ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

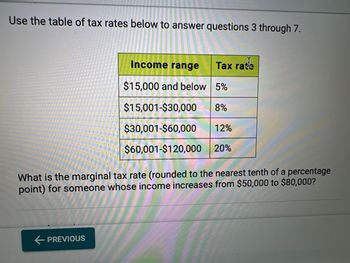

Transcribed Image Text:Use the table of tax rates below to answer questions 3 through 7.

Income range

$15,000 and below

← PREVIOUS

Tax rate

5%

$15,001-$30,000 8%

$30,001-$60,000 12%

$60,001-$120,000 20%

What is the marginal tax rate (rounded to the nearest tenth of a percentage

point) for someone whose income increases from $50,000 to $80,000?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- what is the difference between horizontal and vertical tax equity?arrow_forwardThe government implements a negative income tax plan with a guaranteed minimum income of $5,000 and a phase-out rate for payments of 50%. Complete the following table by calculating the negative tax and total after-tax income for each family income given. (Note: Suppose that any income above $10,600 would pay a positive tax.) Family Income (Dollars) Negative Tax Total After-Tax Income (Dollars) (Dollars) 0 2,600 4,600 6,600 8,600 10,600arrow_forwardGovernment collects the largest percentage of its revenue in which of the following ways? A) excise tax B) payroll tax C) corporate income tax D) personal income taxarrow_forward

- Suppose you bought a digital camera for a total purchase price of $279.99. If state taxes were 5.4%, what was the amount of the sales tax? (Round your answer to the nearest cent.)arrow_forwardGive a brief example of regressive tax systemarrow_forwardWhich type of tax takes a larger percentage of income from high-income earners than from low-income earners? A. Regressive tax B. Proportional tax C. Progressive tax D. Flat taxarrow_forward

- What is the effect of a tax on interest income?arrow_forwardDescribe the relevance of taxation for understanding the American welfare state. How have political institutions shaped the American welfare state?arrow_forwardMACROECONOMICS Progressive Tax Based on your yearly income above, calculate the amount of tax each income bracket would pay under a progressive tax plan. Each row up to the total income amount should be filled in. For an example of a completed chart, go to Page 4 of Lesson 05.03: Sharing with Uncle Sam. Calculate the tax for $95,000. For example, $10,000x40%-%$4,000 in tax. Show your work!! Proposed Regressive Plan Calculate the tax for S25,000. For example, $10,000x40%=$4,000 in tax. Show your work!! 10% on income up to $25,000 20% on income between S25,000 and S34,000 25% on income between S34,000 and S44,000 30% on income between $44,000 and S80,000 40% on taxable income over S80,000 TOTAL TAX PAID (sum of all rows):arrow_forward

- John works from 7am to 4pm 5 days a week, he does not receive overtime He gets an hour unpaid lunch During the year john gets paid for : 10 holiday days, 10 sick days, 14 vacation days, 5 personal days John is paid $20 an hour Johns weekly federal income tax deduction is $65, social security tax is .062 of his gross wage, medicare tax is .008 of his gross pay, and state tax is $25 per week What would John's gross and net pay be for the year ending December 31st, 2021?arrow_forwardDo a comparative analysis of taxation in Kenya, Uganda and Tanzania showing how these countries have addressed the following tax matters: Income tax Customs tax Excise tax Value added taxarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education