ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Transcribed Image Text:**Understanding Progressive Taxation**

A progressive tax is a tax system where the tax rate increases as the taxable amount increases. In other words, individuals or entities with higher incomes tend to pay a larger percentage of their income in taxes. This taxation method is based on the ability-to-pay principle, which asserts that those who have more resources (income or wealth) should contribute more to public coffers.

**Question**:

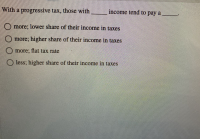

With a progressive tax, those with _____ income tend to pay a _____.

Options:

- More; lower share of their income in taxes

- More; higher share of their income in taxes

- More; flat tax rate

- Less; higher share of their income in taxes

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Why do legislators vote for spending projects in districts that are not their own?arrow_forwardMACROECONOMICS Progressive Tax Based on your yearly income above, calculate the amount of tax each income bracket would pay under a progressive tax plan. Each row up to the total income amount should be filled in. For an example of a completed chart, go to Page 4 of Lesson 05.03: Sharing with Uncle Sam. Calculate the tax for $95,000. For example, $10,000x40%-%$4,000 in tax. Show your work!! Proposed Regressive Plan Calculate the tax for S25,000. For example, $10,000x40%=$4,000 in tax. Show your work!! 10% on income up to $25,000 20% on income between S25,000 and S34,000 25% on income between S34,000 and S44,000 30% on income between $44,000 and S80,000 40% on taxable income over S80,000 TOTAL TAX PAID (sum of all rows):arrow_forwardA country is using a proportional tax when Group of answer choices its marginal tax rate equals its average tax rate. its marginal tax rate is less than its average tax rate. its marginal tax rate is greater than its average tax rate. it uses a lump-sum tax.arrow_forward

- Compare progressive, regressive, and proportional taxes. Give at least oneexample of each type of tax.arrow_forwardTRUE or FALSE and EXPLAIN The corporate income tax is a progressive tax because profits from corporations accrue mostly to high income individuals.arrow_forwardWhy does taxation create an excess burden?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education