

6

16

93

13,920

28,125

49,219

36,914

27,686

20,764

15.573

11,680

8,760

6,570

4.927

3.696

2,772

2.079

1,559

1.169

877

658

493

370

277

208

156

117

88

66

49

Ratio Analysis

D

Wheat

E

105

11

7

74

11,025 150 acre

UCC Ending

196,875 half year rule

147,656

110,742

83,057

62.292

46,719

35,040

26,280

19,710

14,782

11,087

8,315

6,236

4,677

3,508

2,631

1,973

1,480

1.110.

832

624

468

351

263

198

148

F

Depreciation Tax Saving

4,219

% of Sales Method

7.383

5,537

4.153

3,115

2.336

1,752

1,314

985

739

554

416

312

234

175

132

99

74

55

42

31

23

18

C... +

13

10

7

⠀

4

G

H

J

Investment Increase revenue After Tax Cashflow

(225,000)

14.145

14.145

14,145

14.145

14.145

14,145

14.145

14.145

14.145

14.145

14,145

14,145

14,145

14,145

14.145

14.145

14.145

14.145

14,145

14.145

14,145

14,145

14.145

14.145

14.145

(187,031)

19,406

17,560

16.176

15,138

14.359

13,775

13,337

13,009

12,762

12.578

12,439

12.335

12.257

12.199

12.155

12,122

12,097

12,079

12,065

12.054

12,047

12.041

12,036

12,033

12,031

(9.522.41) NPV

K

▶

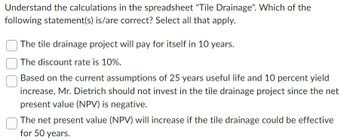

Transcribed Image Text:Understand the calculations in the spreadsheet "Tile Drainage". Which of the

following statement(s) is/are correct? Select all that apply.

The tile drainage project will pay for itself in 10 years.

The discount rate is 10%.

Based on the current assumptions of 25 years useful life and 10 percent yield

increase, Mr. Dietrich should not invest in the tile drainage project since the net

present value (NPV) is negative.

The net present value (NPV) will increase if the tile drainage could be effective

for 50 years.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

What is the math behind the

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

What is the math behind the

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Wavy Inc is examining a project that requires an initial investment of -10 million today. This will be followed by several years of positive incremental after-tax cash flows. However, during the last year of the project's life Wavy expects that the incremental cash flow will again be negative. By which method should Wavy determine whether or not to invest? A) Both NPV or IRR are fine, as they must arrive at same investment decision B) IRR, because there will be no NPV solution in this case C) Neither NPV or IRR are useful in this situation D) NPV, since this project will have two IRRsarrow_forwardOakland Chips, which has a 10 percent required return (K), is considering a new extractor. Because of anticipated start-up delays, cash flow will be $1.000 at the end of each year for years 4 through 20. What is the present value of those future cash flows? Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardYou are evaluating a 20 year project. Using a discount rate of 10%, you have calculated the project's NPV as $200. Part 1 After completing your project estimation, the sales group of another division in the company notes that your project will probably cannibalize the sales of their products. They estimate that their after-tax profits will decrease by $27 per year for the 20-year life of the project. What is the new NPV of your project after taking this into account?arrow_forward

- What is the value of the abandonment option (in millions), in the question below? Round your answer to two decimal places... Sunshine Smoothies Company (SSC) manufactures and distributes smoothies.It is considering the introduction of a "weight loss" smoothie.The project would require a $4 million investment outlay today (t = 0).The after-tax cash flows would depend on whether the weight loss smoothie is well received by consumers.There is a 30% chance that demand will be good, in which case the project will produce after-tax cash flows of $2 million at the end of each of the next 3 years.There is a 70% chance that demand will be poor, in which case the after-tax cash flows will be $1 million for 3 years.The project is riskier than the firm's other projects, so it has a WACC of 12%.The firm will know if the project is successful after receiving first year's cash flows.After receiving the first year's cash flows it will have the option to abandon the project.If the firm decides to…arrow_forwardReplacing old equipment at an immediate cost of $50,000 and an additional outlay of $15,000 six years from now will result in savings of $11,000 per year for 7 years. The required rate of return is 5% compounded annually. Compute the net present value and determine if the investment should be accepted or rejected according to the net present value criterion. The net present value of the project is S (Round the final answer to the nearest dollar as needed. Round all intermediate values to six decimal places as needed.) The proposal should be аcсepted. rejected.arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- A project that costs $2,300 to install will provide annual cash flows of $730 for each of the next 5 years. a. Calculate the NPV if the opportunity cost of capital is 12%? (Do not round intermediate calculations. Round your answer to 2 decimal places.) NPV b. Is this project worth pursuing? Yes O No c. What is the project's internal rate of return IRR? (Do not round intermediate calculations. Round your answer to 2 decimal places.) %24arrow_forward(Discounted payback period) Gio's Restaurants is considering a project with the following expected cash flows: Year 0 1 2 60 3 100 4 105 (Click on the icon in order to copy its contents into a spreadsheet.) Project Cash Flow (millions) $(180) 100 If the project's appropriate discount rate is 8 percent, what is the project's discounted Davback period? The project's discounted payback period is years. (Round to two decimal places.)arrow_forward1. Comparing all methods. Given the following after-tax cash flow on a new toy for Tyler's Toys, find the project's payback period, NPV, and IRR. The appropriate discount rate for the project is 14%. If the cutoff period is 6 years for major projects, determine whether management will accept or reject the project under the three different decision models. (Click on the following icon in order to copy its contents into a spreadsheet.) Initial cash outflow: $11,700,000 Years one through four cash inflow: $2,925,000 each year Year five cash outflow: $1,170,000 Years six through eight cash inflow: $503,000 each year What is the payback period for the new toy at Tyler's Toys? years (Round to two decimal places.) Under the payback period, this project would be (1) What is the NPV for the new toy at Tyler's Toys? $ (Round to the nearest cent.) Under the NPV rule, this project would be (2) What is the IRR for the new toy at Tyler's Toys? % (Round to two decimal places.) Under the IRR rule,…arrow_forward

- Suppose you plan on spending $100/ac on restoring a forest on bare land you plan to buy. The project is projected to yield a harvest worth $2500/ac in 30 years. After which you sell the land for $400/ac. If you want to earn at least 6% rate of return, what is your willingness to pay for the land? Assume no other costs and revenues and that all values are in real terms. Show your work solving the problems a.) $490.28 b.) $265.63 C.) $636.27 d.) $404.92 e.) none of the abovearrow_forwardYou are evaluating a project that costs $69,000 today. The project has an inflow of $148,000 in one year and an outflow of $59,000 in two years. What are the IRRs for the project? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) What discount rate results in the maximum NPV for this project? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forward(Discounted payback period) Gio's Restaurants is considering a project with the following expected cash flows: Year 0 Project Cash Flow (millions) $(180) 1 2 3 4 95 60 95 110 (Click on the icon in order to copy its contents into a spreadsheet.) If the project's appropriate discount rate is 13 percent, what is the project's discounted payback period? The project's discounted payback period is years. (Round to two decimal places.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education